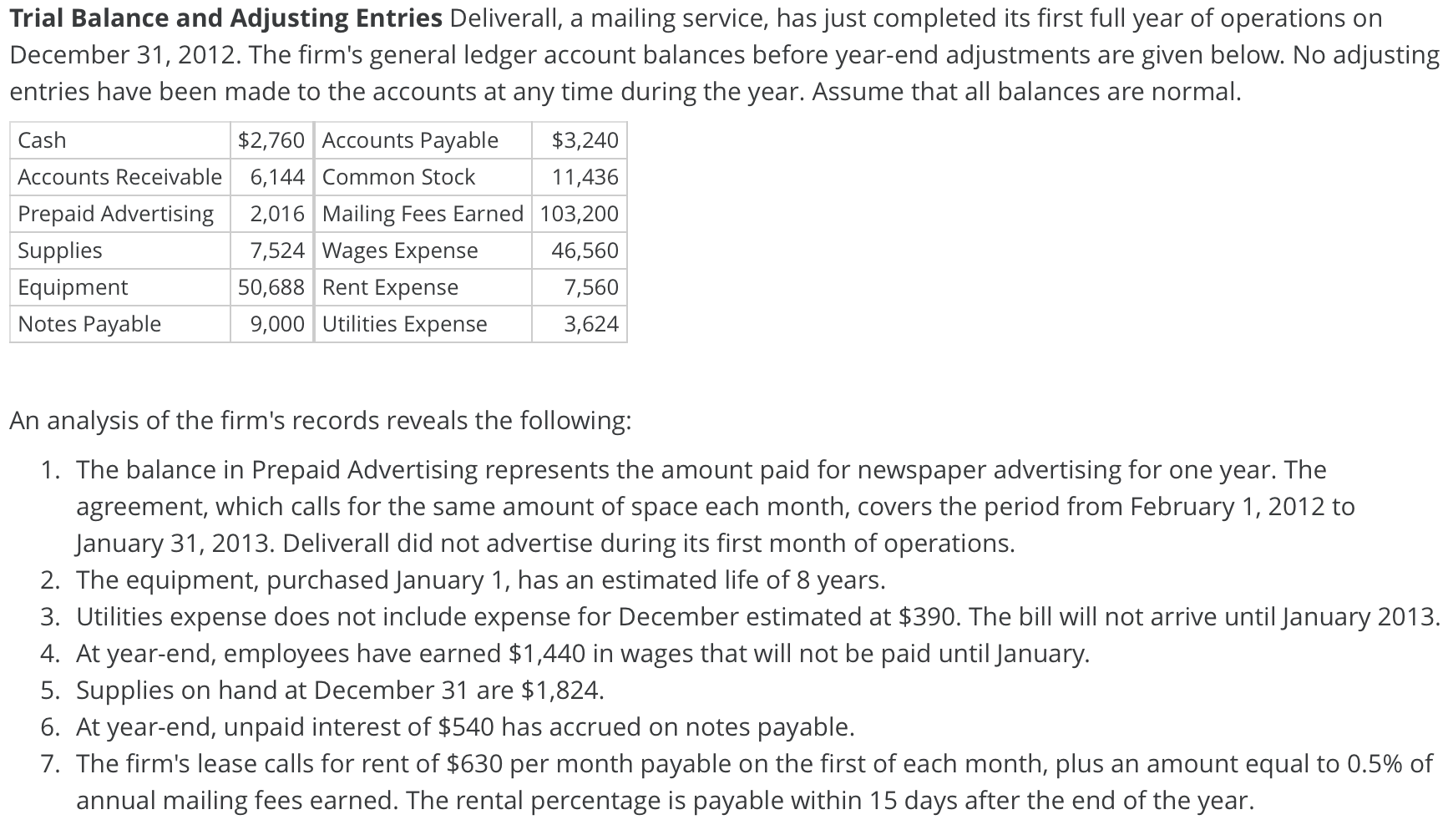

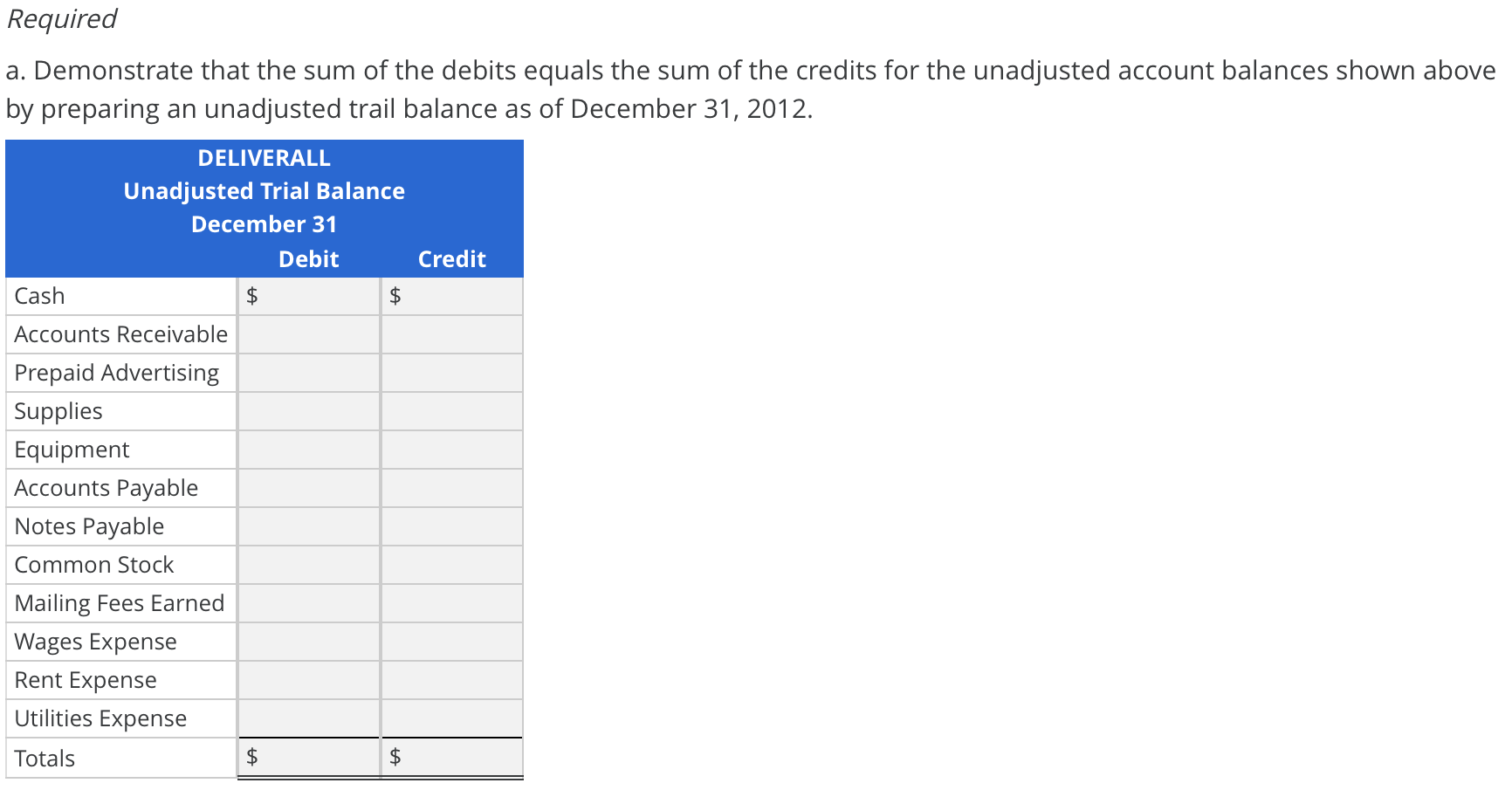

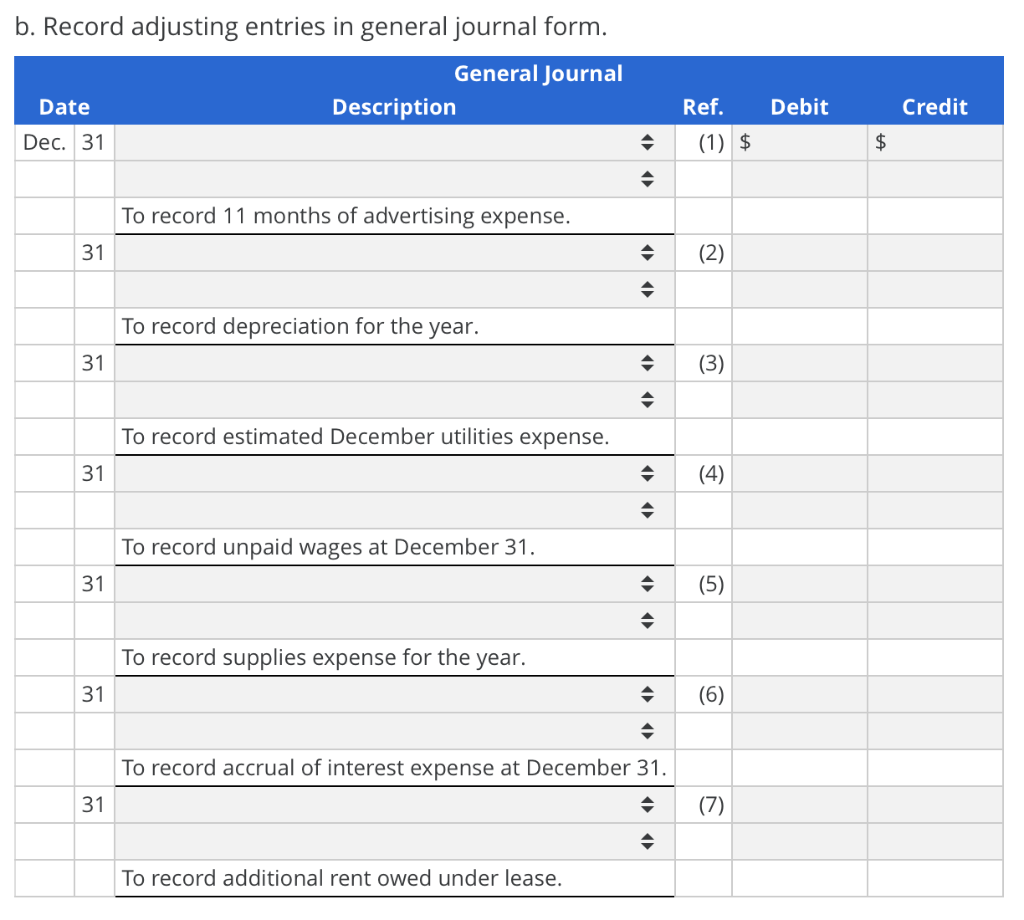

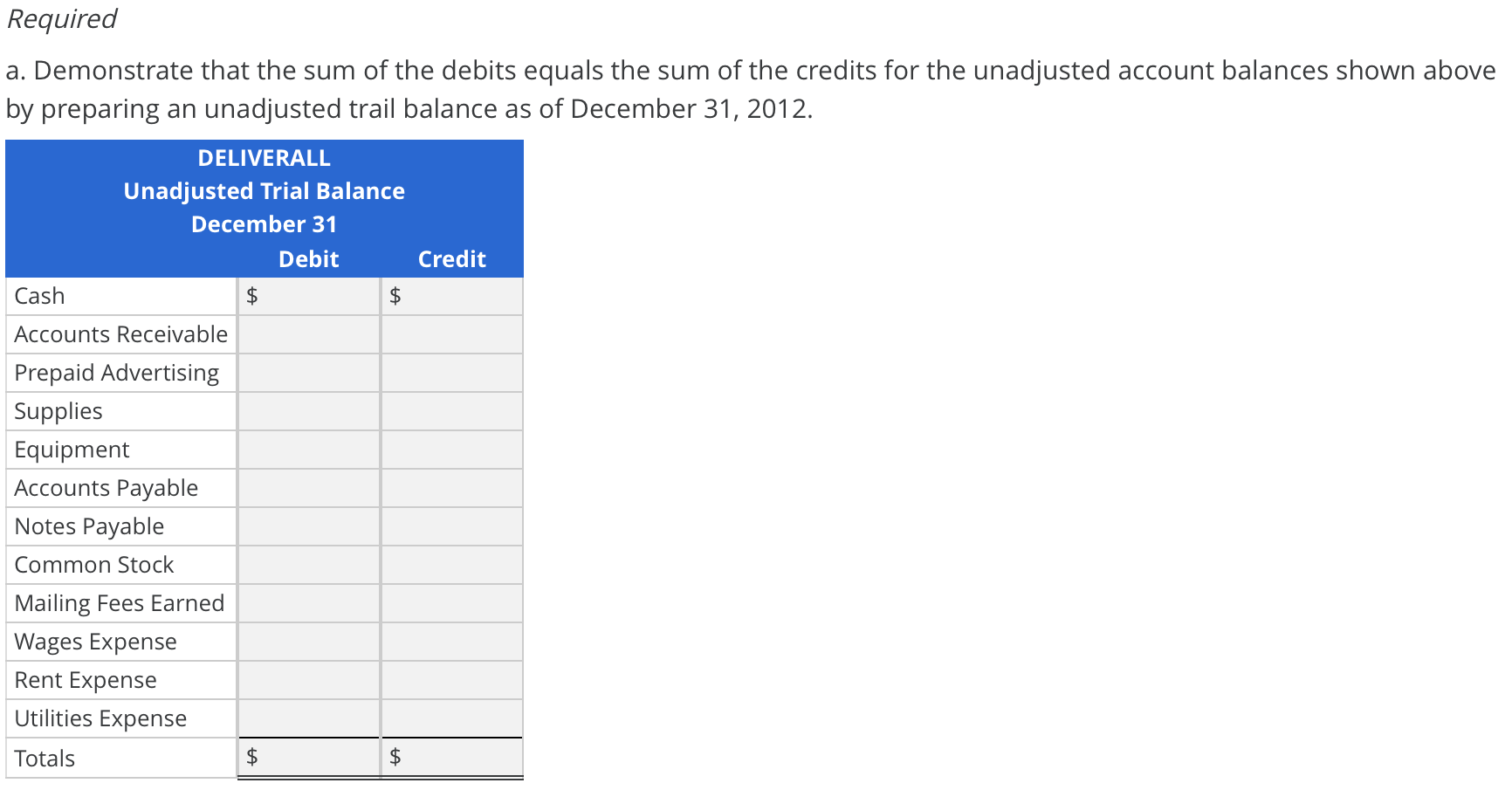

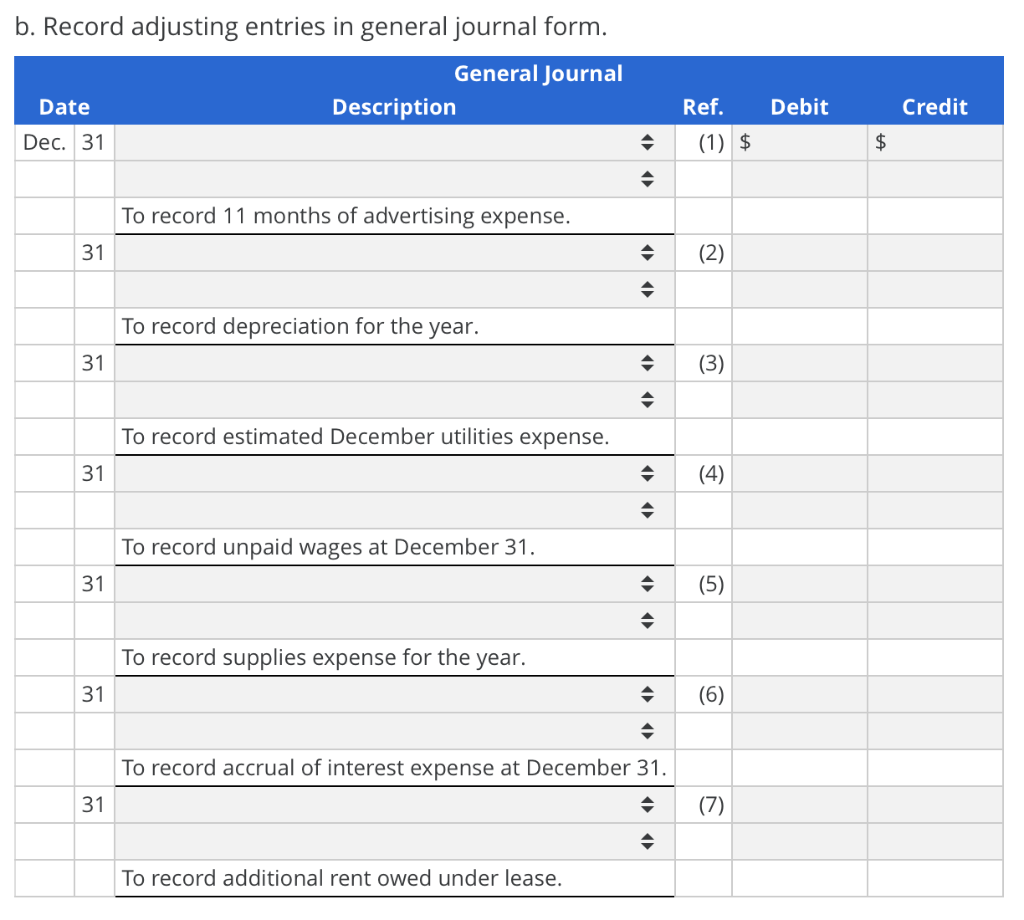

Trial Balance and Adjusting Entries Deliverall, a mailing service, has just completed its first full year of operations on December 31, 2012. The firm's general ledger account balances before year-end adjustments are given below. No adjusting entries have been made to the accounts at any time during the year. Assume that all balances