Answered step by step

Verified Expert Solution

Question

1 Approved Answer

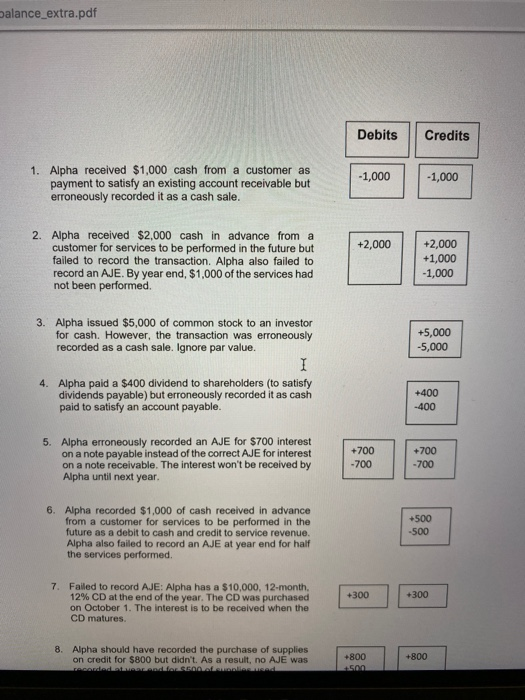

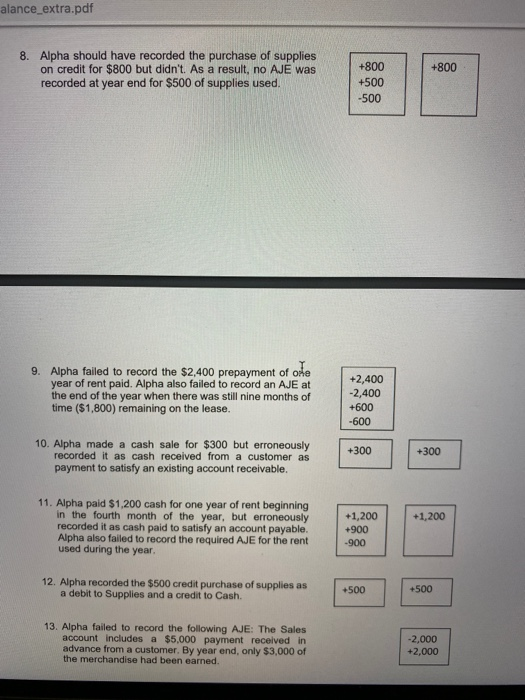

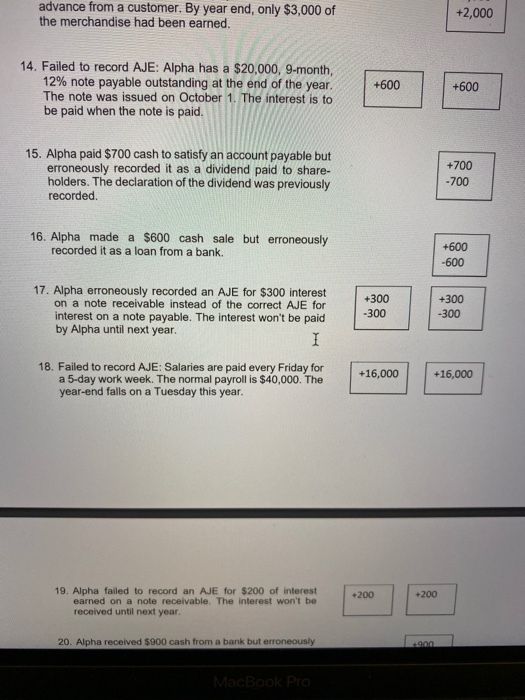

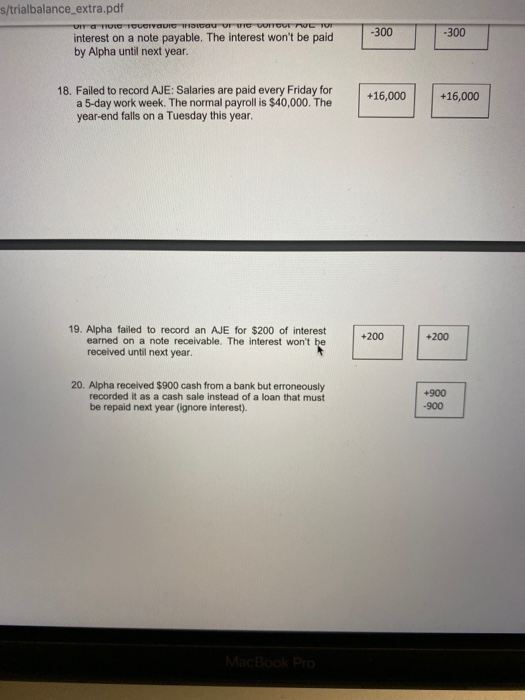

Trial balance errors balance_extra.pdf Debits Credits -1,000 1. Alpha received $1,000 cash from a customer as payment to satisfy an existing account receivable but erroneously

