Answered step by step

Verified Expert Solution

Question

1 Approved Answer

transfer pricing = Another company produces a component H in H-country (tax rate th on profit: 40%). This component is delivered to L-country (tax rate

transfer pricing

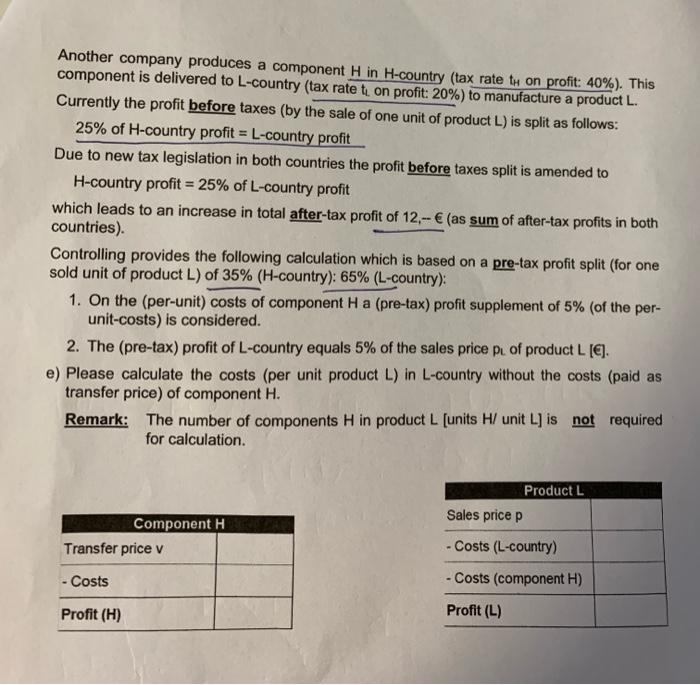

= Another company produces a component H in H-country (tax rate th on profit: 40%). This component is delivered to L-country (tax rate ton profit: 20%) to manufacture a product L. Currently the profit before taxes (by the sale of one unit of product L) is split as follows: 25% of H-country profit = L-country profit Due to new tax legislation in both countries the profit before taxes split is amended to H-country profit = 25% of L-country profit which leads to an increase in total after-tax profit of 12,-- (as sum of after-tax profits in both countries). Controlling provides the following calculation which is based on a pre-tax profit split (for one sold unit of product L) of 35% (H-country): 65% (L-country): 1. On the (per unit) costs of component H a (pre-tax) profit supplement of 5% (of the per- unit-costs) is considered. 2. The (pre-tax) profit of L-country equals 5% of the sales price PL of product L (). e) Please calculate the costs (per unit product L) in L-country without the costs (paid as transfer price) of component H. Remark: The number of components H in product L [units H/ unit L) is not required for calculation. Product L Sales price p Component H Transfer price v - Costs (L-country) Costs - Costs (component H) Profit (H) Profit (L) = Another company produces a component H in H-country (tax rate th on profit: 40%). This component is delivered to L-country (tax rate ton profit: 20%) to manufacture a product L. Currently the profit before taxes (by the sale of one unit of product L) is split as follows: 25% of H-country profit = L-country profit Due to new tax legislation in both countries the profit before taxes split is amended to H-country profit = 25% of L-country profit which leads to an increase in total after-tax profit of 12,-- (as sum of after-tax profits in both countries). Controlling provides the following calculation which is based on a pre-tax profit split (for one sold unit of product L) of 35% (H-country): 65% (L-country): 1. On the (per unit) costs of component H a (pre-tax) profit supplement of 5% (of the per- unit-costs) is considered. 2. The (pre-tax) profit of L-country equals 5% of the sales price PL of product L (). e) Please calculate the costs (per unit product L) in L-country without the costs (paid as transfer price) of component H. Remark: The number of components H in product L [units H/ unit L) is not required for calculation. Product L Sales price p Component H Transfer price v - Costs (L-country) Costs - Costs (component H) Profit (H) Profit (L) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started