are normal. Cash $2,760 Accounts Payable $3,240 Accounts Receivable 6,144 Common Stock 11,436 Prepaid Advertising 2,016 Mailing Fees Earned 103,200 Supplies 7,524 Wages Expense 46,560 Equipment 50,688 Rent Expense 7,560 Notes Payable 9,000 Utilities Expense 3,624 An analysis of the firm's records reveals the following: 1. The balance in Prepaid Advertising represents the amount paid for newspaper advertising for one year. The agreement, which calls for the same amount of space each month, covers the period from February 1, 2012 to January 31, 2013. Deliverall did not advertise during its first month of operations. 2. The equipment, purchased January 1, has an estimated life of 8 years. 3. Utilities expense does not include expense for December estimated at $390. The bill will not arrive until January 2013. 4. At year-end, employees have earned $1,440 in wages that will not be paid until January. 5. Supplies on hand at December 31 are $1,824. 6. At year-end, unpaid interest of $540 has accrued on notes payable. 7. The firm's lease calls for rent of $630 per month payable on the first of each month, plus an amount equal to 0.5% of annual mailing fees earned. The rental percentage is payable within 15 days after the end of the year. Required a. Demonstrate that the sum of the debits equals the sum of the credits for the unadjusted account balances shown above by preparing an unadjusted trail balance as of December 31, 2012. DELIVERALL Unadjusted Trial Balance December 31 Debit Credit Cash $ $ Accounts Receivable Prepaid Advertising Supplies Equipment Accounts Payable Notes Payable Common Stock Mailing Fees Earned Wages Expense Rent Expense Utilities Expense Totals ta $ b. Record adjusting entries in general journal form. General Journal Date Description Dec. 31 Ref. Debit Credit (1) $ $ To record 11 months of advertising expense. 31 (2) To record depreciation for the year. 31 (3) To record estimated December utilities expense. 31 (4) To record unpaid wages at December 31. 31 (5) To record supplies expense for the year. 31 (6) . To record accrual of interest expense at December 31. 31 (7) To record additional rent owed under lease