Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TranscribedText: QUESTION 4 (IAS 36 and IAS 38: Impairment of intangible assets} On 2 Jan 2010, E2E Corporation Ltd., a technology hardware company, capitalized $40

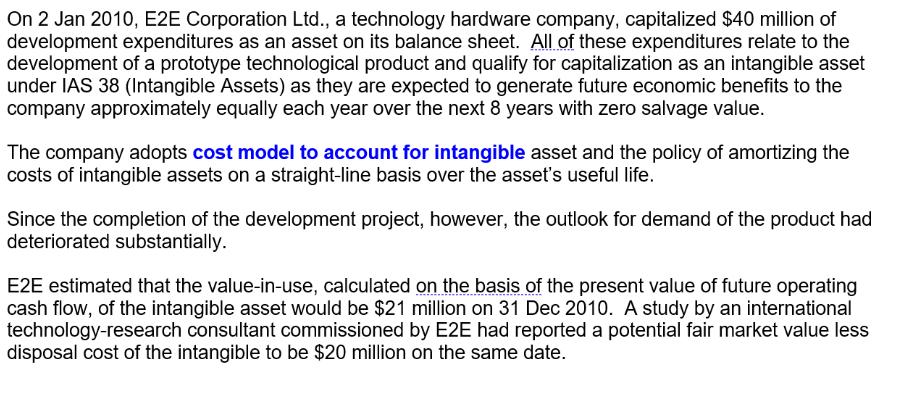

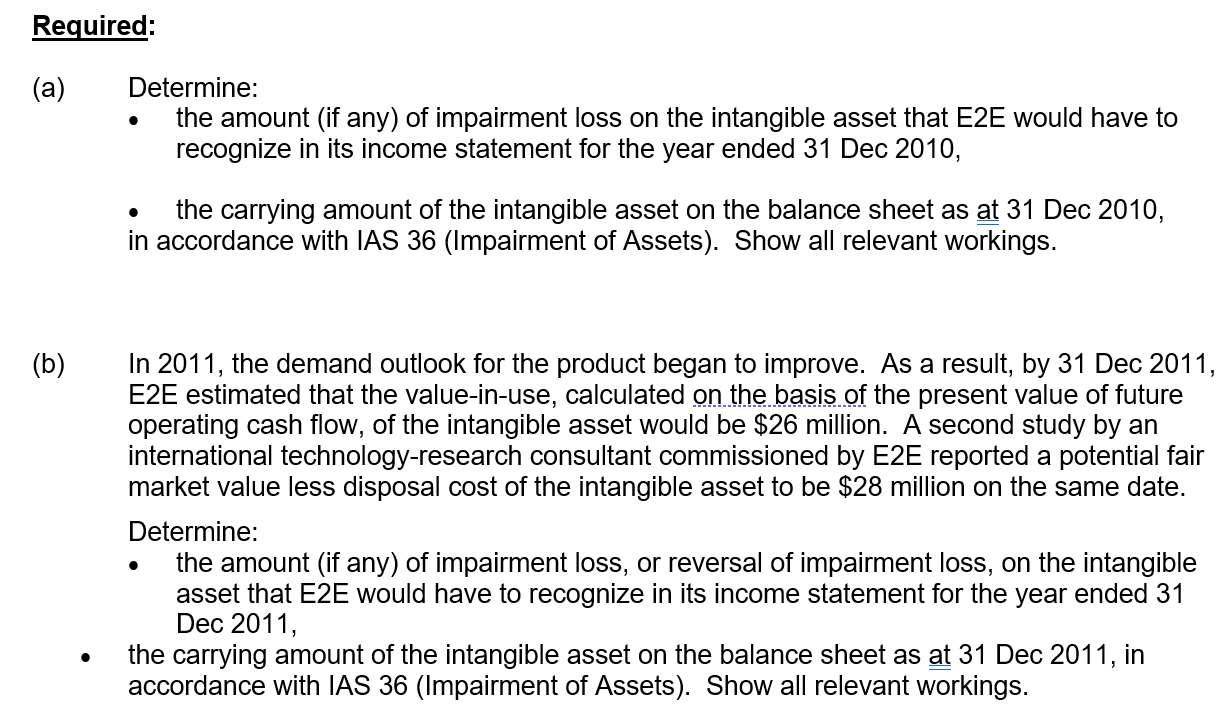

On 2 Jan 2010, E2E Corporation Ltd., a technology hardware company, capitalized $40 million of development expenditures as an asset on its balance sheet. All of these expenditures relate to the development of a prototype technological product and qualify for capitalization as an intangible asset under IAS 38 (Intangible Assets) as they are expected to generate future economic benefits to the company approximately equally each year over the next 8 years with zero salvage value. The company adopts cost model to account for intangible asset and the policy of amortizing the costs of intangible assets on a straight-line basis over the asset's useful life. Since the completion of the development project, however, the outlook for demand of the product had deteriorated substantially. E2E estimated that the value-in-use, calculated on the basis of the present value of future operating cash flow, of the intangible asset would be $21 million on 31 Dec 2010. A study by an international technology-research consultant commissioned by E2E had reported a potential fair market value less disposal cost of the intangible to be $20 million on the same date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started