Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For Firm J, prepare an income statement. Note: Use cost of goods manufactured calculated in part 1. Important! Be sure to click the correct

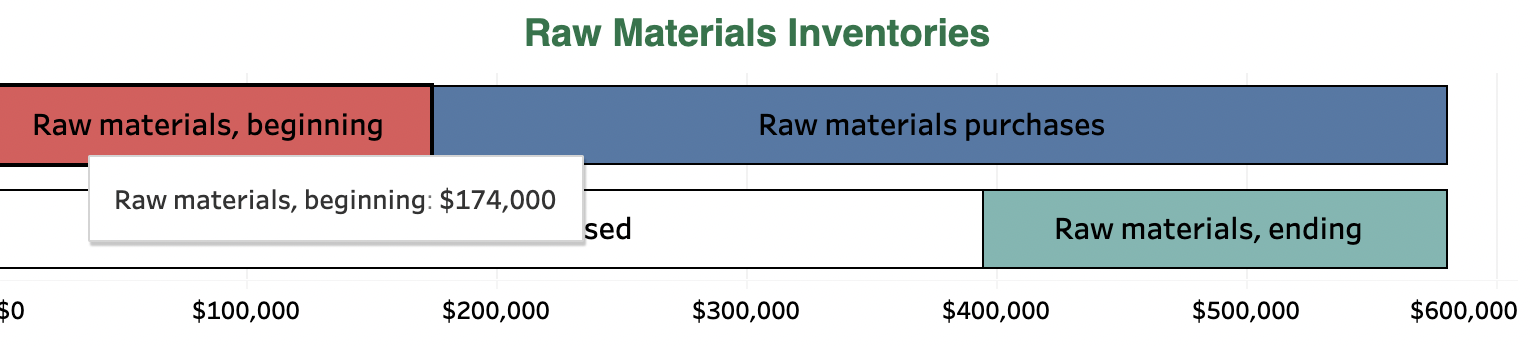

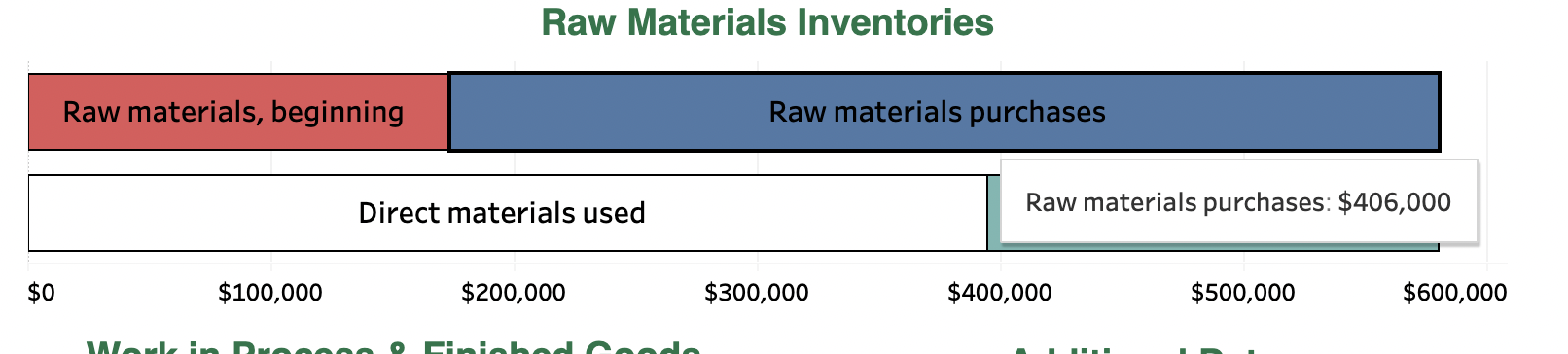

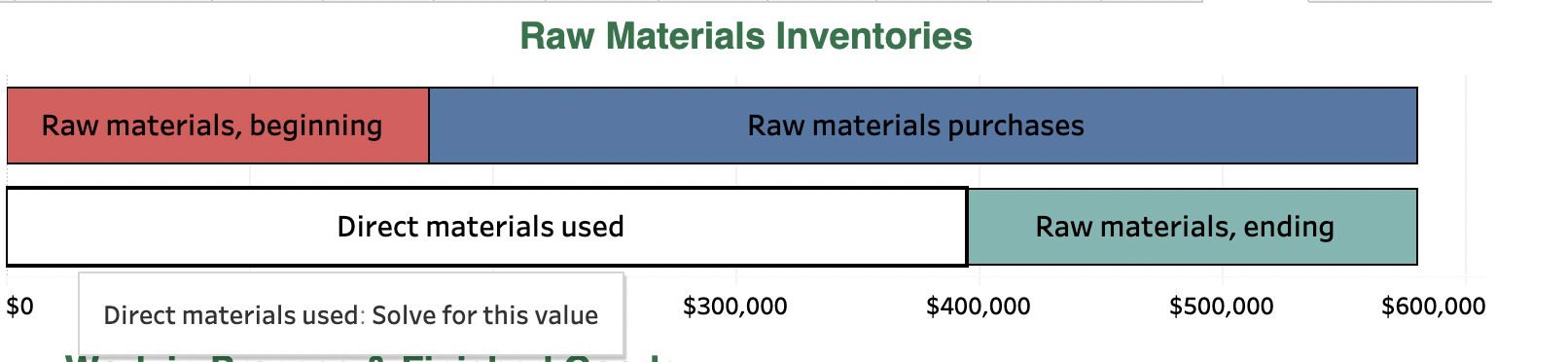

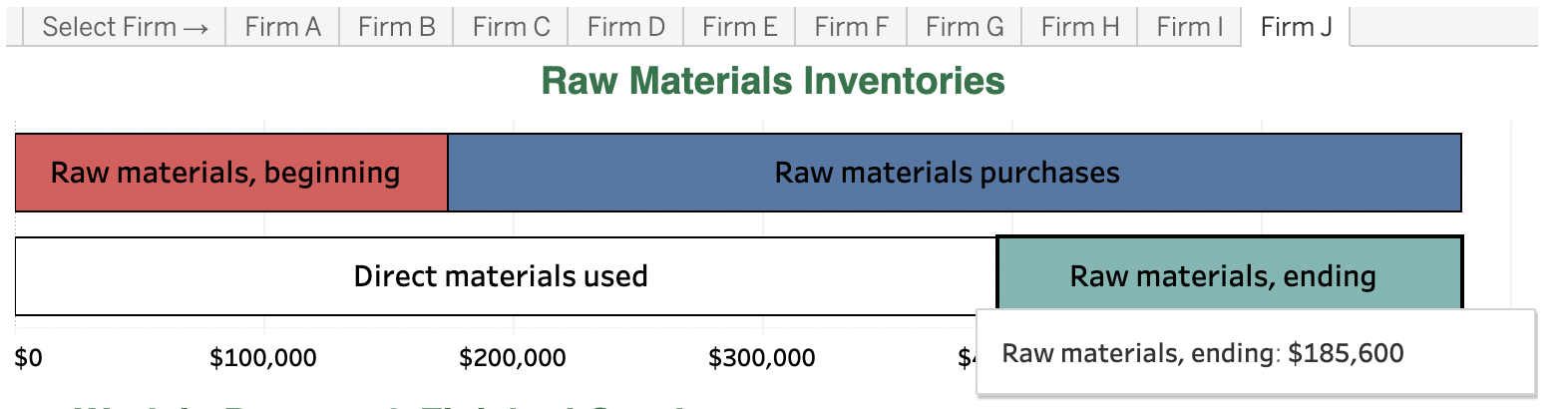

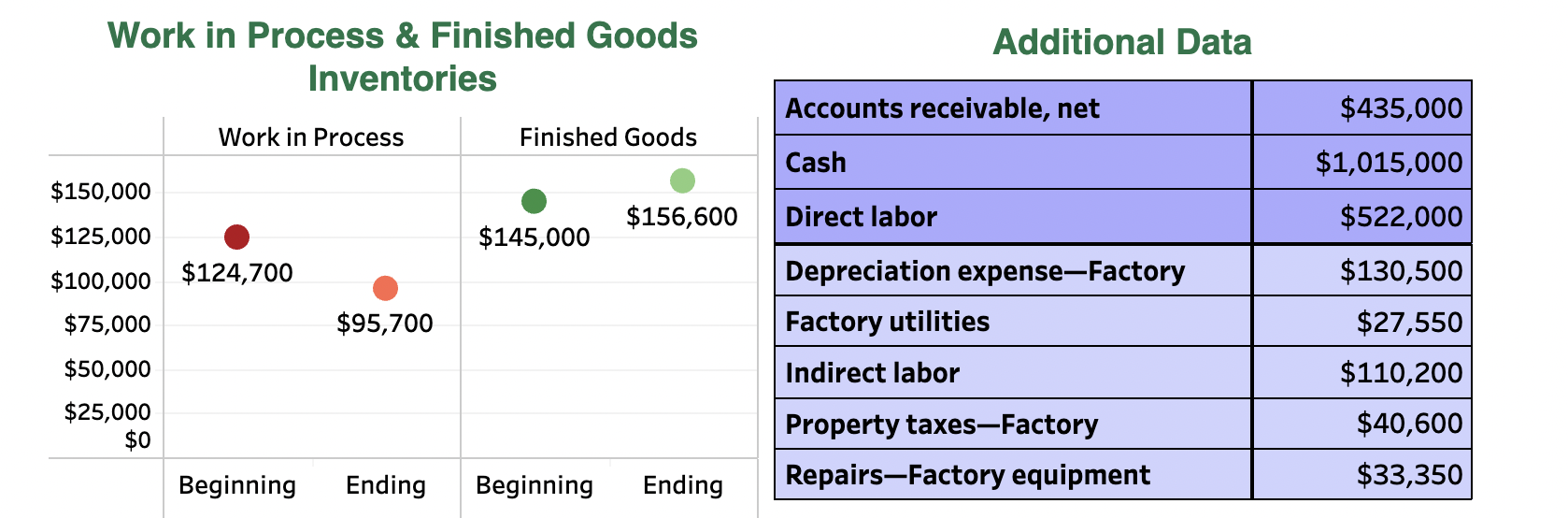

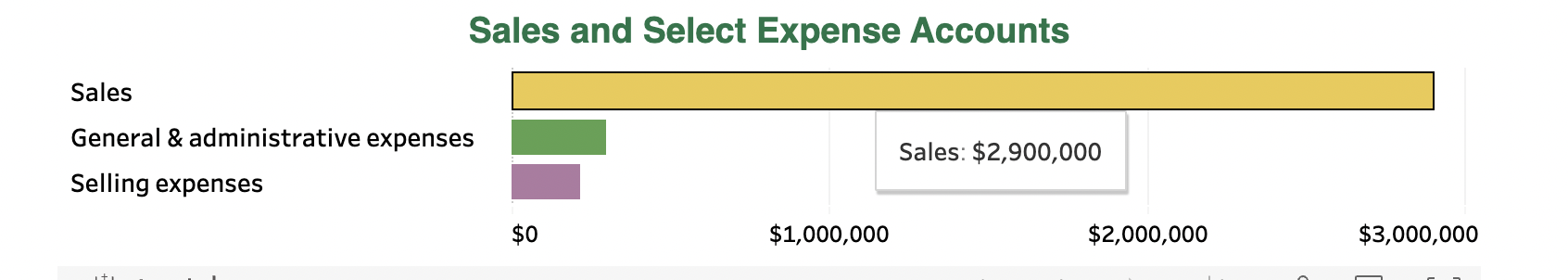

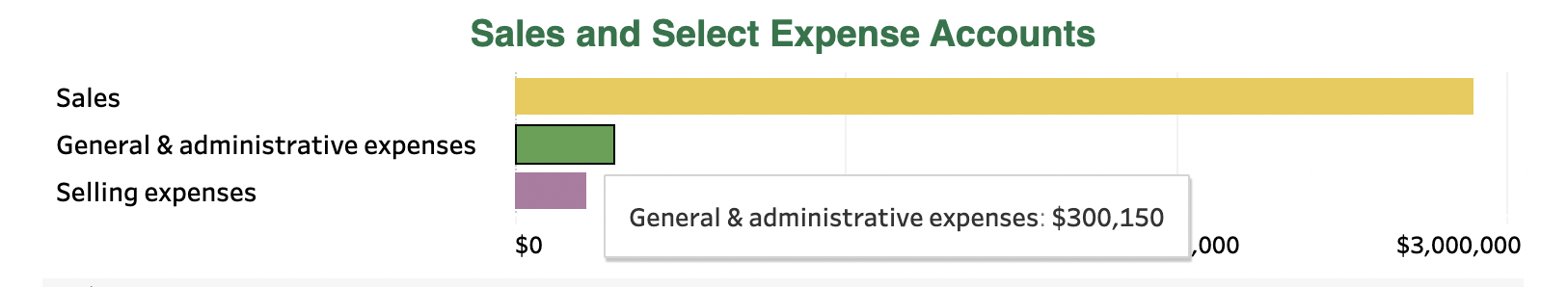

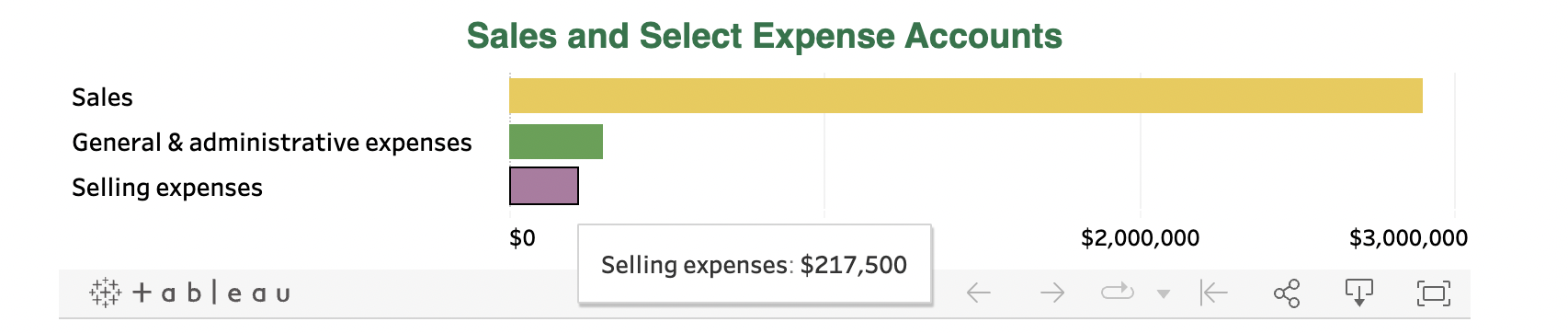

For Firm J, prepare an income statement. Note: Use cost of goods manufactured calculated in part 1. Important! Be sure to click the correct