Trial balance errors

balance_extra.pdf Debits Credits -1,000 1. Alpha received $1,000 cash from a customer as payment to satisfy an existing account receivable but erroneously recorded it as a cash sale. - 1,000 +2,000 2. Alpha received $2,000 cash in advance from a customer for services to be performed in the future but failed to record the transaction. Alpha also failed to record an AJE. By year end, $1,000 of the services had not been performed. +2,000 +1,000 -1,000 3. Alpha issued $5,000 of common stock to an investor for cash. However, the transaction was erroneously recorded as a cash sale. Ignore par value. +5,000 -5,000 4. Alpha paid a $400 dividend to shareholders (to satisfy dividends payable) but erroneously recorded it as cash paid to satisfy an account payable. +400 -400 5. Alpha erroneously recorded an AJE for $700 interest on a note payable instead of the correct AJE for interest on a note receivable. The interest won't be received by Alpha until next year. +700 -700 +700 -700 6. Alpha recorded $1,000 of cash received in advance from a customer for services to be performed in the future as a debit to cash and credit to service revenue. Alpha also failed to record an AJE at year end for half the services performed +500 -500 7. Failed to record AJE: Alpha has a $10,000, 12-month. 12% CD at the end of the year. The CD was purchased on October 1. The interest is to be received when the CD matures 8. Alpha should have recorded the purchase of supplies on credit for $800 but didn't. As a result, no AJE was Condado de acord +800 +800 500 alance_extra.pdf 8. Alpha should have recorded the purchase of supplies on credit for $800 but didn't. As a result, no AJE was recorded at year end for $500 of supplies used. +800 +800 +500 -500 9. Alpha failed to record the $2,400 prepayment of one year of rent paid. Alpha also failed to record an AJE at the end of the year when there was still nine months of time ($1,800) remaining on the lease. +2,400 -2,400 +600 -600 10. Alpha made a cash sale for $300 but erroneously recorded it as cash received from a customer as payment to satisfy an existing account receivable. +300 +300 +1,200 11. Alpha paid $1,200 cash for one year of rent beginning in the fourth month of the year, but erroneously recorded it as cash paid to satisfy an account payable. Alpha also failed to record the required AJE for the rent used during the year. +1,200 +900 -900 12. Alpha recorded the $500 credit purchase of supplies as a debit to Supplies and a credit to Cash. +500 +500 13. Alpha failed to record the following AJE: The Sales account includes a $5,000 payment received in advance from a customer. By year end, only $3,000 of the merchandise had been earned. -2,000 +2,000 advance from a customer. By year end, only $3,000 of the merchandise had been earned. +2,000 14. Failed to record AJE: Alpha has a $20,000, 9-month, 12% note payable outstanding at the end of the year. The note was issued on October 1. The interest is to be paid when the note is paid. +600 +600 15. Alpha paid $700 cash to satisfy an account payable but erroneously recorded it as a dividend paid to share- holders. The declaration of the dividend was previously recorded. +700 -700 16. Alpha made a $600 cash sale but erroneously recorded it as a loan from a bank. +600 -600 17. Alpha erroneously recorded an AJE for $300 interest on a note receivable instead of the correct AJE for interest on a note payable. The interest won't be paid by Alpha until next year. +300 -300 +300 -300 18. Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal payroll is $40,000. The year-end falls on a Tuesday this year. +16,000 +16,000 +200 +200 19. Alpha failed to record an AJE for $200 of interest earned on a note receivable. The interest won't be received until next year. 20. Alpha received $900 cash from a bank but erroneously 900 s/trialbalance_extra.pdf UIT OTU TOUOVOUR T OUT TO VOTOU ROL TUT -300 -300 interest on a note payable. The interest won't be paid by Alpha until next year. 18. Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal payroll is $40,000. The year-end falls on a Tuesday this year. +16,000 +16,000 19. Alpha failed to record an AJE for $200 of interest earned on a note receivable. The interest won't be received until next year. +200 +200 20. Alpha received $900 cash from a bank but erroneously recorded it as a cash sale instead of a loan that must be repaid next year (ignore interest). +900 -900 balance_extra.pdf Debits Credits -1,000 1. Alpha received $1,000 cash from a customer as payment to satisfy an existing account receivable but erroneously recorded it as a cash sale. - 1,000 +2,000 2. Alpha received $2,000 cash in advance from a customer for services to be performed in the future but failed to record the transaction. Alpha also failed to record an AJE. By year end, $1,000 of the services had not been performed. +2,000 +1,000 -1,000 3. Alpha issued $5,000 of common stock to an investor for cash. However, the transaction was erroneously recorded as a cash sale. Ignore par value. +5,000 -5,000 4. Alpha paid a $400 dividend to shareholders (to satisfy dividends payable) but erroneously recorded it as cash paid to satisfy an account payable. +400 -400 5. Alpha erroneously recorded an AJE for $700 interest on a note payable instead of the correct AJE for interest on a note receivable. The interest won't be received by Alpha until next year. +700 -700 +700 -700 6. Alpha recorded $1,000 of cash received in advance from a customer for services to be performed in the future as a debit to cash and credit to service revenue. Alpha also failed to record an AJE at year end for half the services performed +500 -500 7. Failed to record AJE: Alpha has a $10,000, 12-month. 12% CD at the end of the year. The CD was purchased on October 1. The interest is to be received when the CD matures 8. Alpha should have recorded the purchase of supplies on credit for $800 but didn't. As a result, no AJE was Condado de acord +800 +800 500 alance_extra.pdf 8. Alpha should have recorded the purchase of supplies on credit for $800 but didn't. As a result, no AJE was recorded at year end for $500 of supplies used. +800 +800 +500 -500 9. Alpha failed to record the $2,400 prepayment of one year of rent paid. Alpha also failed to record an AJE at the end of the year when there was still nine months of time ($1,800) remaining on the lease. +2,400 -2,400 +600 -600 10. Alpha made a cash sale for $300 but erroneously recorded it as cash received from a customer as payment to satisfy an existing account receivable. +300 +300 +1,200 11. Alpha paid $1,200 cash for one year of rent beginning in the fourth month of the year, but erroneously recorded it as cash paid to satisfy an account payable. Alpha also failed to record the required AJE for the rent used during the year. +1,200 +900 -900 12. Alpha recorded the $500 credit purchase of supplies as a debit to Supplies and a credit to Cash. +500 +500 13. Alpha failed to record the following AJE: The Sales account includes a $5,000 payment received in advance from a customer. By year end, only $3,000 of the merchandise had been earned. -2,000 +2,000 advance from a customer. By year end, only $3,000 of the merchandise had been earned. +2,000 14. Failed to record AJE: Alpha has a $20,000, 9-month, 12% note payable outstanding at the end of the year. The note was issued on October 1. The interest is to be paid when the note is paid. +600 +600 15. Alpha paid $700 cash to satisfy an account payable but erroneously recorded it as a dividend paid to share- holders. The declaration of the dividend was previously recorded. +700 -700 16. Alpha made a $600 cash sale but erroneously recorded it as a loan from a bank. +600 -600 17. Alpha erroneously recorded an AJE for $300 interest on a note receivable instead of the correct AJE for interest on a note payable. The interest won't be paid by Alpha until next year. +300 -300 +300 -300 18. Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal payroll is $40,000. The year-end falls on a Tuesday this year. +16,000 +16,000 +200 +200 19. Alpha failed to record an AJE for $200 of interest earned on a note receivable. The interest won't be received until next year. 20. Alpha received $900 cash from a bank but erroneously 900 s/trialbalance_extra.pdf UIT OTU TOUOVOUR T OUT TO VOTOU ROL TUT -300 -300 interest on a note payable. The interest won't be paid by Alpha until next year. 18. Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal payroll is $40,000. The year-end falls on a Tuesday this year. +16,000 +16,000 19. Alpha failed to record an AJE for $200 of interest earned on a note receivable. The interest won't be received until next year. +200 +200 20. Alpha received $900 cash from a bank but erroneously recorded it as a cash sale instead of a loan that must be repaid next year (ignore interest). +900 -900 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started