Answered step by step

Verified Expert Solution

Question

1 Approved Answer

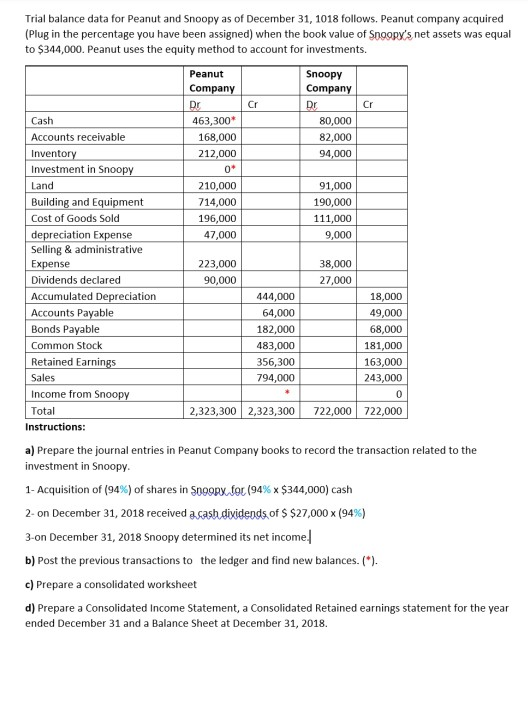

Trial balance data for Peanut and Snoopy as of December 31, 1018 follows. Peanut company acquired (Plug in the percentage you have been assigned) when

Trial balance data for Peanut and Snoopy as of December 31, 1018 follows. Peanut company acquired (Plug in the percentage you have been assigned) when the book value of Snoopy's net assets was equal to $344,000. Peanut uses the equity method to account for investments. Peanut Company Snoopy Company 463,300* 168,000 212,000 80,000 82,000 94,000 210,000 714,000 196,000 47,000 91,000 190,000 111,000 9,000 Cash Accounts receivable Inventory Investment in Snoopy Land Building and Equipment Cost of Goods Sold depreciation Expense Selling & administrative Expense Dividends declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Total Instructions: 223,000 90,000 38,000 27,000 444,000 64,000 182,000 483,000 356,300 794,000 18,000 49,000 68,000 181,000 163,000 243,000 2,323,300 2,323,300 722,000 722,000 a) Prepare the journal entries in Peanut Company books to record the transaction related to the investment in Snoopy. 1- Acquisition of (94%) of shares in Snoopy for 194% x $344,000) cash 2- on December 31, 2018 received a cash dividends of $ $27,000 X (94%) 3-on December 31, 2018 Snoopy determined its net income b) Post the previous transactions to the ledger and find new balances. (*). c) Prepare a consolidated worksheet d) Prepare a Consolidated Income Statement, a Consolidated Retained earnings statement for the year ended December 31 and a Balance Sheet at December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started