Answered step by step

Verified Expert Solution

Question

1 Approved Answer

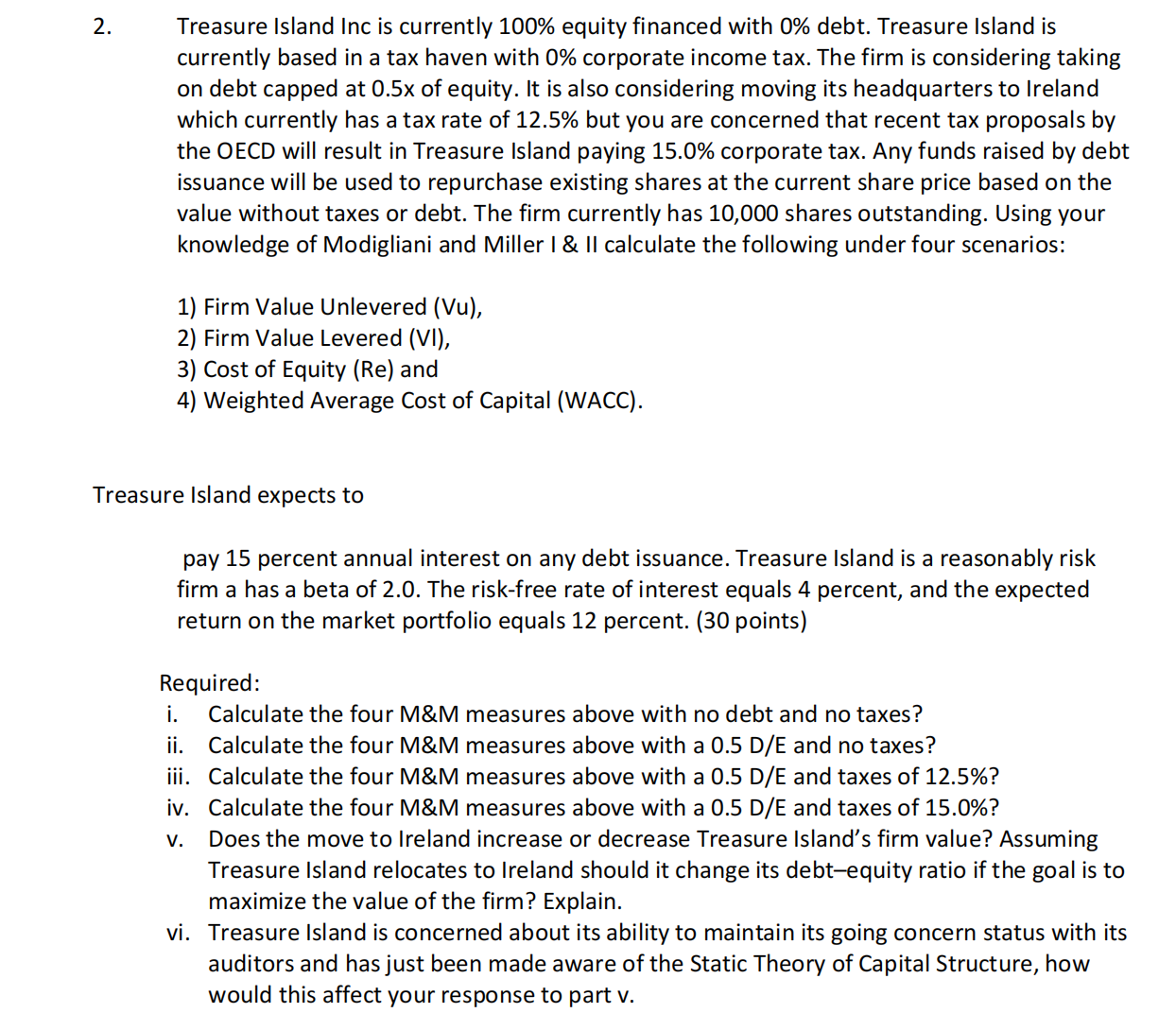

Treasure Island Inc is currently 1 0 0 % equity financed with 0 % debt. Treasure Island is currently based in a tax haven with

Treasure Island Inc is currently equity financed with debt. Treasure Island is

currently based in a tax haven with corporate income tax. The firm is considering taking

on debt capped at of equity. It is also considering moving its headquarters to Ireland

which currently has a tax rate of but you are concerned that recent tax proposals by

the OECD will result in Treasure Island paying corporate tax. Any funds raised by debt

issuance will be used to repurchase existing shares at the current share price based on the

value without taxes or debt. The firm currently has shares outstanding. Using your

knowledge of Modigliani and Miller I & II calculate the following under four scenarios:

Firm Value Unlevered Vu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started