Answered step by step

Verified Expert Solution

Question

1 Approved Answer

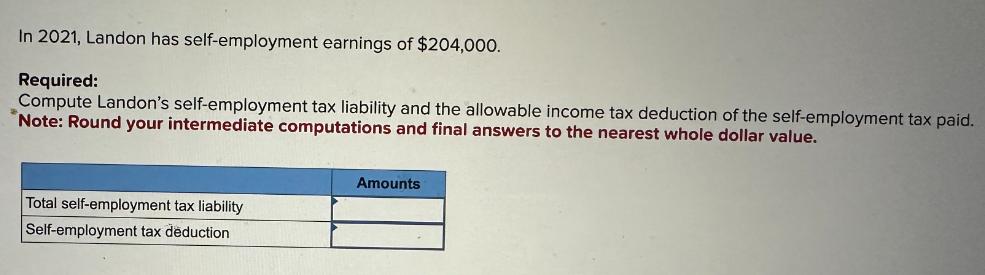

In 2021, Landon has self-employment earnings of $204,000. Required: Compute Landon's self-employment tax liability and the allowable income tax deduction of the self-employment tax

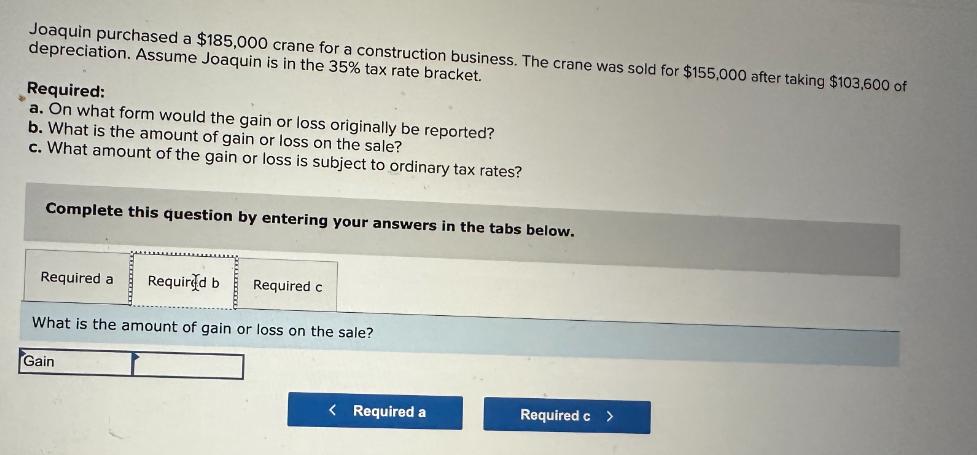

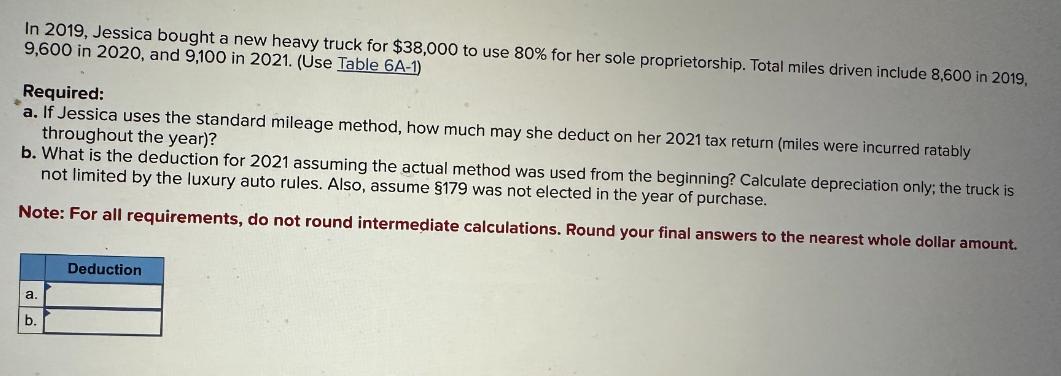

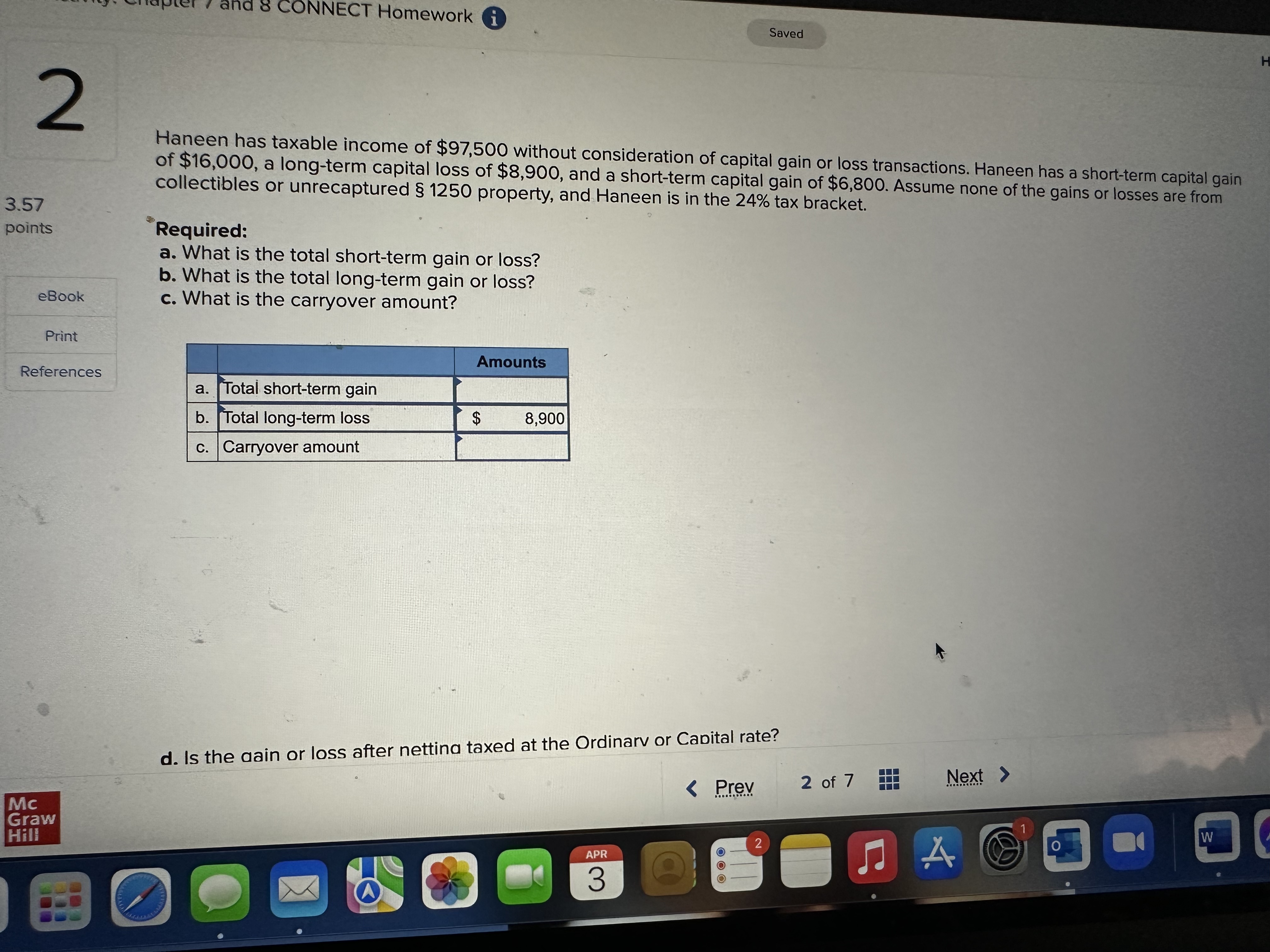

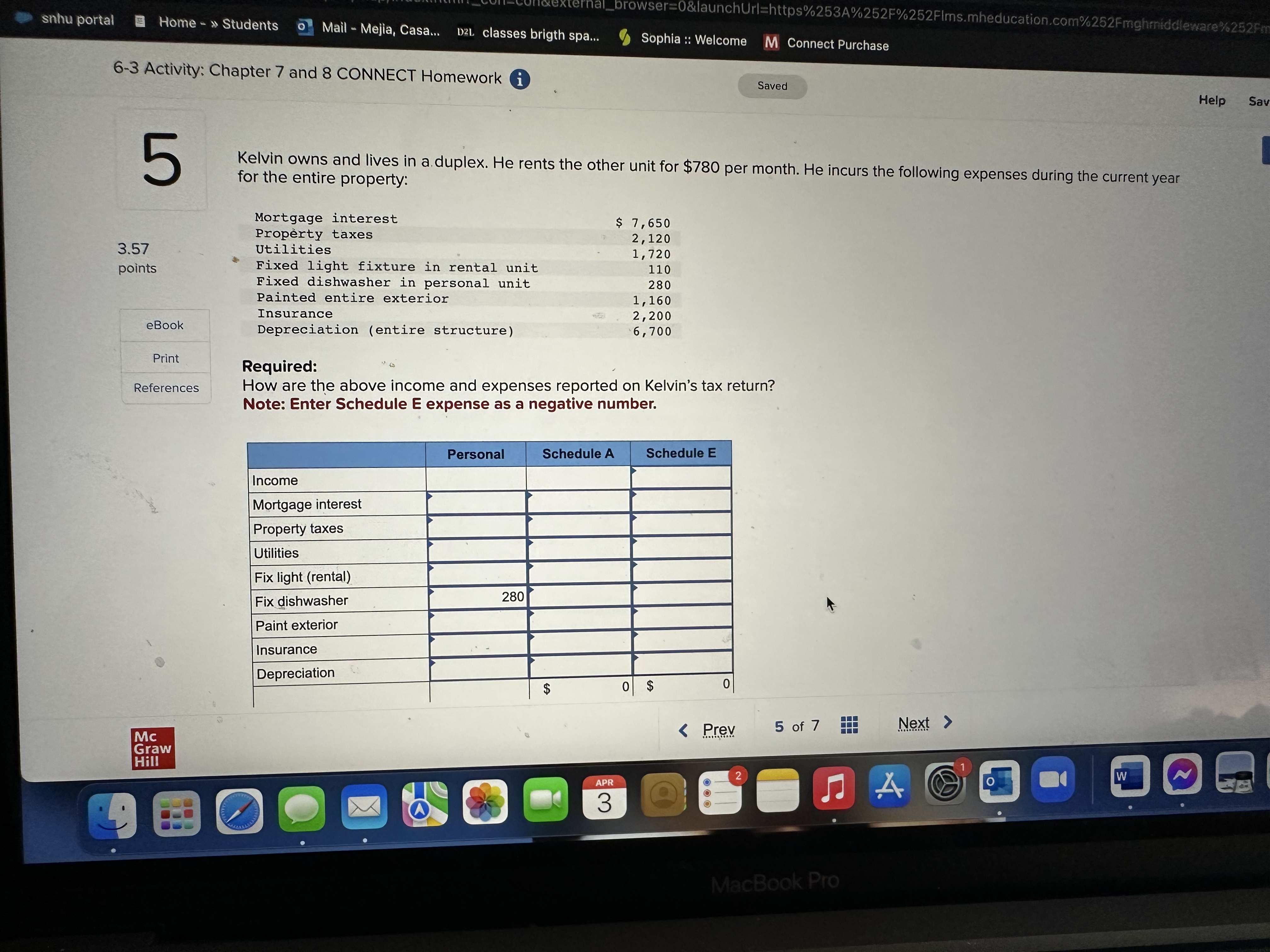

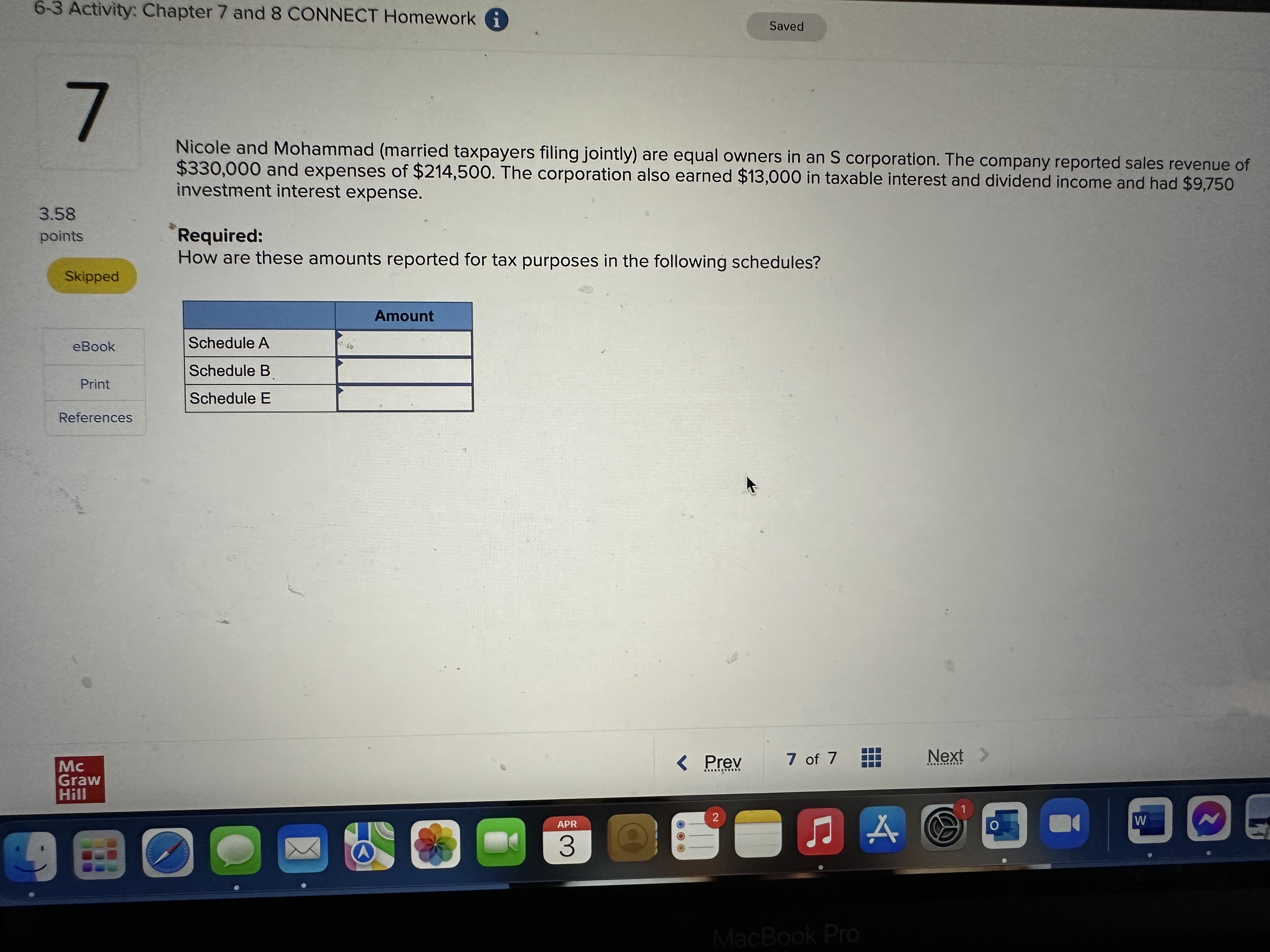

In 2021, Landon has self-employment earnings of $204,000. Required: Compute Landon's self-employment tax liability and the allowable income tax deduction of the self-employment tax paid. Note: Round your intermediate computations and final answers to the nearest whole dollar value. Total self-employment tax liability Self-employment tax deduction Amounts Joaquin purchased a $185,000 crane for a construction business. The crane was sold for $155,000 after taking $103,600 of depreciation. Assume Joaquin is in the 35% tax rate bracket. Required: a. On what form would the gain or loss originally be reported? b. What is the amount of gain or loss on the sale? c. What amount of the gain or loss is subject to ordinary tax rates? Complete this question by entering your answers in the tabs below. Required a Required b Required c What is the amount of gain or loss on the sale? Gain < Required