Answered step by step

Verified Expert Solution

Question

1 Approved Answer

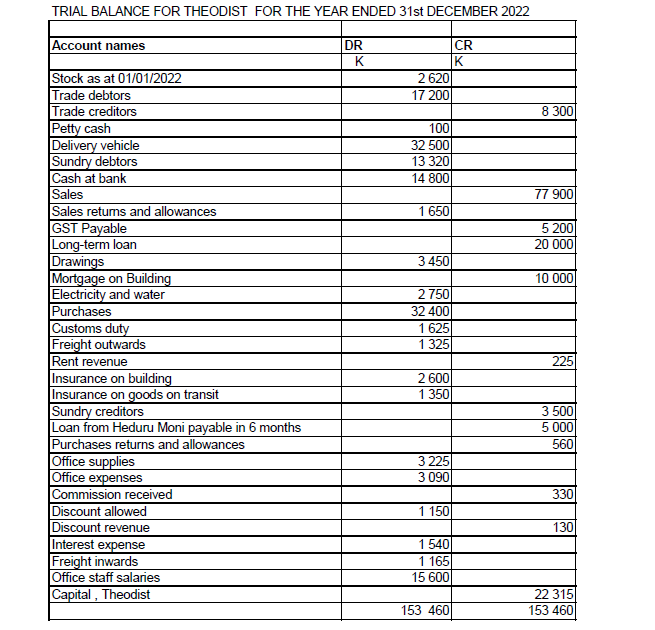

TRIAL BALANCE FOR THEODIST FOR THE YEAR ENDED 31st DECEMBER 2022 Account names Stock as at 01/01/2022 Trade debtors Trade creditors Petty cash Delivery

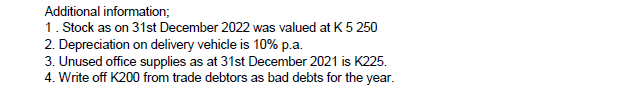

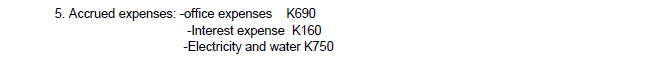

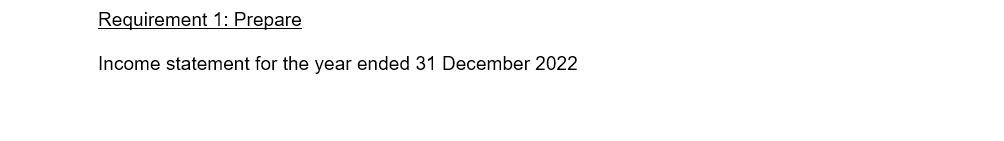

TRIAL BALANCE FOR THEODIST FOR THE YEAR ENDED 31st DECEMBER 2022 Account names Stock as at 01/01/2022 Trade debtors Trade creditors Petty cash Delivery vehicle Sundry debtors Cash at bank Sales Sales returns and allowances GST Payable Long-term loan Drawings Mortgage on Building Electricity and water Purchases Customs duty Freight outwards Rent revenue Insurance on building Insurance on goods on transit Sundry creditors Loan from Heduru Moni payable in 6 months Purchases returns and allowances Office supplies Office expenses Commission received Discount allowed Discount revenue Interest expense Freight inwards Office staff salaries Capital, Theodist DR K 2 620 17 200 100 32 500 13 320 14 800 1 650 3 450 2750 32 400 1 625 1 325 2 600 1 350 3 225 3 090 1 150 1 540 1 165 15 600 153 460 CR K 8 300 77 900 5 200 20 000 10 000 225 3 500 5 000 560 3301 130 22 315 153 460 Additional information; 1. Stock as on 31st December 2022 was valued at K 5 250 2. Depreciation on delivery vehicle is 10% p.a. 3. Unused office supplies as at 31st December 2021 is K225. 4. Write off K200 from trade debtors as bad debts for the year. 5. Accrued expenses: -office expenses K690 -Interest expense K160 -Electricity and water K750 Requirement 1: Prepare Income statement for the year ended 31 December 2022

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

lets calculate the amounts Cost of Goods Sold Opening Stock 01012022 2620 Ksh Purchases 32400 Ksh Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started