Answered step by step

Verified Expert Solution

Question

1 Approved Answer

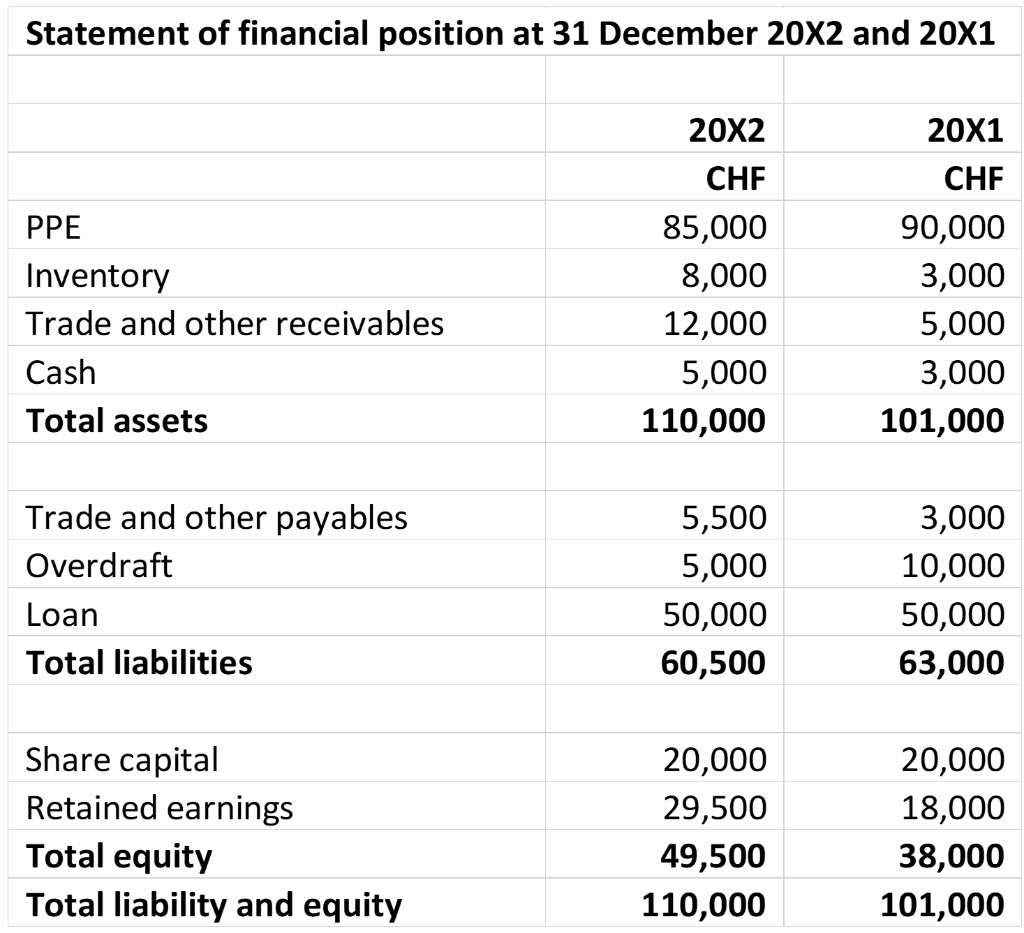

Translating FS of stand-alone entity from functional currency into presentation currency SCI: 20x2 CHF Rate SGD Revenue Cost of sales Gross profit Other income Distribution

