Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TranscribedText: Question 22 of 23 /40 marks Instructions Show In 20X0, Canterra Company invested $1,500,000 CDN (600,000FC) to establish a foreign subsidiary, Forterra Ltd. Forterra

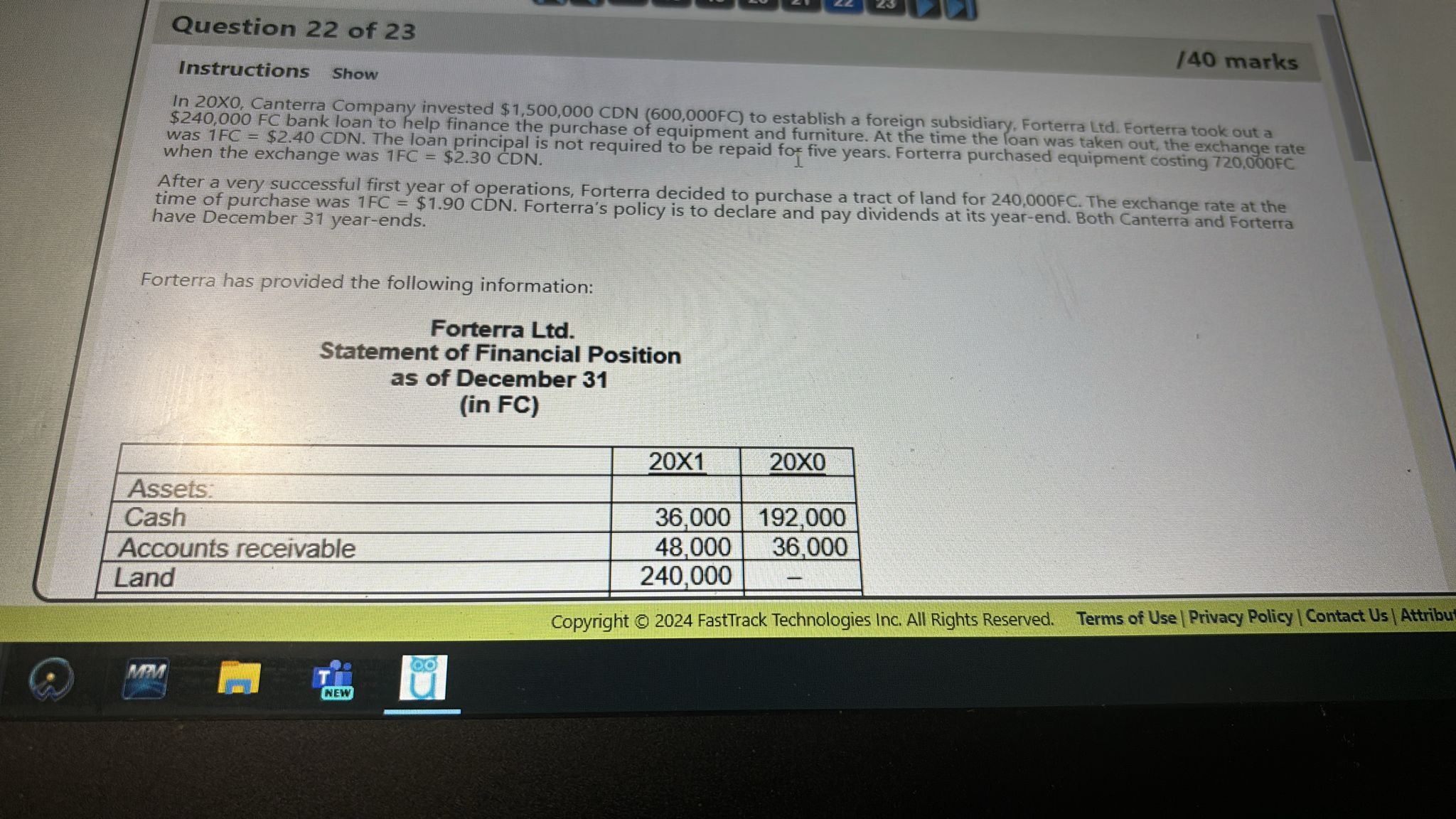

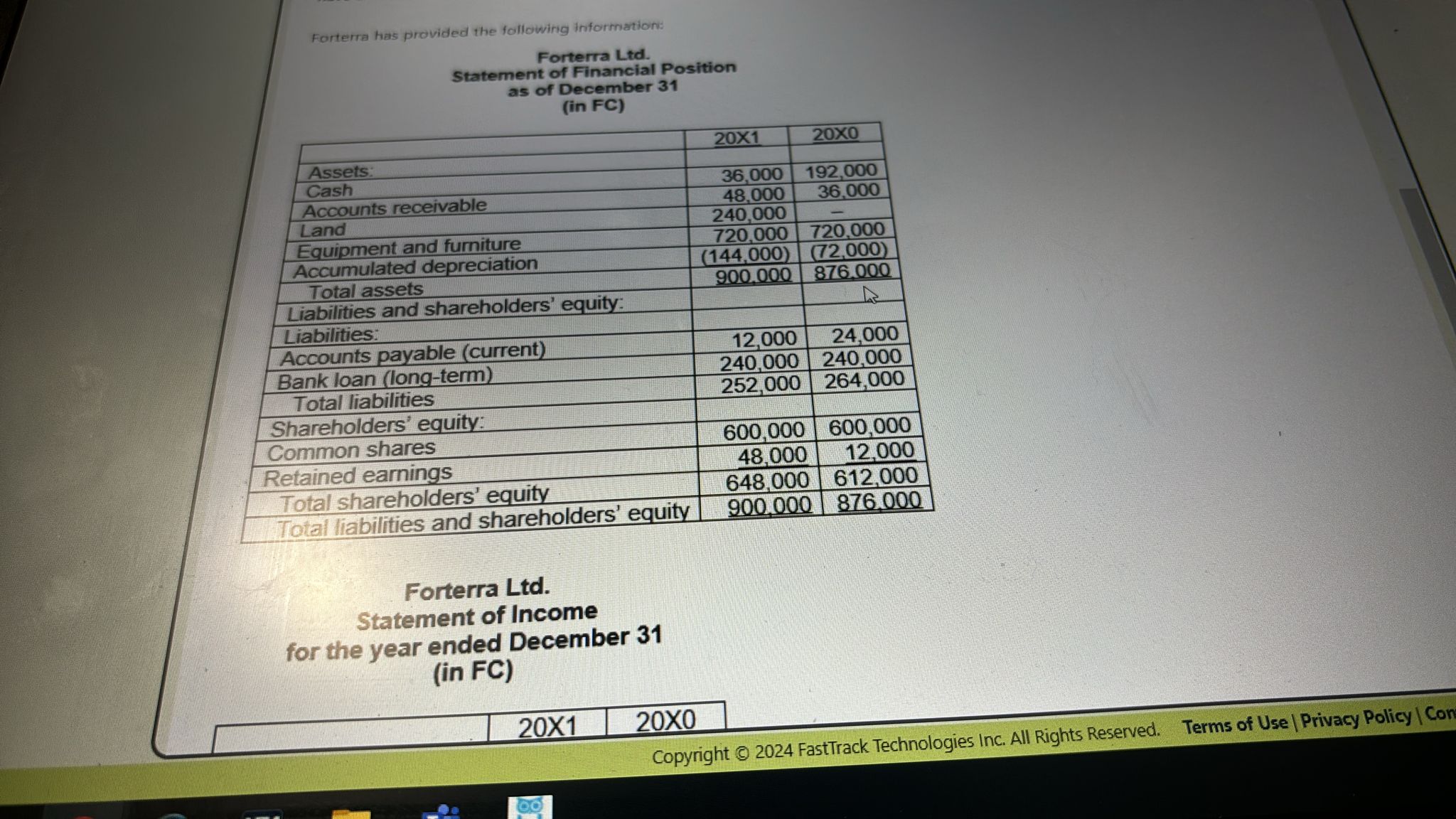

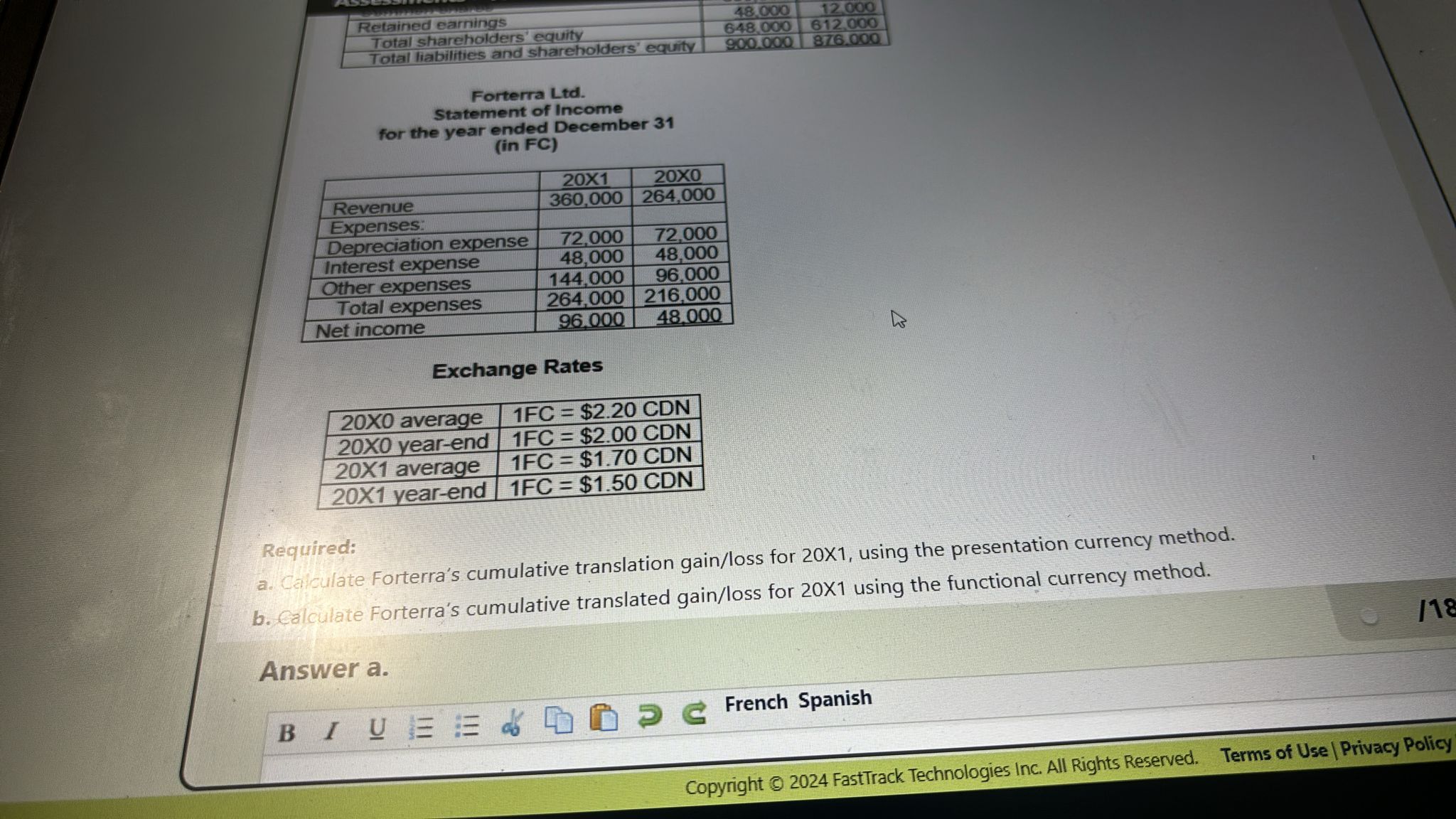

Question 22 of 23 Instructions Show /40 marks In 20X0, Canterra Company invested $1,500,000 CDN (600,000FC) to establish a foreign subsidiary, Forterra Ltd. Forterra took out a $240,000 FC bank loan to help finance the purchase of equipment and furniture. At the time the loan was taken out, the exchange rate was 1FC = $2.40 CDN. The loan principal is not required to be repaid for five years. Forterra purchased equipment costing 720,000FC when the exchange was 1FC = $2.30 CDN. After a very successful first year of operations, Forterra decided to purchase a tract of land for 240,000FC. The exchange rate at the time of purchase was 1FC = $1.90 CDN. Forterra's policy is to declare and pay dividends at its year-end. Both Canterra and Forterra have December 31 year-ends. Forterra has provided the following information: Forterra Ltd. Statement of Financial Position as of December 31 (in FC) Assets: Cash Accounts receivable Land NEW 20X1 20X0 36,000 192,000 36,000 48,000 240,000 Copyright 2024 FastTrack Technologies Inc. All Rights Reserved. Terms of Use | Privacy Policy | Contact Us | Attribut

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started