Answered step by step

Verified Expert Solution

Question

1 Approved Answer

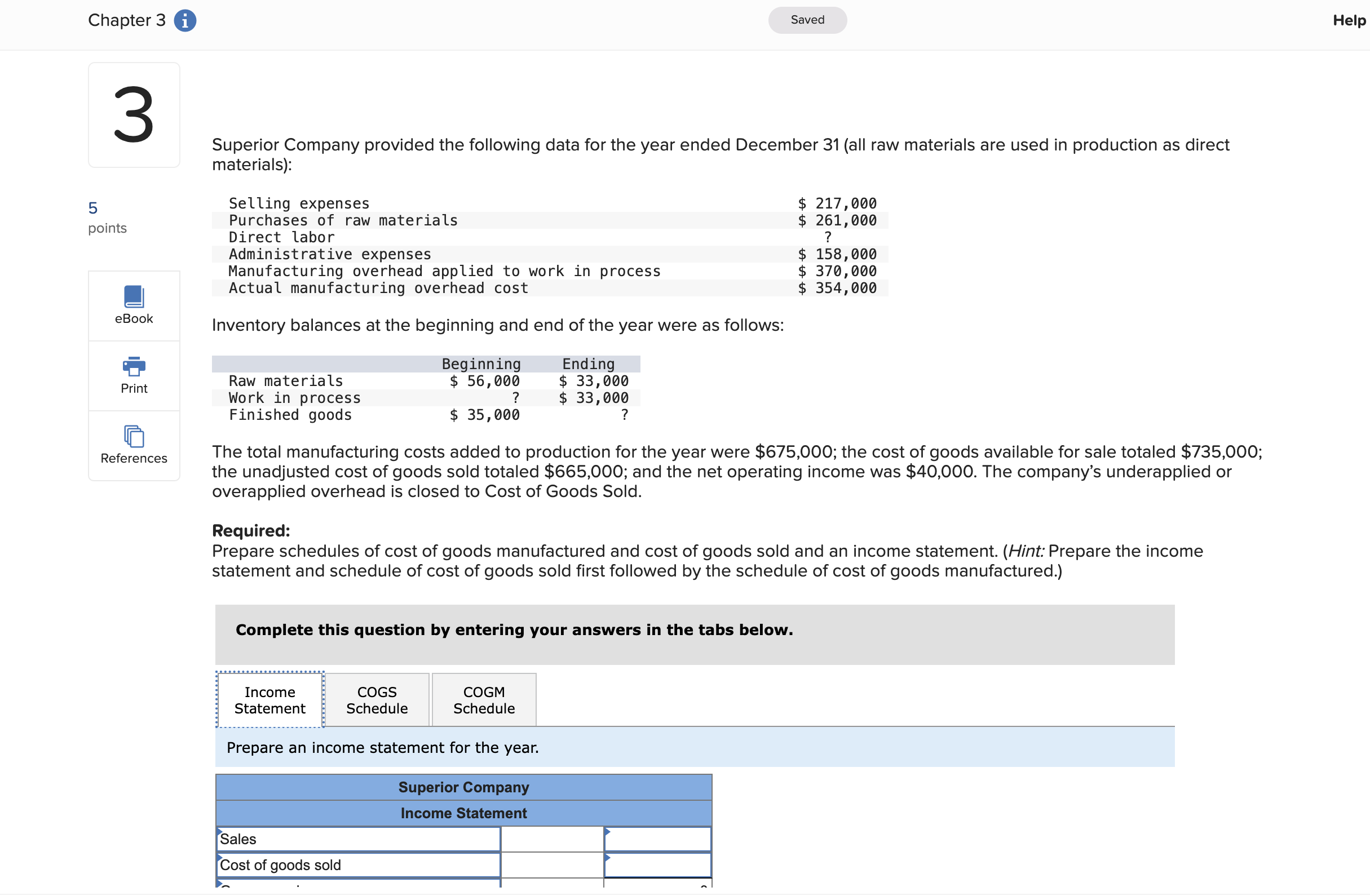

TranscribedText: I'Gll e Prepare schedules of cost of goods manufactured and cost of goods sold and an income statemen statement and schedule of cost of

