Answered step by step

Verified Expert Solution

Question

1 Approved Answer

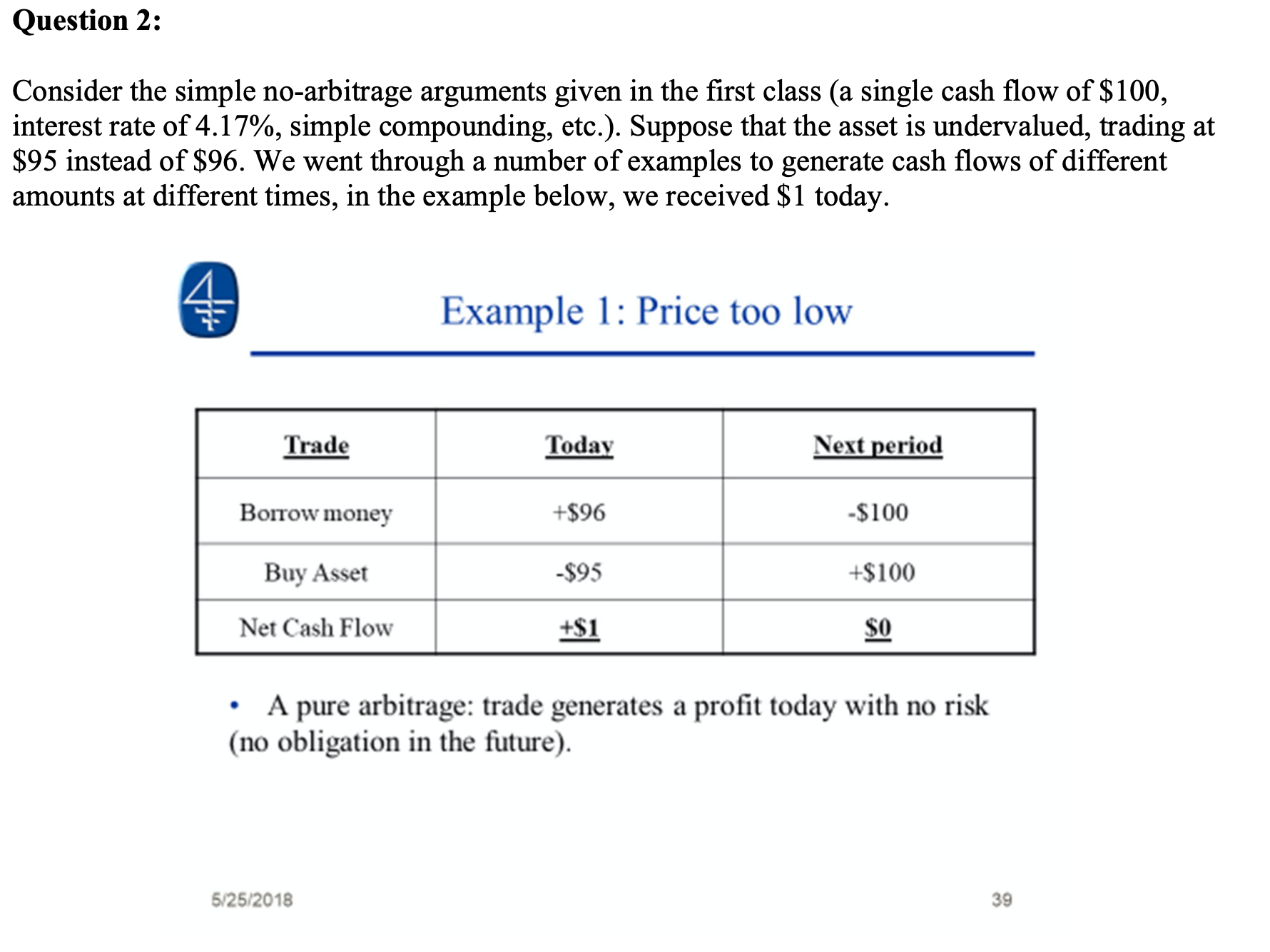

TranscribedText: Question 2: Consider the simple no-arbitrage arguments given in the first class (a single cash flow of $100, interest rate of 4.17%, simple compounding,

Question 2: Consider the simple no-arbitrage arguments given in the first class (a single cash flow of $100, interest rate of 4.17%, simple compounding, etc.). Suppose that the asset is undervalued, trading at $95 instead of $96. We went through a number of examples to generate cash flows of different amounts at different times, in the example below, we received $1 today. Example 1: Price too low Trade Today Next period Borrow money +$96 -$100 Buy Asset -$95 +$100 Net Cash Flow +$1 $0 A pure arbitrage: trade generates a profit today with no risk (no obligation in the future). 5/25/2018 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started