Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRANSFER PRICING TUTORIAL QUESTION Super Appliance Manufacturers Ltd has a wide range of manufacturing activities. The company operates on a divisionalised basis with each division

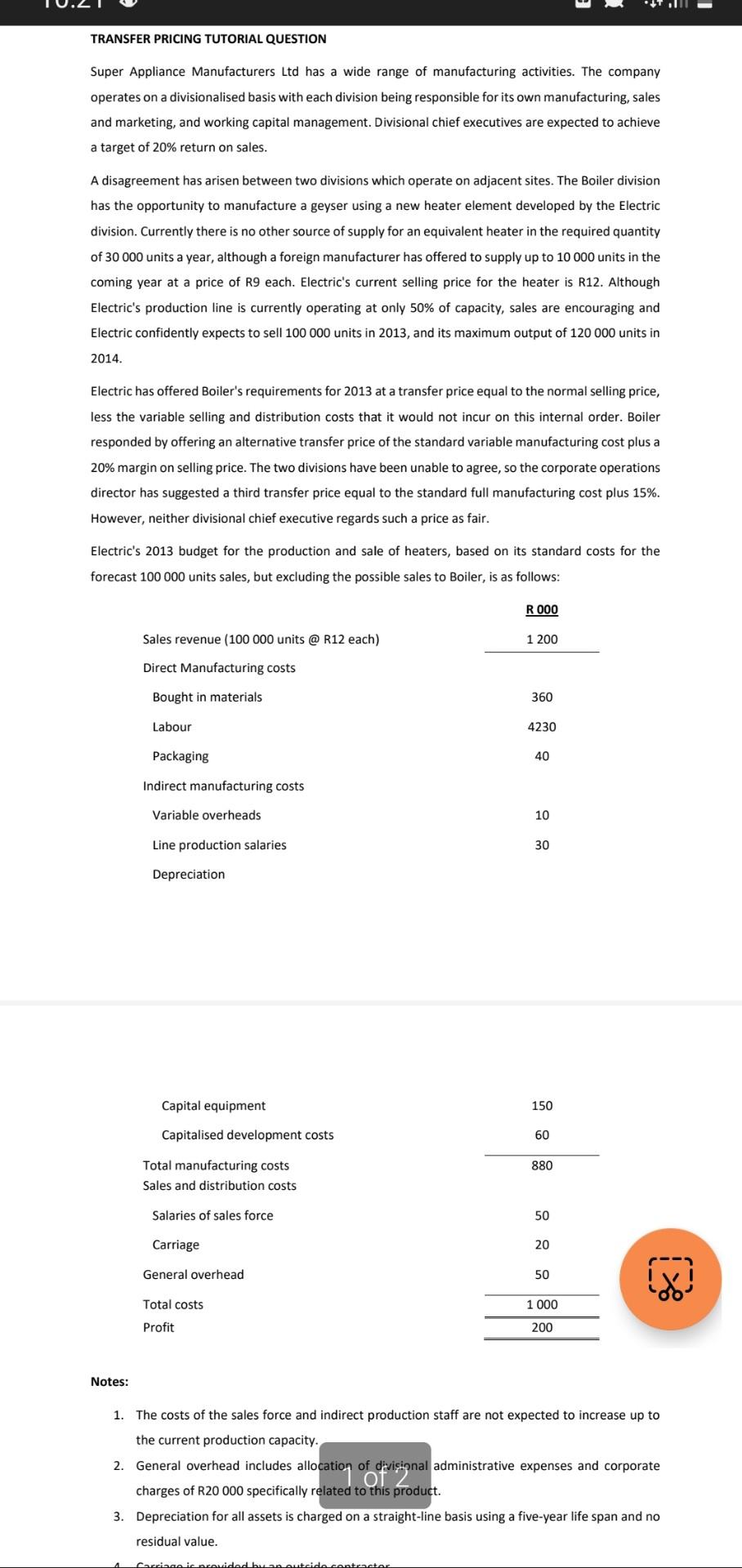

TRANSFER PRICING TUTORIAL QUESTION Super Appliance Manufacturers Ltd has a wide range of manufacturing activities. The company operates on a divisionalised basis with each division being responsible for its own manufacturing, sales and marketing, and working capital management. Divisional chief executives are expected to achieve a target of 20% return on sales. A disagreement has arisen between two divisions which operate on adjacent sites. The Boiler division has the opportunity to manufacture a geyser using a new heater element developed by the Electric division. Currently there is no other source of supply for an equivalent heater in the required quantity of 30000 units a year, although a foreign manufacturer has offered to supply up to 10000 units in the coming year at a price of R9 each. Electric's current selling price for the heater is R12. Although Electric's production line is currently operating at only 50% of capacity, sales are encouraging and Electric confidently expects to sell 100000 units in 2013, and its maximum output of 120000 units in 5014. Electric has offered Boiler's requirements for 2013 at a transfer price equal to the normal selling price, less the variable selling and distribution costs that it would not incur on this internal order. Boiler responded by offering an alternative transfer price of the standard variable manufacturing cost plus a 20% margin on selling price. The two divisions have been unable to agree, so the corporate operations director has suggested a third transfer price equal to the standard full manufacturing cost plus 15%. However, neither divisional chief executive regards such a price as fair. Electric's 2013 budget for the production and sale of heaters, based on its standard costs for the forecast 100000 units sales, but excluding the possible sales to Boiler, is as follows: Notes: 1. The costs of the sales force and indirect production staff are not expected to increase up to the current production capacity. 2. General overhead includes allocation of divisional administrative expenses and corporate charges of R20 000 specifically related to this product. 3. Depreciation for all assets is charged on a straight-line basis using a five-year life span and no residual value. TRANSFER PRICING TUTORIAL QUESTION Super Appliance Manufacturers Ltd has a wide range of manufacturing activities. The company operates on a divisionalised basis with each division being responsible for its own manufacturing, sales and marketing, and working capital management. Divisional chief executives are expected to achieve a target of 20% return on sales. A disagreement has arisen between two divisions which operate on adjacent sites. The Boiler division has the opportunity to manufacture a geyser using a new heater element developed by the Electric division. Currently there is no other source of supply for an equivalent heater in the required quantity of 30000 units a year, although a foreign manufacturer has offered to supply up to 10000 units in the coming year at a price of R9 each. Electric's current selling price for the heater is R12. Although Electric's production line is currently operating at only 50% of capacity, sales are encouraging and Electric confidently expects to sell 100000 units in 2013, and its maximum output of 120000 units in 5014. Electric has offered Boiler's requirements for 2013 at a transfer price equal to the normal selling price, less the variable selling and distribution costs that it would not incur on this internal order. Boiler responded by offering an alternative transfer price of the standard variable manufacturing cost plus a 20% margin on selling price. The two divisions have been unable to agree, so the corporate operations director has suggested a third transfer price equal to the standard full manufacturing cost plus 15%. However, neither divisional chief executive regards such a price as fair. Electric's 2013 budget for the production and sale of heaters, based on its standard costs for the forecast 100000 units sales, but excluding the possible sales to Boiler, is as follows: Notes: 1. The costs of the sales force and indirect production staff are not expected to increase up to the current production capacity. 2. General overhead includes allocation of divisional administrative expenses and corporate charges of R20 000 specifically related to this product. 3. Depreciation for all assets is charged on a straight-line basis using a five-year life span and no residual value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started