Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (80 marks) Now assume that on December 31, 2019, VVS paid $960,000 cash to acquire 80% of ISI's outstanding common shares. (No

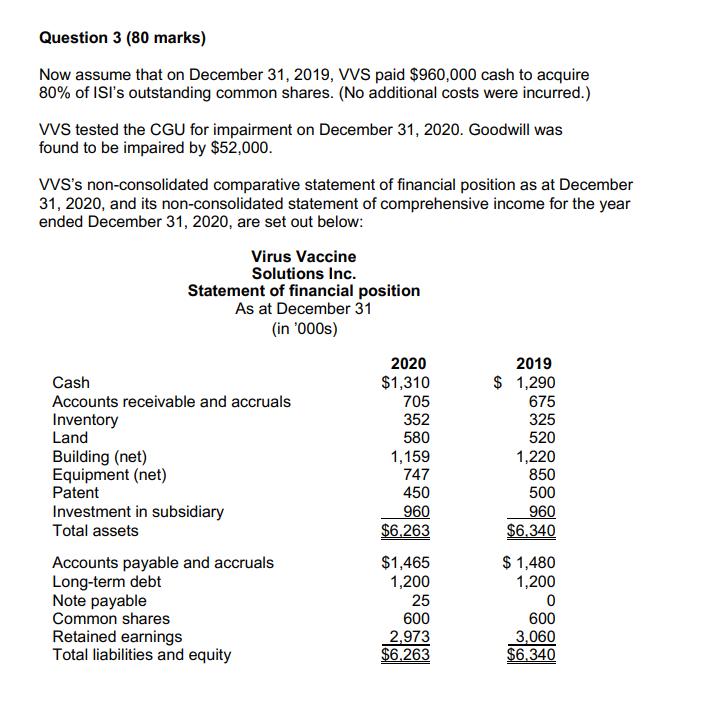

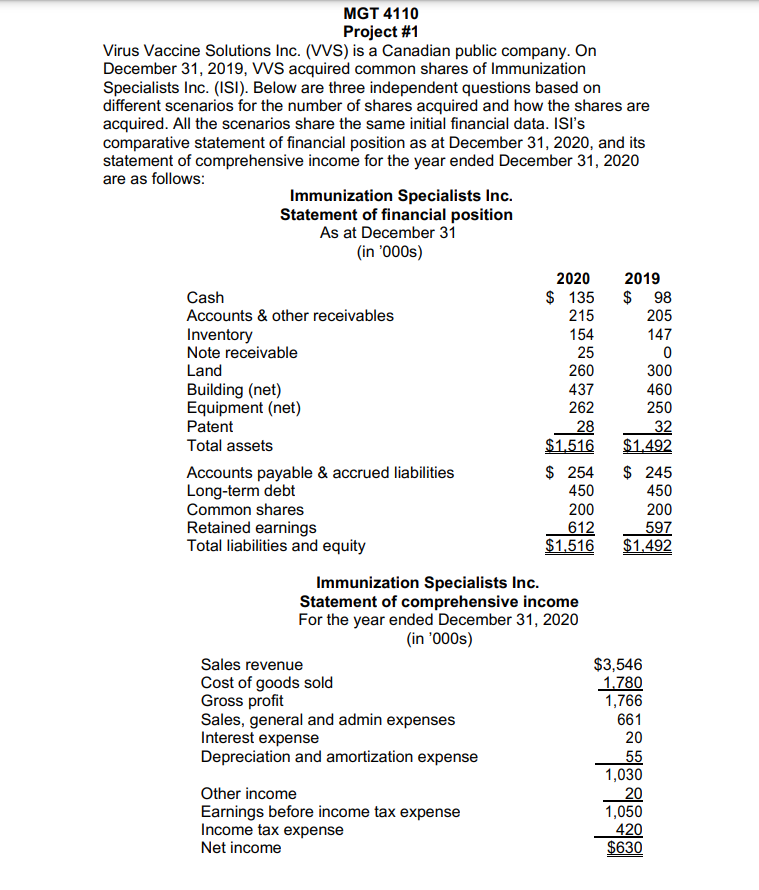

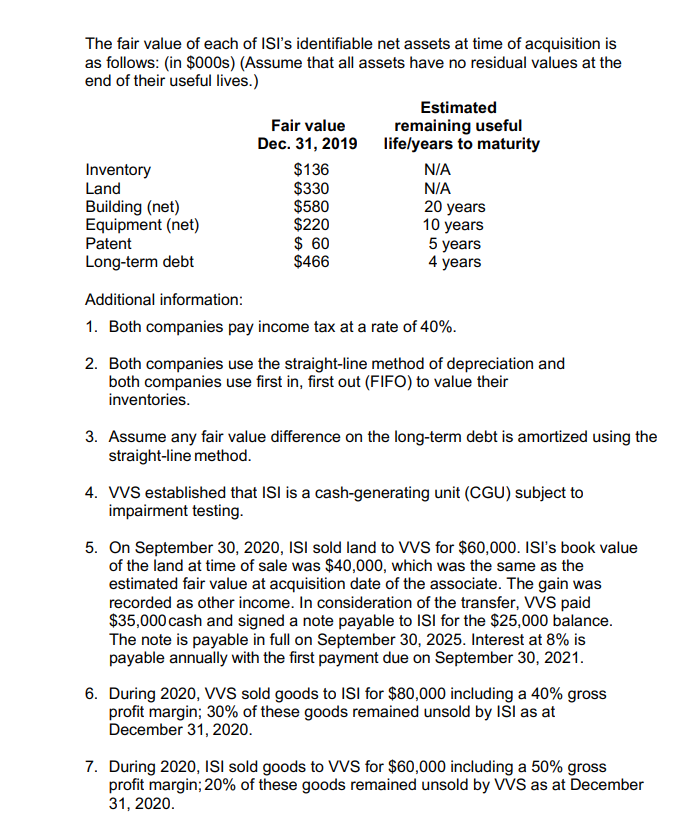

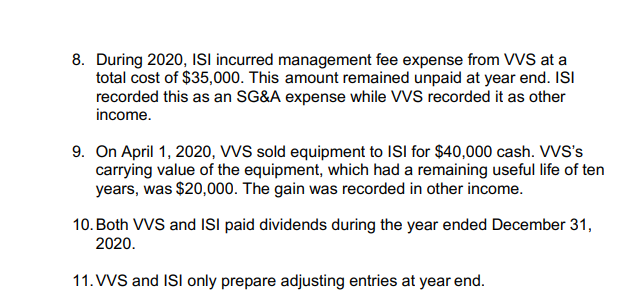

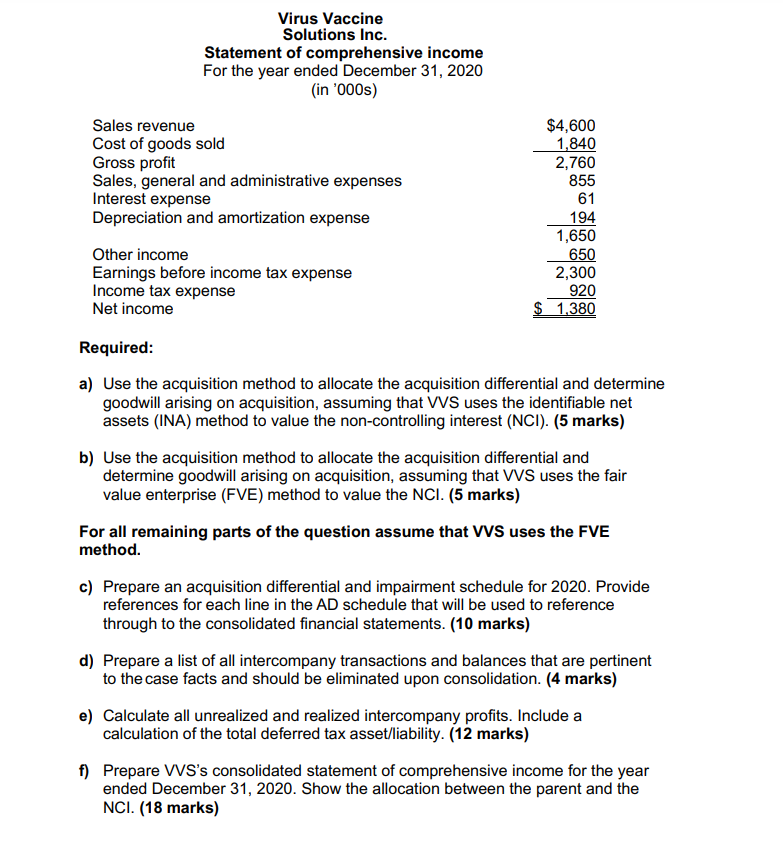

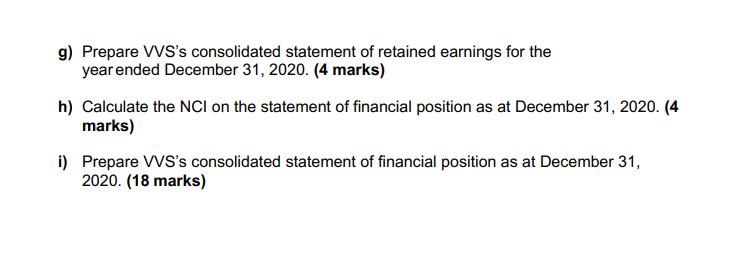

Question 3 (80 marks) Now assume that on December 31, 2019, VVS paid $960,000 cash to acquire 80% of ISI's outstanding common shares. (No additional costs were incurred.) VVS tested the CGU for impairment on December 31, 2020. Goodwill was found to be impaired by $52,000. VVS's non-consolidated comparative statement of financial position as at December 31, 2020, and its non-consolidated statement of comprehensive income for the year ended December 31, 2020, are set out below: Virus Vaccine Solutions Inc. Statement of financial position As at December 31 (in '000s) 2020 2019 Cash Accounts receivable and accruals $1,310 $ 1,290 705 675 Inventory 352 325 Land 580 520 Building (net) 1,159 1,220 Equipment (net) 747 850 Patent 450 500 Investment in subsidiary 960 960 Total assets $6,263 $6.340 Accounts payable and accruals $1,465 Long-term debt 1,200 $ 1,480 1,200 Note payable 25 0 Common shares 600 600 Retained earnings 2,973 3,060 Total liabilities and equity $6.263 $6,340 MGT 4110 Project #1 Virus Vaccine Solutions Inc. (VVS) is a Canadian public company. On December 31, 2019, VVS acquired common shares of Immunization Specialists Inc. (ISI). Below are three independent questions based on different scenarios for the number of shares acquired and how the shares are acquired. All