a Required c > In 2019, Jessica bought a new heavy truck for $38,000 to use 80% for her sole proprietorship. Total miles driven include 8,600 in 2019, 9,600 in 2020, and 9,100 in 2021. (Use Table 6A-1) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2021 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2021 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume 179 was not elected in the year of purchase. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. a. Deduction b. D hd 8 CONNECT Homework i Saved 2 3.57 points eBook Print Haneen has taxable income of $97,500 without consideration of capital gain or loss transactions. Haneen has a short-term capital gain of $16,000, a long-term capital loss of $8,900, and a short-term capital gain of $6,800. Assume none of the gains or losses are from collectibles or unrecaptured 1250 property, and Haneen is in the 24% tax bracket. *Required: a. What is the total short-term gain or loss? b. What is the total long-term gain or loss? c. What is the carryover amount? Amounts References a. Total short-term gain b. Total long-term loss $ 8,900 c. Carryover amount Mc Graw Hill d. Is the gain or loss after netting taxed at the Ordinary or Capital rate? APR 3 < Prev 2 of 7 Next > DODGODDARE 000 2 H A W 0 portal Home -> Students Mail - Mejia, Casa... D2L classes brigth spa... Sophia :: Welcome M Connect Purchase 6-2 Activity: Chapter 6 CONNECT