Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TravelAAA Corp. help travelers to organize and plans their trips to ensure the best experiences possible. TravelAAA operate their business online and have 40

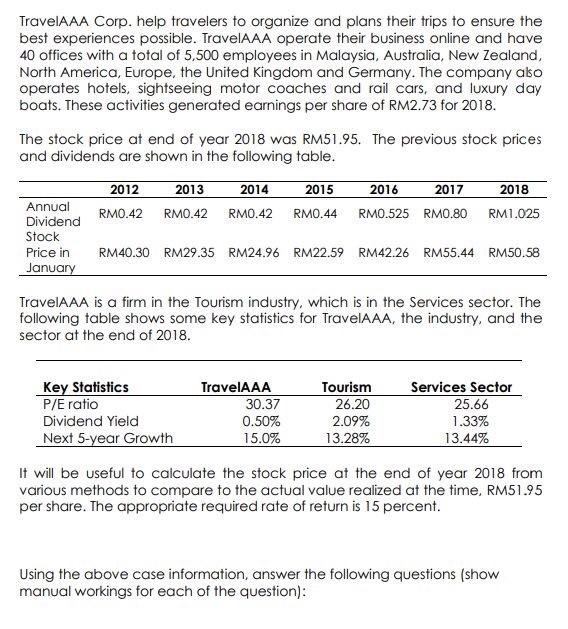

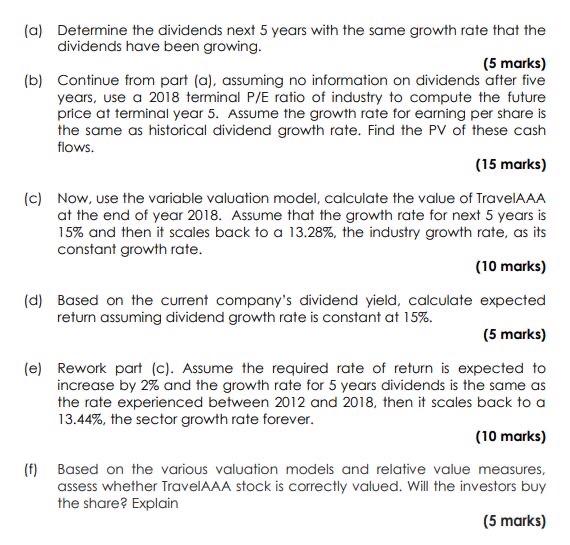

TravelAAA Corp. help travelers to organize and plans their trips to ensure the best experiences possible. TravelAAA operate their business online and have 40 offices with a total of 5,500 employees in Malaysia, Australia, New Zealand, North America, Europe, the United Kingdom and Germany. The company ako operates hotels, sightseeing motor coaches and rail cars, and luxury day boats. These activities generated earnings per share of RM2.73 for 2018. The stock price at end of year 2018 was RM51.95. The previous stock prices and dividends are shown in the following table. 2012 2013 2014 2015 2016 2017 2018 Annual RM0.42 RMO.42 RM0.42 RMO.44 RMO.525 RM0.80 RM1.025 Dividend Stock Price in RM40.30 RM29.35 RM24.96 RM22.59 RM42.26 RM55.44 RM50.58 January TravelAAA is a firm in the Tourism industry, which is in the Services sector. The following table shows some key statistics for TravelAAA, the industry, and the sector at the end of 2018. Key Statistics P/E ratio Dividend Yield TravelAAA Tourism Services Sector 30.37 26.20 25.66 1.33% 2.09% Next 5-year Growth 0.50% 15.0% 13.28% 13.44% It will be useful to calculate the stock price at the end of year 2018 from various methods to compare to the actual value realized at the time, RM51.95 per share. The appropriate required rate of return is 15 percent. Using the above case information, answer the following questions (show manual workings for each of the question): (a) Determine the dividends next 5 years with the same growth rate that the dividends have been growing. (5 marks) (b) Continue from part (a), assuming no information on dividends after five years, use a 2018 terminal P/E ratio of industry to compute the future price at terminal year 5. Assume the growth rate for earning per share is the same as historical dividend growth rate. Find the PV of these cash flows. (15 marks) (c) Now, use the variable valuation model, calculate the value of TravelAAA at the end of year 2018. Assume that the growth rate for next 5 years is 15% and then it scales back to a 13.28%, the industry growth rate, as its constant growth rate. (10 marks) (d) Based on the current company's dividend yield, calculate expected return assuming dividend growth rate is constant at 15%. (5 marks) (e) Rework part (c). Assume the required rate of return is expected to increase by 2% and the growth rate for 5 years dividends is the same as the rate experienced between 2012 and 2018, then it scales back to a 13.44%, the sector growth rate forever. (10 marks) (f) Based on the various valuation models and relative value measures, assess whether TravelAAA stock is correctly valued. Will the investors buy the share? Explain (5 marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Determining the average growth rate of dividends between yrs 2012 2018 Year 2012 2013 2014 2015 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started