the scenarios share the same initial financial data. ISI's comparative statement of financial position as at December 31, 2020, and its statement of comprehensive income for the year ended December 31, 2020 are as follows: Immunization Specialists Inc. Statement of financial position As at December 31 (in '000s) 2020 2019 Cash Accounts & other receivables Inventory Note receivable Land $ 135 $ 98 215 205 154 147 25 0 260 300 Building (net) 437 460 Equipment (net) 262 250 Patent 28 32 Total assets $1,516 $1,492 Accounts payable & accrued liabilities $ 254 $ 245 Long-term debt 450 450 Common shares 200 200 Retained earnings 612 597 Total liabilities and equity $1,516 $1,492 Immunization Specialists Inc. Statement of comprehensive income For the year ended December 31, 2020 Sales revenue Cost of goods sold Gross profit (in '000s) Sales, general and admin expenses Interest expense Depreciation and amortization expense Other income Earnings before income tax expense Income tax expense Net income $3,546 1,780 1,766 661 20 55 1,030 20 1,050 420 $630 The fair value of each of ISI's identifiable net assets at time of acquisition is as follows: (in $000s) (Assume that all assets have no residual values at the end of their useful lives.) Estimated remaining useful life/years to maturity Fair value Dec. 31, 2019 Inventory $136 N/A Land $330 N/A Building (net) $580 20 years Equipment (net) $220 10 years Patent $ 60 5 years Long-term debt $466 4 years Additional information: 1. Both companies pay income tax at a rate of 40%. 2. Both companies use the straight-line method of depreciation and both companies use first in, first out (FIFO) to value their inventories. 