Homework i Saved 3 Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: 5 points eBook Airfare Lodging $ 500 3,000 Meals 750 Entertainment of clients 600 Required: Print How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value. References Mc Graw Hill Deduction APR 3 < Prev 3 of 5 Next > 2 MacBook Pro 1 W Hel 2F%252Flms.mheducation.com%252Fmghmiddleware% D2L classes brigth spa... Sophia :: Welcome M Connect Purchase 6-3 Activity: Chapter 7 and 8 CONNECT Homework i Saved 4 3.57 points In 2021, Rosalva sold stock considered short-term for a gain of $1,150 and stock considered long-term for a loss of $4,140. Rosalva also had a $3,950 short-term loss carryover from 2020 and a $1,460 long-term loss carryover from 2020. Required: a. What amount will be shown as a short-term gain (loss) for 2021? b. What amount will be shown as a long-term gain (loss) for 2021? c. How much of the loss is deductible in 2021? d. What is the amount of long-term carryover to 2022? eBook Print a. Short-term loss References b. Long-term loss C. Maximum loss deductible in 2021 d. Amount of long-term carryover to 2022 Mc Graw Hill - APR 3 < Prev 2704844RDOY 2 4 of 7 Next > SOFCACIBORY JA MacBook Pro W 0 Help 9 6 3.57 points mework i Saved In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Skipped Mortgage interest Depreciation Repairs and maintenance Required: eBook Print References Mc Graw Hill 15,600 2,600 