Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Travel Corporation, a public company using IFRS with a 25% tax rate, reported the following balances at January 1, 2020: Preferred Shares (1,000 shares

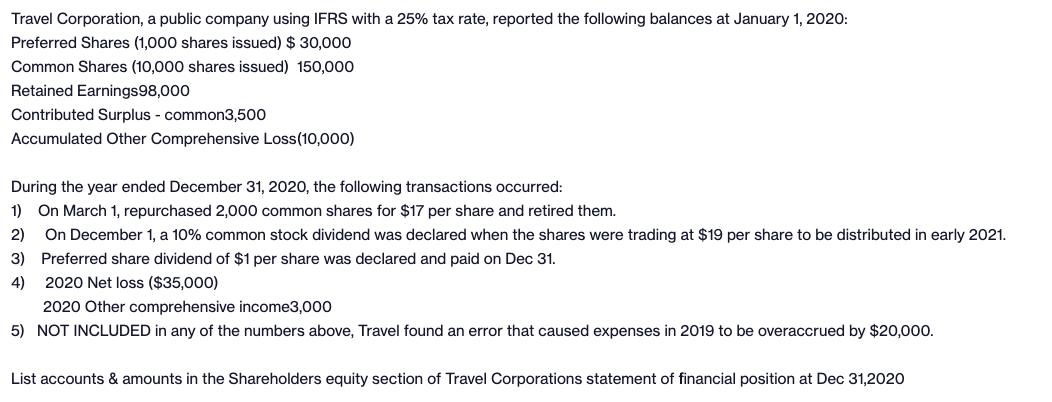

Travel Corporation, a public company using IFRS with a 25% tax rate, reported the following balances at January 1, 2020: Preferred Shares (1,000 shares issued) $ 30,000 Common Shares (10,000 shares issued) 150,000 Retained Earnings98,000 Contributed Surplus - common3,500 Accumulated Other Comprehensive Loss (10,000) During the year ended December 31, 2020, the following transactions occurred: 1) On March 1, repurchased 2,000 common shares for $17 per share and retired them. 2) On December 1, a 10% common stock dividend was declared when the shares were trading at $19 per share to be distributed in early 2021. Preferred share dividend of $1 per share was declared and paid on Dec 31. 2020 Net loss ($35,000) 2020 Other comprehensive income3,000 5) NOT INCLUDED in any of the numbers above, Travel found an error that caused expenses in 2019 to be overaccrued by $20,000. 3) 4) List accounts & amounts in the Shareholders equity section of Travel Corporations statement of financial position at Dec 31,2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Preferred Shares 30000 Common Shares 133000 Retained Earnings 83000 Contributed Surplus common 3500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started