Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transfer Pricing and Section 482 Mossfort, Inc., has a division in Canada that makes long-lasting exterior wood stain. Mossfort has another U.S. division, the Retail

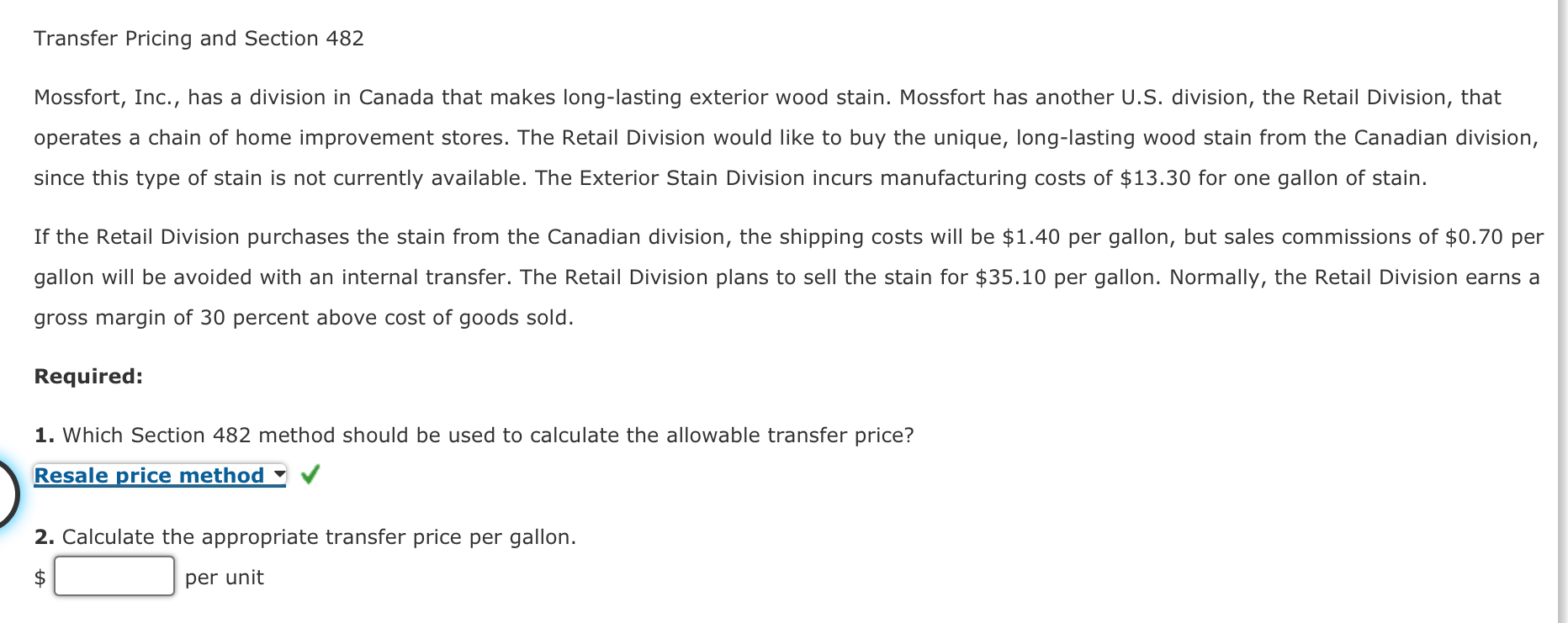

Transfer Pricing and Section 482 Mossfort, Inc., has a division in Canada that makes long-lasting exterior wood stain. Mossfort has another U.S. division, the Retail Division, that operates a chain of home improvement stores. The Retail Division would like to buy the unique, long-lasting wood stain from the Canadian division, since this type of stain is not currently available. The Exterior Stain Division incurs manufacturing costs of $13.30 for one gallon of stain. If the Retail Division purchases the stain from the Canadian division, the shipping costs will be $1.40 per gallon, but sales commissions of $0.70 per gallon will be avoided with an internal transfer. The Retail Division plans to sell the stain for $35.10 per gallon. Normally, the Retail Division earns a gross margin of 30 percent above cost of goods sold. Required: 1. Which Section 482 method should be used to calculate the allowable transfer price? 2. Calculate the appropriate transfer price per gallon. \$ per unit

Transfer Pricing and Section 482 Mossfort, Inc., has a division in Canada that makes long-lasting exterior wood stain. Mossfort has another U.S. division, the Retail Division, that operates a chain of home improvement stores. The Retail Division would like to buy the unique, long-lasting wood stain from the Canadian division, since this type of stain is not currently available. The Exterior Stain Division incurs manufacturing costs of $13.30 for one gallon of stain. If the Retail Division purchases the stain from the Canadian division, the shipping costs will be $1.40 per gallon, but sales commissions of $0.70 per gallon will be avoided with an internal transfer. The Retail Division plans to sell the stain for $35.10 per gallon. Normally, the Retail Division earns a gross margin of 30 percent above cost of goods sold. Required: 1. Which Section 482 method should be used to calculate the allowable transfer price? 2. Calculate the appropriate transfer price per gallon. \$ per unit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started