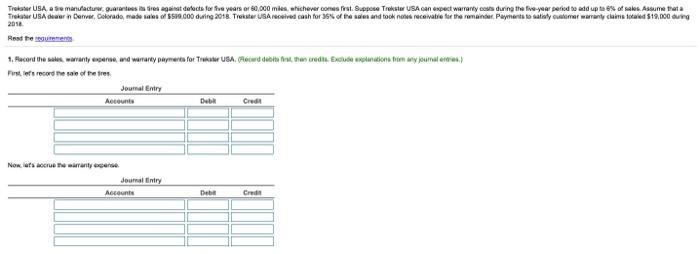

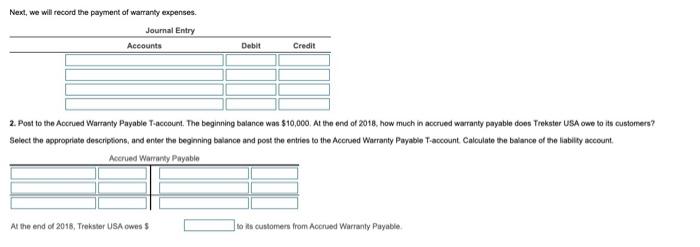

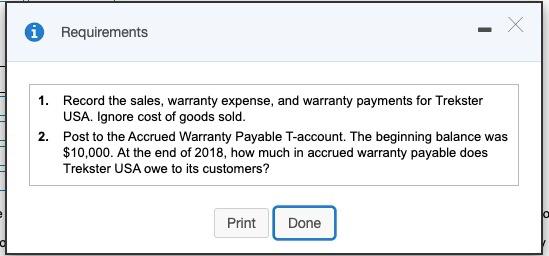

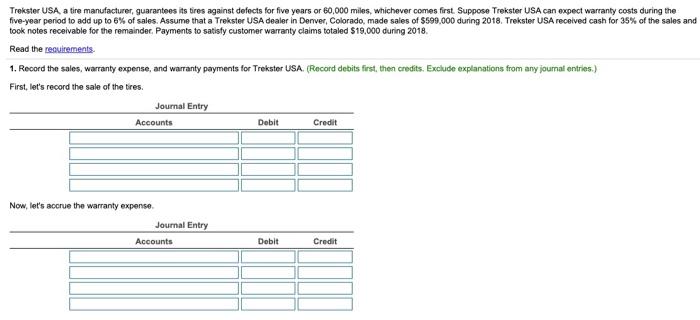

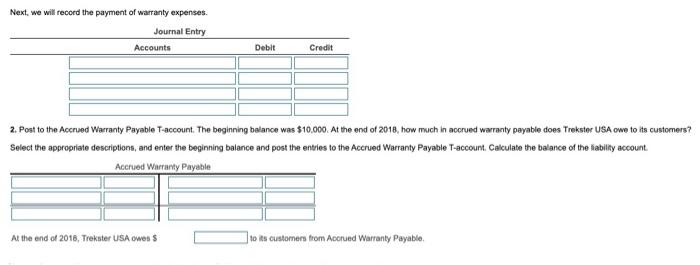

Tre USA are manufacture, guarantees in res against defects for fre years or 80,000 miles whichever comes first. Suppose Tristar USA can expect warranty cos during the five-year period to add up to 8 of sales. Assume that a Treker USA in Denver, Colorado, made of 10.000 during 2018. Tekster USA received cash for of the sand took the receivable for the remainder Payments to sately customer warranty chaine 519,000 ung 2018 Read the green 1. Record the sales warranty expense and warranty payments for The USA. Add the credit. Excudentions to any ouma Posted record the son of the tres Journal Entry Account Dub Credit Now lets or any Journal Entry Account Det Credi Next, we will record the payment of warranty expenses. Journal Entry Accounts Debit Credit 2. Post to the Accrued Warranty Payable T-account. The beginning balance was $10,000. At the end of 2018, how much in accrued warranty payable does Trekster USA owe to its customers? Select the appropriate descriptions and enter the beginning balance and post the entries to the Accrued Warranty Payable T-account Calculate the balance of the liabilty account Accrued Warranty Payable Al the end of 2018, Trekster USA owes $ to its customers from Accrued Warranty Payable Requirements X 1. Record the sales, warranty expense, and warranty payments for Trekster USA. Ignore cost of goods sold. 2. Post to the Accrued Warranty Payable T-account. The beginning balance was $10,000. At the end of 2018, how much in accrued warranty payable does Trekster USA owe to its customers? Print Done Trekster USA a tire manufacturer, guarantees its tires against defects for five years or 60,000 miles, whichever comes first. Suppose Trekster USA can expect warranty costs during the five-year period to add up to 6% of sales. Assume that a Trekster USA dealer in Denver, Colorado, made sales of $599,000 during 2018. Trekster USA received cash for 35% of the sales and took notes receivable for the remainder Payments to satisfy customer warranty claims totaled $19,000 during 2018, Read the requirements 1. Record the sales, warranty expense, and warranty payments for Trekstor USA. (Record debits first, then credits. Exclude explanations from any journal entries.) First, let's record the sale of the tires Journal Entry Accounts Debit Credit Now, let's accrue the warranty expense Journal Entry Accounts Debit Credit Next, we will record the payment of warranty expenses Journal Entry Accounts Debit Credit 2. Post to the Accrued Warranty Payable T-account. The beginning balance was $10,000. At the end of 2018, how much in accrued warranty payable does Trekster USA owe to its customers Select the appropriate descriptions, and enter the beginning balance and post the entries to the Accrued Warranty Payable T-account. Calculate the balance of the ability account Accrued Warranty Payable At the end of 2016, Trekster USA owes S to its customers from Accrued Warranty Payable