2,400 4,600 7,500 1,230 What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income Schedule E Schedule A $ 0 APR 3 004400 MacBook Pro Help A W N 0 R M Question 3-6-3 Activity: Cha X *Course Hero X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware C snhu portal Home Students 1 Mail Mejia, Casa... D2L classes brigth spa... Sophia :: Welcome M Connect Purchase 6-3 Activity: Chapter 7 and 8 CONNECT Homework i Saved 3 3.57 points eBook Print Joaquin purchased a $185,000 crane for a construction business. The crane was sold for $155,000 after taking $103,600 of depreciation. Assume Joaquin is in the 35% tax rate bracket. Required: a. On what form would the gain or loss originally be reported? b. What is the amount of gain or loss on the sale? c. What amount of the gain or loss is subject to ordinary tax rates? Complete this question by entering your answers in the tabs below. References Required a Required b Required c What amount of the gain or loss is subject to ordinary tax rates? Amount of gain or loss which is subject to ordinary tax rates < Required b Required c Mc Graw Hill B APR 3 < Plm.v 3 of 7 Next 00000000 2 A 1 Hel W C ernal_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fm snhu portal Home >> Students Mail - Mejia, Casa... D2L classes brigth spa... Sophia :: Welcome M Connect Purchase 6-3 Activity: Chapter 7 and 8 CONNECT Homework 5 3.57 points eBook Saved