Answered step by step

Verified Expert Solution

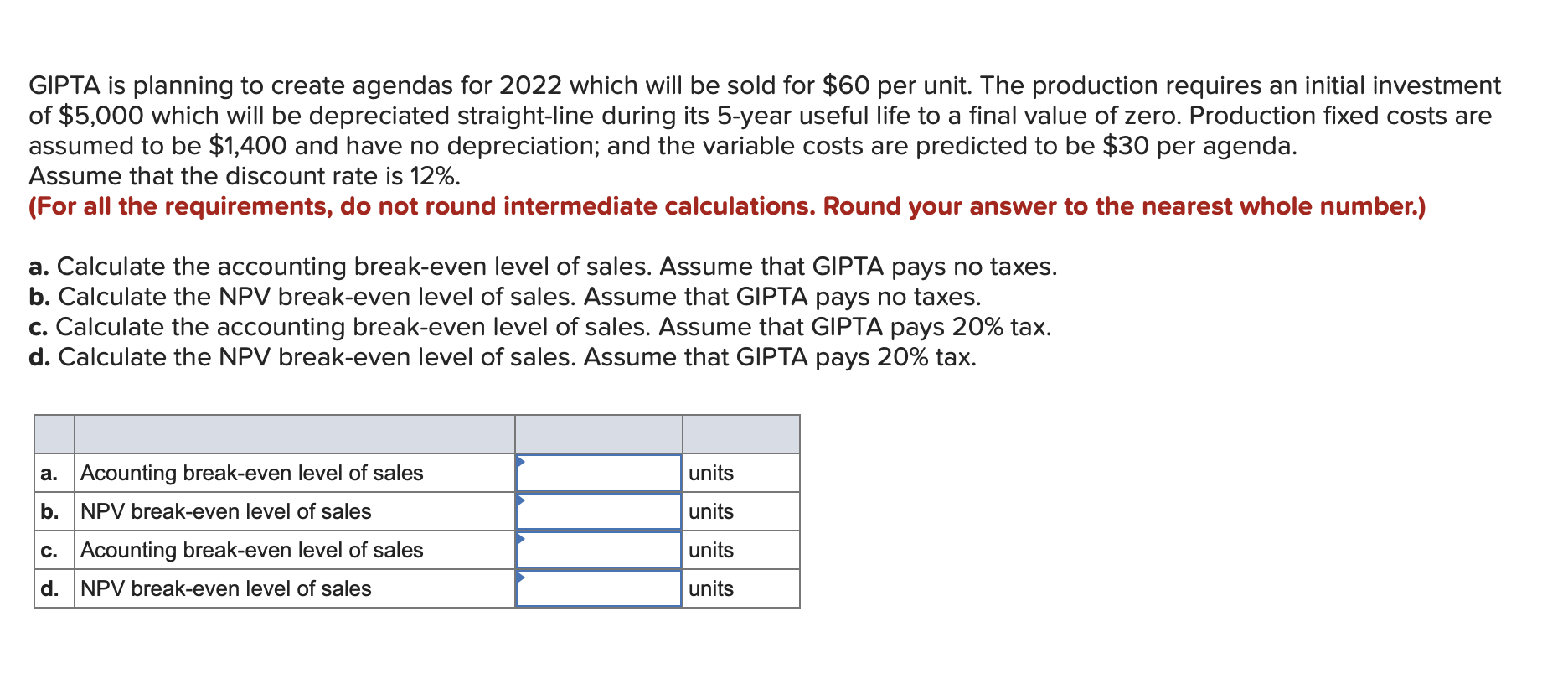

Question

1 Approved Answer

TRANSLATE with x English Arabic Hebrew Polish Bulgarian Hindi Portuguese Catalan Hmong Daw Romanian Chinese Simplified Hungarian Russian Chinese Traditional Indonesian Slovak Czech Italian Slovenian

TRANSLATE with x

English

| Arabic | Hebrew | Polish |

| Bulgarian | Hindi | Portuguese |

| Catalan | Hmong Daw | Romanian |

| Chinese Simplified | Hungarian | Russian |

| Chinese Traditional | Indonesian | Slovak |

| Czech | Italian | Slovenian |

| Danish | Japanese | Spanish |

| Dutch | Klingon | Swedish |

| English | Korean | Thai |

| Estonian | Latvian | Turkish |

| Finnish | Lithuanian | Ukrainian |

| French | Malay | Urdu |

| German | Maltese | Vietnamese |

| Greek | Norwegian | Welsh |

| Haitian Creole | Persian |

TRANSLATE with

EMBED THE SNIPPET BELOW IN YOUR SITE

Enable collaborative features and customize widget: Bing Webmaster Portal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started