3. Assume any fair value difference on the long-term debt is amortized using the straight-line method. 4. VVS established that ISI is a cash-generating unit (CGU) subject to impairment testing. 5. On September 30, 2020, ISI sold land to VVS for $60,000. ISI's book value of the land at time of sale was $40,000, which was the same as the estimated fair value at acquisition date of the associate. The gain was recorded as other income. In consideration of the transfer, VVS paid $35,000 cash and signed a note payable to ISI for the $25,000 balance. The note is payable in full on September 30, 2025. Interest at 8% is payable annually with the first payment due on September 30, 2021. 6. During 2020, VVS sold goods to ISI for $80,000 including a 40% gross profit margin; 30% of these goods remained unsold by ISI as at December 31, 2020. 7. During 2020, ISI sold goods to VVS for $60,000 including a 50% gross profit margin; 20% of these goods remained unsold by VVS as at December 31, 2020. 8. During 2020, ISI incurred management fee expense from VVS at a total cost of $35,000. This amount remained unpaid at year end. ISI recorded this as an SG&A expense while VVS recorded it as other income. 9. On April 1, 2020, VVS sold equipment to ISI for $40,000 cash. VVS's carrying value of the equipment, which had a remaining useful life of ten years, was $20,000. The gain was recorded in other income. 10. Both VVS and ISI paid dividends during the year ended December 31, 2020. 11. VVS and ISI only prepare adjusting entries at year end. Virus Vaccine Solutions Inc. Statement of comprehensive income For the year ended December 31, 2020 (in '000s) Sales revenue Cost of goods sold Gross profit Sales, general and administrative expenses Interest expense Depreciation