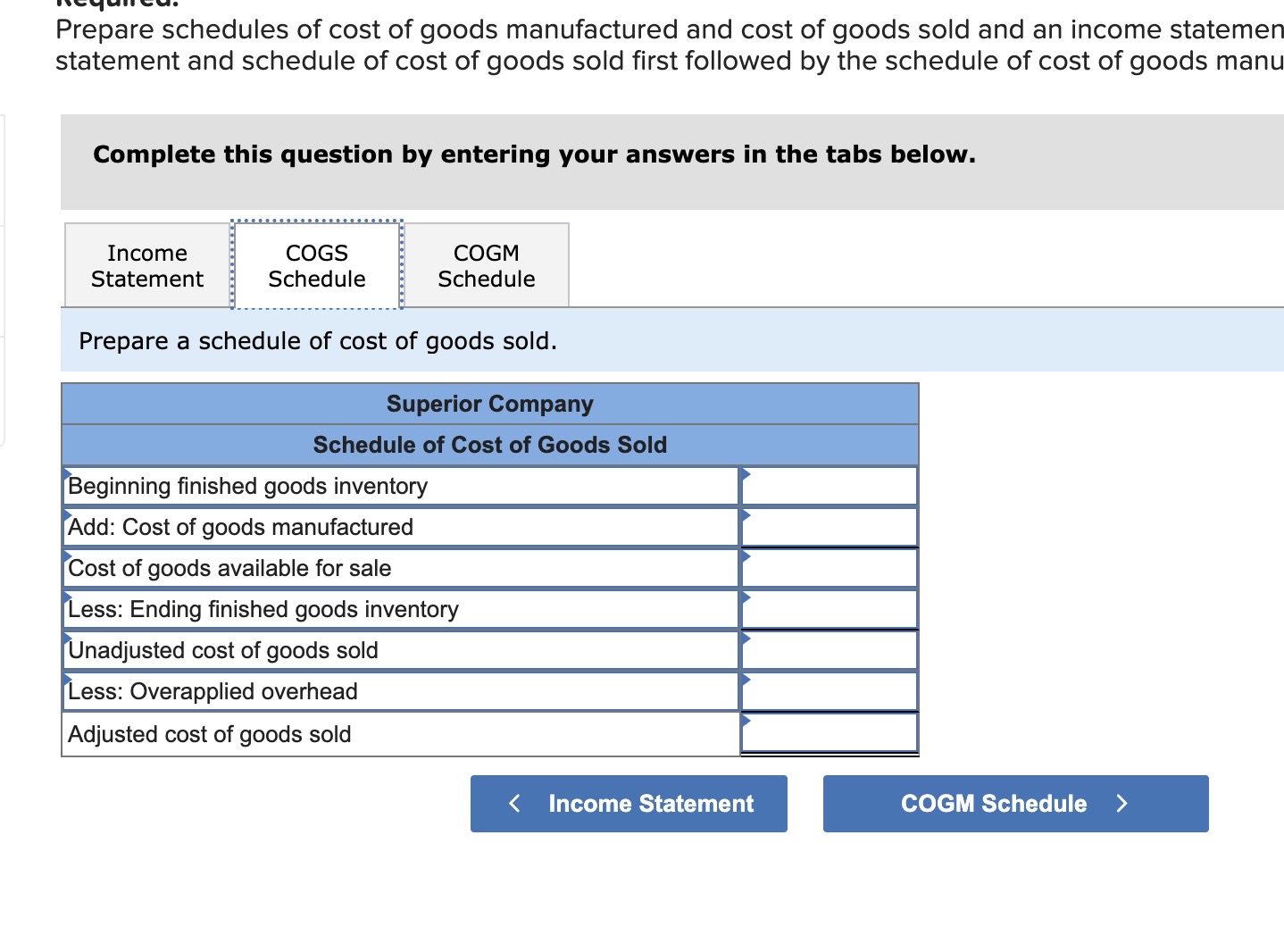

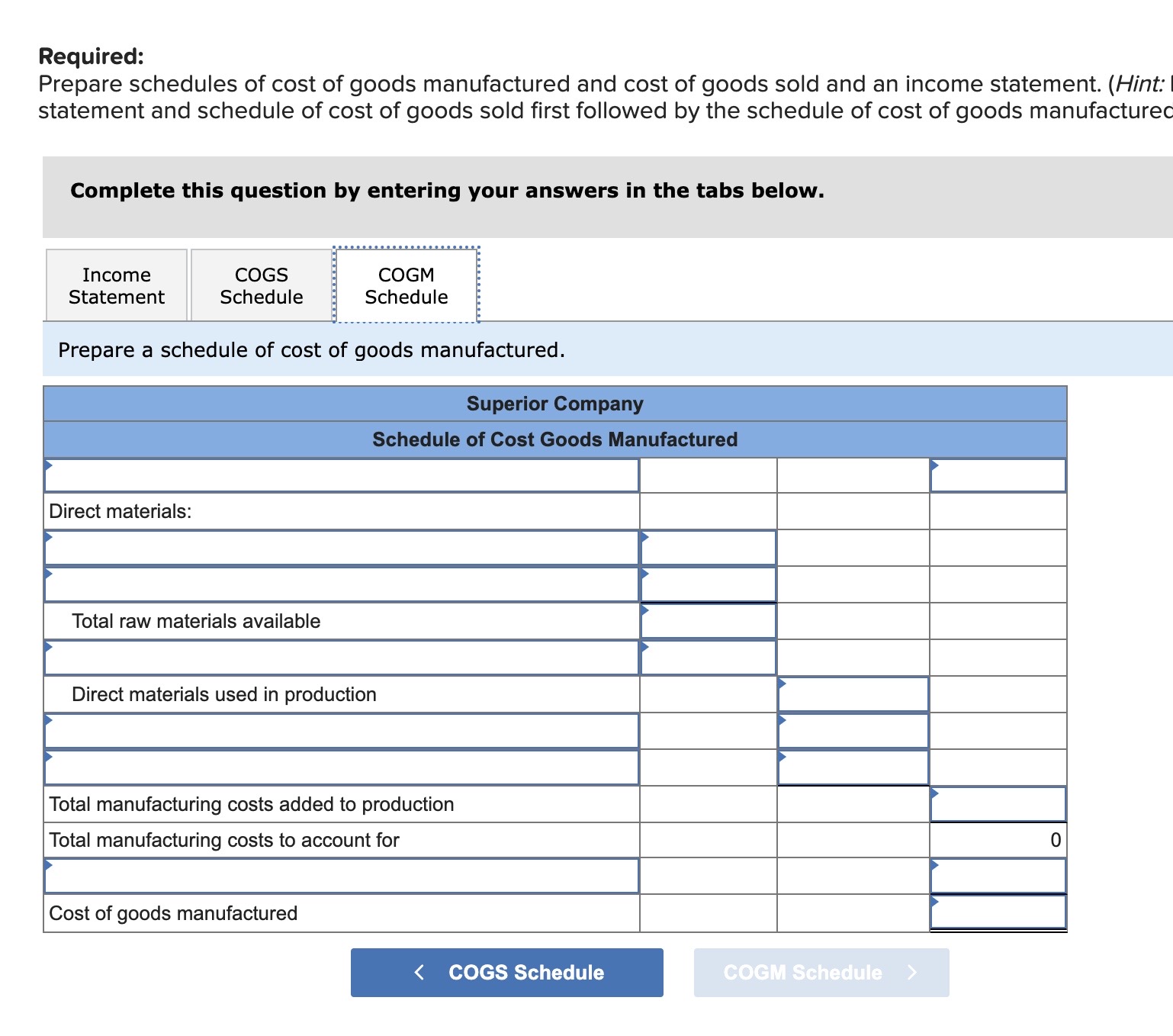

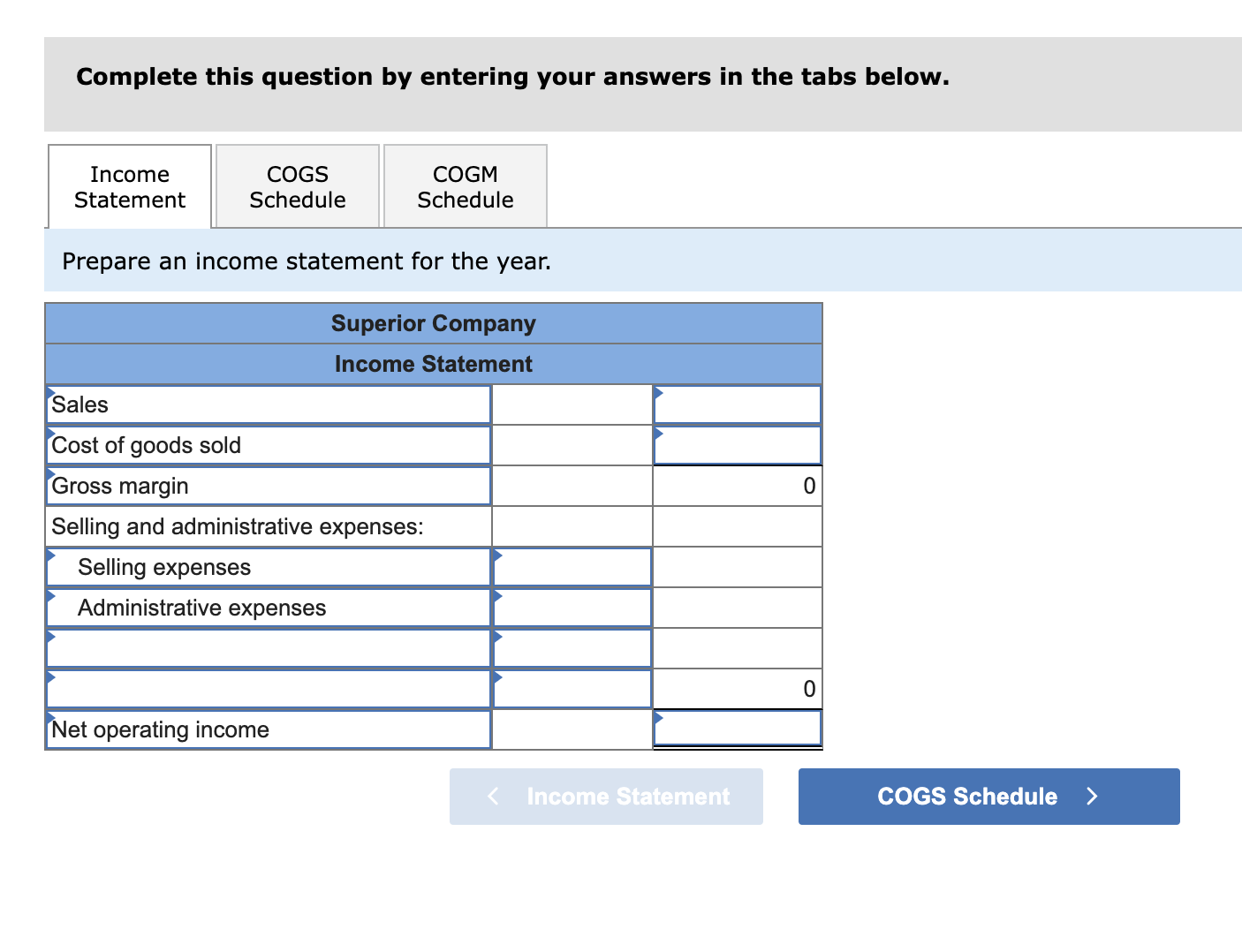

Prepare schedules of cost of goods manufactured and cost of goods sold and an income statemen statement and schedule of cost of goods sold first followed by the schedule of cost of goods manu Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods sold. Superior Company Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Less: Overapplied overhead Adjusted cost of goods sold < Income Statement COGM Schedule >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started