Translating FS of stand-alone entity from functional currency into presentation currency

| SCI: | 20x2 | ||

| CHF | Rate | SGD | |

| Revenue | |||

| Cost of sales | |||

| Gross profit | |||

| Other income | |||

| Distribution costs | |||

| Admin expenses | |||

| Other expenses | |||

| Finance cost | |||

| Profit before tax | |||

| Income tax expense | |||

| Profit for the year | |||

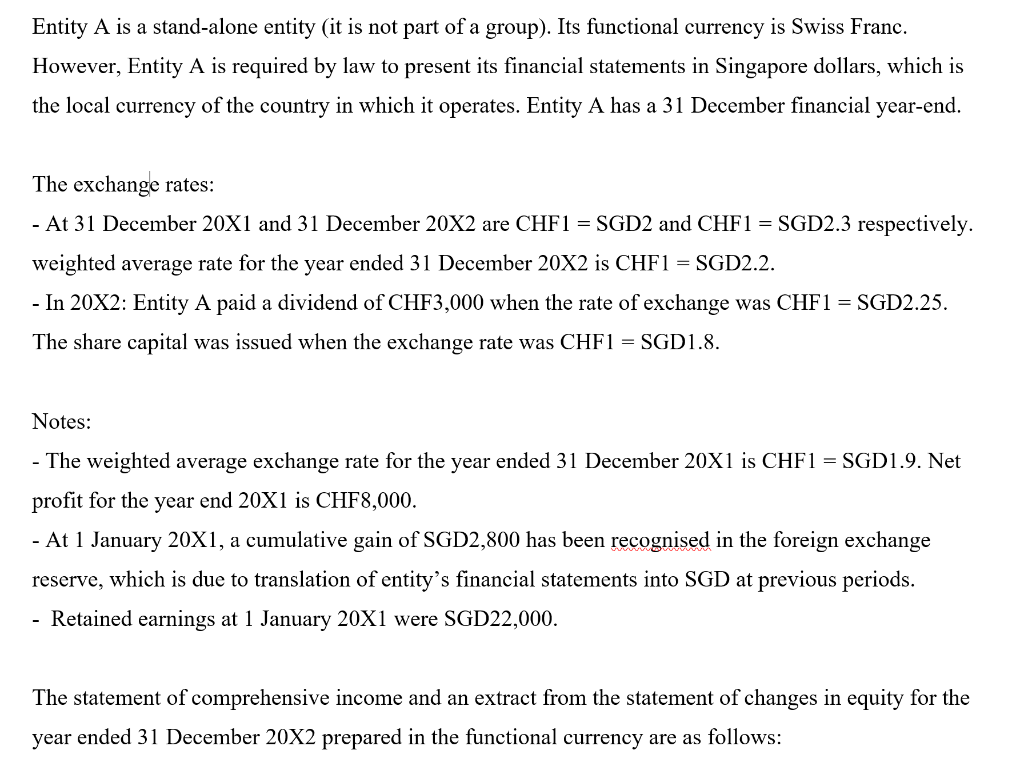

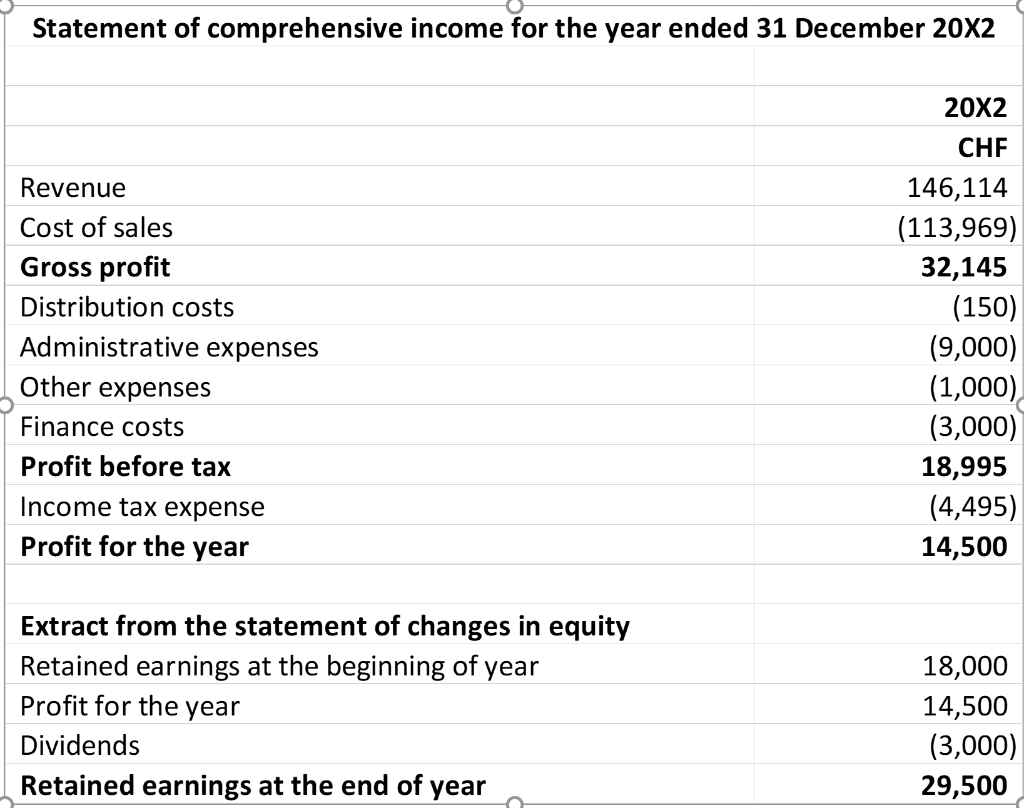

Entity A is a stand-alone entity (it is not part of a group). Its functional currency is Swiss Franc. However, Entity A is required by law to present its financial statements in Singapore dollars, which is the local currency of the country in which it operates. Entity A has a 31 December financial year-end. The exchange rates: - At 31 December 20X1 and 31 December 20X2 are CHF1 = SGD2 and CHF1 = SGD2.3 respectively. weighted average rate for the year ended 31 December 20X2 is CHF1 =SGD2.2. - In 20X2: Entity A paid a dividend of CHF3,000 when the rate of exchange was CHF1 = SGD2.25. The share capital was issued when the exchange rate was CHF1 = SGD1.8. Notes: - The weighted average exchange rate for the year ended 31 December 20X1 is CHF1 = SGD1.9. Net profit for the year end 20X1 is CHF8,000. - At 1 January 20X1, a cumulative gain of SGD2,800 has been recognised in the foreign exchange reserve, which is due to translation of entity's financial statements into SGD at previous periods. - Retained