Firm at the top of the dashboard. Cost of goods sold: Goods available for sale Cost of goods sold Net income Mountaineer Co. Income Statement For Year Ended December 31 0 $ 0 0$ Raw materials, beginning Raw Materials Inventories Raw materials purchases Raw materials, beginning: $174,000 $100,000 sed Raw materials, ending $200,000 $300,000 $400,000 $500,000 $600,000 $0 Raw Materials Inventories Raw materials, beginning Raw materials purchases Raw materials purchases: $406,000 Direct materials used $100,000 $200,000 $300,000 $400,000 Work in Dresses 2 Finished C $500,000 $600,000 Raw Materials Inventories Raw materials, beginning Raw materials purchases Direct materials used Raw materials, ending $0 Direct materials used: Solve for this value $300,000 $400,000 $500,000 $600,000 Select Firm Firm A Firm B Firm C Firm D Firm E Firm F Firm G Raw Materials Inventories Firm H Firm I Firm J Raw materials, beginning Raw materials purchases $0 $100,000 Direct materials used Raw materials, ending $200,000 $300,000 $. Raw materials, ending: $185,600 Work in Process & Finished Goods Inventories Additional Data Accounts receivable, net $435,000 Work in Process Finished Goods Cash $1,015,000 $150,000 $156,600 Direct labor $522,000 $125,000 $145,000 $100,000 $124,700 Depreciation expense-Factory $130,500 $75,000 $95,700 Factory utilities $27,550 $50,000 Indirect labor $110,200 $25,000 Property taxes-Factory $40,600 $0 Beginning Ending Beginning Ending Repairs-Factory equipment $33,350 Sales General & administrative expenses Selling expenses Sales and Select Expense Accounts 60 $0 $1,000,000 Sales: $2,900,000 $2,000,000 $3,000,000 Sales General & administrative expenses Selling expenses Sales and Select Expense Accounts General & administrative expenses: $300,150 90 $0 ,000 $3,000,000 Sales General & administrative expenses Selling expenses +ableau Sales and Select Expense Accounts $0 $2,000,000 Selling expenses: $217,500 K $3,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started