Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Tree cut) Suppose that you have the opportunity to plant trees that later can be sold for lumber. This project requires an initial outlay

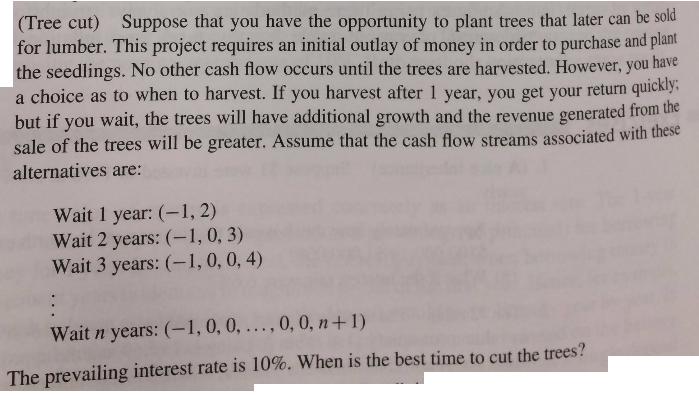

(Tree cut) Suppose that you have the opportunity to plant trees that later can be sold for lumber. This project requires an initial outlay of money in order to purchase and plant the seedlings. No other cash flow occurs until the trees are harvested. However, you have a choice as to when to harvest. If you harvest after 1 year, you get your return quickly: but if you wait, the trees will have additional growth and the revenue generated from the sale of the trees will be greater. Assume that the cash flow streams associated with these alternatives are: Wait 1 year: (-1, 2) Wait 2 years: (-1,0, 3) Wait 3 years: (-1, 0, 0, 4) Wait n years: (-1, 0, 0, ..., 0, 0, n+1) The prevailing interest rate is 10%. When is the best time to cut the trees?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Wehave to calculate the Net Present value for each alternativ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started