Kelvin owns and lives in a duplex. He rents the other unit for $780 per month. He incurs the following expenses during the current year for the entire property: Mortgage interest Property taxes Utilities Fixed light fixture in rental unit Fixed dishwasher in personal unit Painted entire exterior Insurance Depreciation (entire structure) Required: $ 7,650 2,120 1,720 110 280 1,160 2,200 6,700 Print References How are the above income and expenses reported on Kelvin's tax return? Note: Enter Schedule E expense as a negative number. Mc Graw Hill Income Mortgage interest Property taxes Utilities Fix light (rental) Fix dishwasher Paint exterior Insurance Depreciation Personal Schedule A Schedule E 280 $ 0 $ 0 APR 3 < Prev 5 of 7 Next > CANDUR00004 2 MacBook Pro W Help Sav 6-3 Activity: Chapter 7 and 8 CONNECT Homework i 7 3.58 points Skipped Saved Nicole and Mohammad (married taxpayers filing jointly) are equal owners in an S corporation. The company reported sales revenue of $330,000 and expenses of $214,500. The corporation also earned $13,000 in taxable interest and dividend income and had $9,750 investment interest expense. Required: How are these amounts reported for tax purposes in the following schedules? eBook Schedule A Schedule B Print Schedule E References Mc Graw Hill Amount APR 3 < Prev 7 of 7 Next 2 A 1 MacBook Pro O W DO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started