earnings at 1 January 20X1 were SGD22,000. The statement of comprehensive income and an extract from the statement of changes in equity for the year ended 31 December 20X2 prepared in the functional currency are as follows: Statement of comprehensive income for the year ended 31 December 202 202 \begin{tabular}{lc} Revenue & 146,114 \\ Cost of sales & (113,969) \\ \hline Gross profit & 32,145 \\ Distribution costs & (150) \\ Administrative expenses & (9,000) \\ Other expenses & (1,000) \\ Finance costs & (3,000) \\ Profit before tax & 18,995 \\ Income tax expense & (4,495) \\ Profit for the year & 14,500 \end{tabular} Extract from the statement of changes in equity RetainedearningsatthebeginningofyearProfitfortheyearDividendsRetainedearningsattheendofyear18,00014,500(3,000)29,500 Statement of financial position at 31 December 202 and 201 \begin{tabular}{|l|r|r|} \hline & 20X2 & 201 \\ \hline PPE & CHF & CHF \\ \hline Inventory & 85,000 & 90,000 \\ \hline Trade and other receivables & 8,000 & 3,000 \\ \hline Cash & 12,000 & 5,000 \\ \hline Total assets & 5,000 & 3,000 \\ \hline & 110,000 & 101,000 \\ \hline Trade and other payables & & \\ \hline Overdraft & 5,500 & 3,000 \\ \hline Loan & 5,000 & 10,000 \\ \hline Total liabilities & 50,000 & 50,000 \\ \hline Share capital & 60,500 & 63,000 \\ \hline Retained earnings & & \\ \hline Total equity & 20,000 & 20,000 \\ \hline Total liability and equity & 29,500 & 18,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started