Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the start of 2023, Marine Corporation (Marine) had three divisions: the Boat Division, the Recreation Division, and the Accessories Division. During 2023, Marine

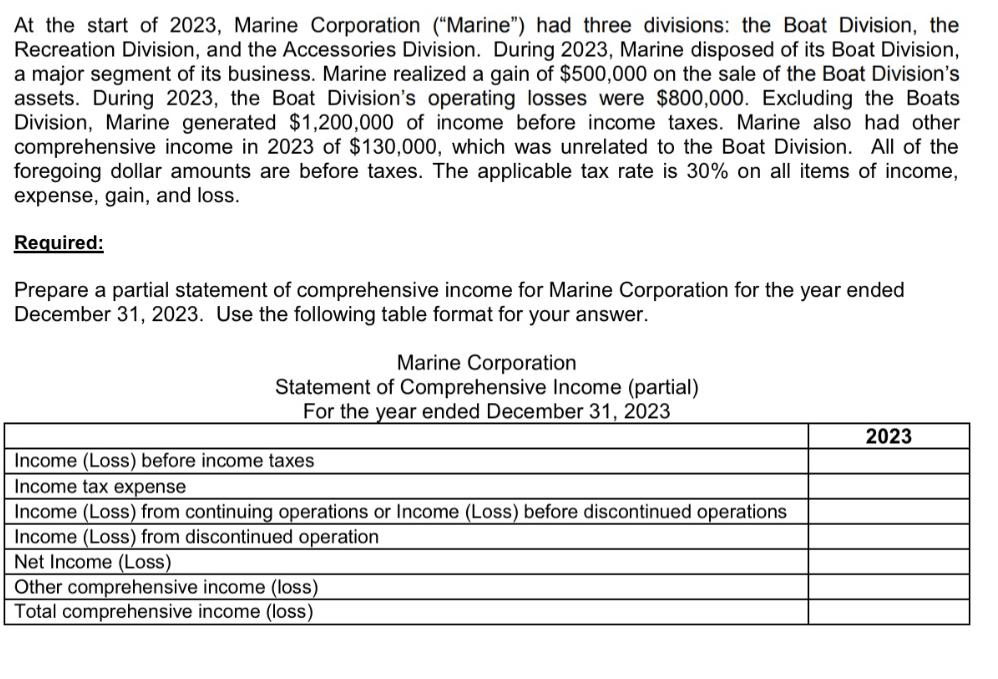

At the start of 2023, Marine Corporation ("Marine") had three divisions: the Boat Division, the Recreation Division, and the Accessories Division. During 2023, Marine disposed of its Boat Division, a major segment of its business. Marine realized a gain of $500,000 on the sale of the Boat Division's assets. During 2023, the Boat Division's operating losses were $800,000. Excluding the Boats Division, Marine generated $1,200,000 of income before income taxes. Marine also had other comprehensive income in 2023 of $130,000, which was unrelated to the Boat Division. All of the foregoing dollar amounts are before taxes. The applicable tax rate is 30% on all items of income, expense, gain, and loss. Required: Prepare a partial statement of comprehensive income for Marine Corporation for the year ended December 31, 2023. Use the following table format for your answer. Marine Corporation Statement of Comprehensive Income (partial) For the year ended December 31, 2023 Income (Loss) before income taxes Income tax expense Income (Loss) from continuing operations or Income (Loss) before discontinued operations Income (Loss) from discontinued operation 2023 Net Income (Loss) Other comprehensive income (loss) Total comprehensive income (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started