Answered step by step

Verified Expert Solution

Question

1 Approved Answer

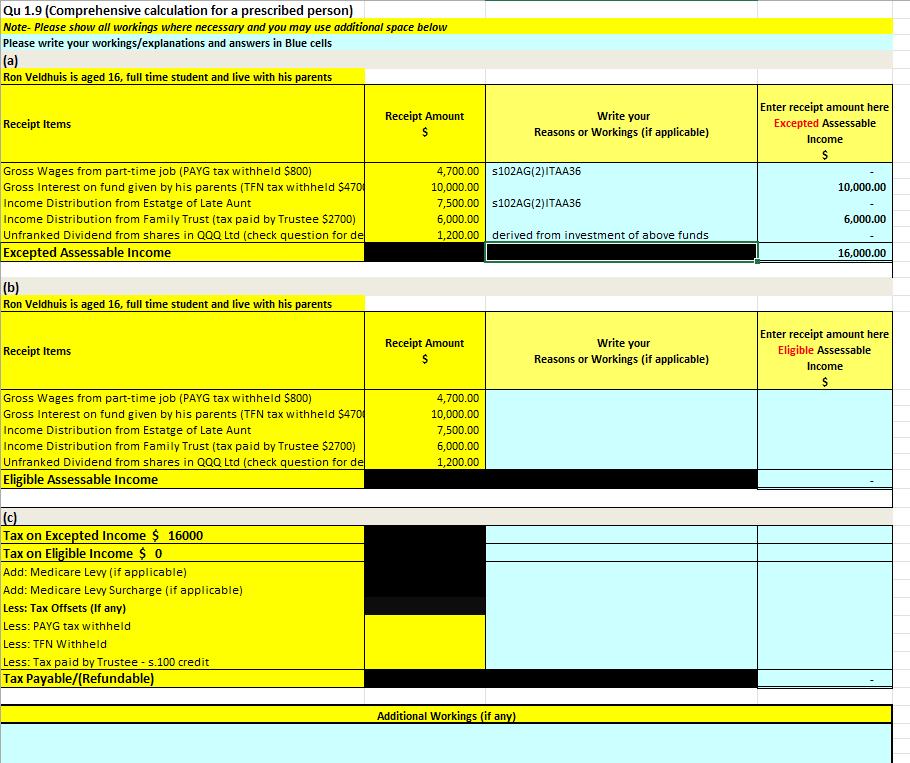

Qu 1.9 (Comprehensive calculation for a prescribed person) Note- Please show all workings where necessary and you may use additional space below Please write

Qu 1.9 (Comprehensive calculation for a prescribed person) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells (a) Ron Veldhuis is aged 16, full time student and live with his parents Receipt Items Receipt Amount $ Write your Reasons or Workings (if applicable) 4,700.00 $102AG(2)ITAA36 Gross Wages from part-time job (PAYG tax withheld $800) Gross Interest on fund given by his parents (TFN tax withheld $470 Income Distribution from Estatge of Late Aunt Income Distribution from Family Trust (tax paid by Trustee $2700) Unfranked Dividend from shares in QQQ Ltd (check question for de Excepted Assessable Income (b) Ron Veldhuis is aged 16, full time student and live with his parents 10,000.00 7,500.00 $102AG(2)ITAA36 6,000.00 1,200.00 derived from investment of above funds Receipt Items Receipt Amount $ Write your Reasons or Workings (if applicable) Gross Wages from part-time job (PAYG tax withheld $800) 4,700.00 Gross Interest on fund given by his parents (TFN tax withheld $470 Income Distribution from Estatge of Late Aunt 10,000.00 7,500.00 6,000.00 1,200.00 Income Distribution from Family Trust (tax paid by Trustee $2700) Unfranked Dividend from shares in QQQ Ltd (check question for de Eligible Assessable Income (c) Tax on Excepted Income $ 16000 Tax on Eligible Income $ 0 Add: Medicare Levy (if applicable) Add: Medicare Levy Surcharge (if applicable) Less: Tax Offsets (If any) Less: PAYG tax withheld Less: TFN Withheld Less: Tax paid by Trustee - s.100 credit Tax Payable/(Refundable) Additional Workings (if any) Enter receipt amount here Excepted Assessable Income $ 10,000.00 6,000.00 16,000.00 Enter receipt amount here Eligible Assessable Income $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started