Answered step by step

Verified Expert Solution

Question

1 Approved Answer

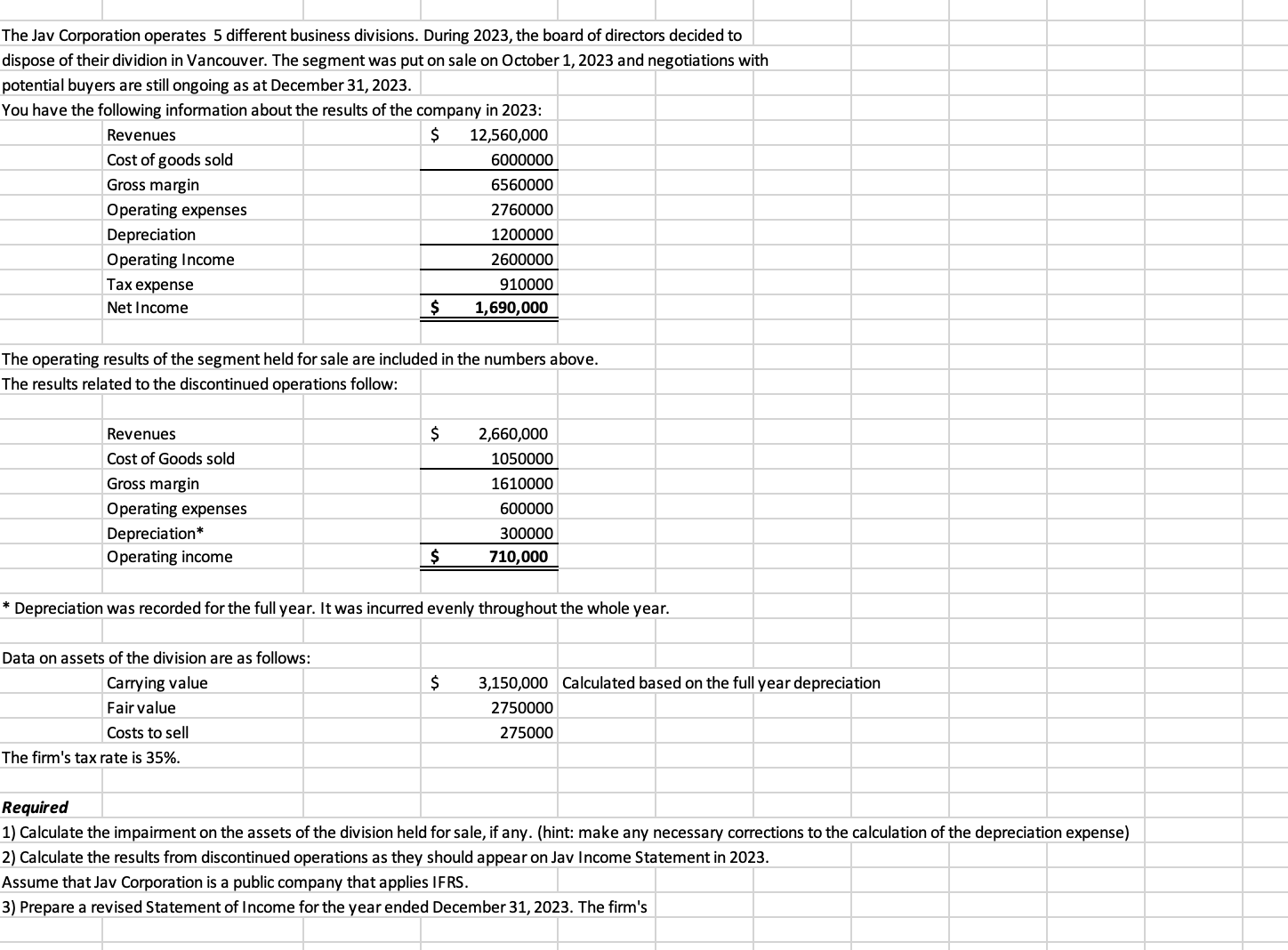

The Jav Corporation operates 5 different business divisions. During 2023, the board of directors decided to dispose of their dividion in Vancouver. The segment

The Jav Corporation operates 5 different business divisions. During 2023, the board of directors decided to dispose of their dividion in Vancouver. The segment was put on sale on October 1, 2023 and negotiations with potential buyers are still ongoing as at December 31, 2023. You have the following information about the results of the company in 2023: Revenues Cost of goods sold Gross margin Operating expenses Depreciation Operating Income Tax expense Net Income $ 12,560,000 6000000 6560000 2760000 1200000 2600000 910000 $ 1,690,000 The operating results of the segment held for sale are included in the numbers above. The results related to the discontinued operations follow: Revenues Cost of Goods sold Gross margin Operating expenses Depreciation* Operating income $ 2,660,000 1050000 1610000 600000 300000 $ 710,000 * Depreciation was recorded for the full year. It was incurred evenly throughout the whole year. Data on assets of the division are as follows: Carrying value Fair value Costs to sell The firm's tax rate is 35%. Required $ 3,150,000 Calculated based on the full year depreciation 2750000 275000 1) Calculate the impairment on the assets of the division held for sale, if any. (hint: make any necessary corrections to the calculation of the depreciation expense) 2) Calculate the results from discontinued operations as they should appear on Jav Income Statement in 2023. Assume that Jav Corporation is a public company that applies IFRS. 3) Prepare a revised Statement of Income for the year ended December 31, 2023. The firm's

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started