and amortization expense Other income Earnings before income tax expense Income tax expense Net income Required: $4,600 1,840 2,760 855 61 194 1,650 650 2,300 920 $ 1,380 a) Use the acquisition method to allocate the acquisition differential and determine goodwill arising on acquisition, assuming that VVS uses the identifiable net assets (INA) method to value the non-controlling interest (NCI). (5 marks) b) Use the acquisition method to allocate the acquisition differential and determine goodwill arising on acquisition, assuming that VVS uses the fair value enterprise (FVE) method to value the NCI. (5 marks) For all remaining parts of the question assume that VVS uses the FVE method. c) Prepare an acquisition differential and impairment schedule for 2020. Provide references for each line in the AD schedule that will be used to reference through to the consolidated financial statements. (10 marks) d) Prepare a list of all intercompany transactions and balances that are pertinent to the case facts and should be eliminated upon consolidation. (4 marks) e) Calculate all unrealized and realized intercompany profits. Include a calculation of the total deferred tax asset/liability. (12 marks) f) Prepare VVS's consolidated statement of comprehensive income for the year ended December 31, 2020. Show the allocation between the parent and the NCI. (18 marks) g) Prepare VVS's consolidated statement of retained earnings for the year ended December 31, 2020. (4 marks) h) Calculate the NCI on the statement of financial position as at December 31, 2020. (4 marks) i) Prepare VVS's consolidated statement of financial position as at December 31, 2020. (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started