Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRIG You are the senior accountant at Rocky Limited (Rocky). Rocky is a JSE listed company and the financial year end is 31 December

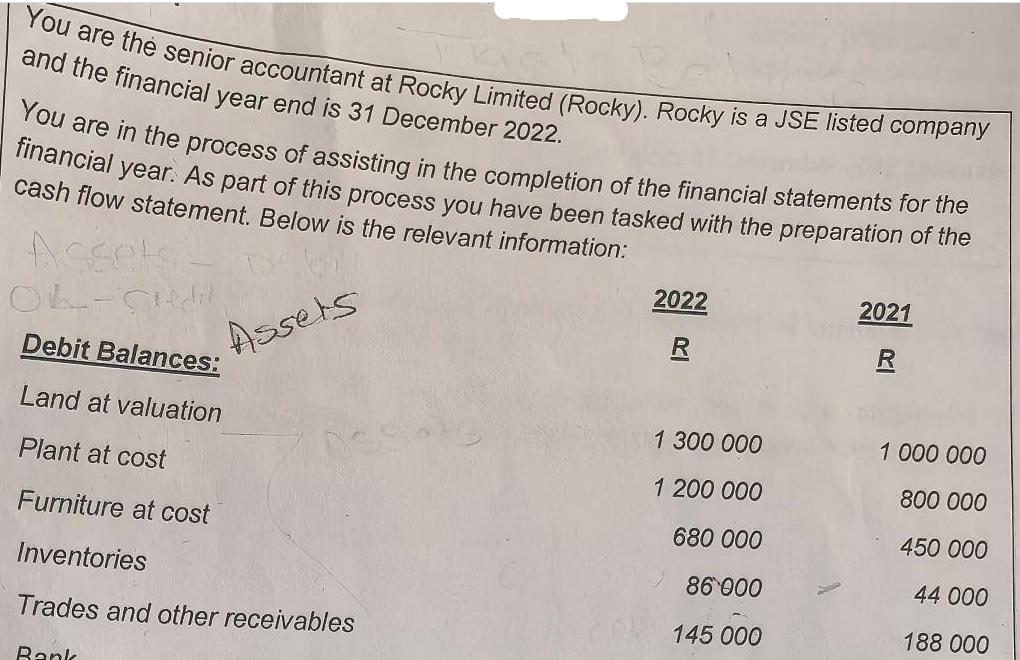

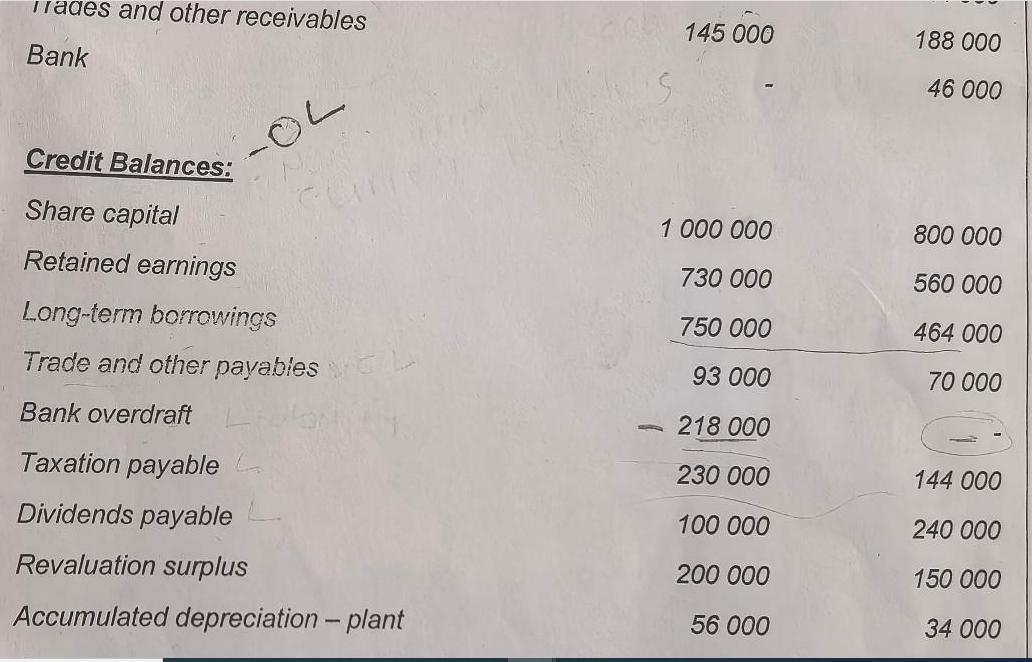

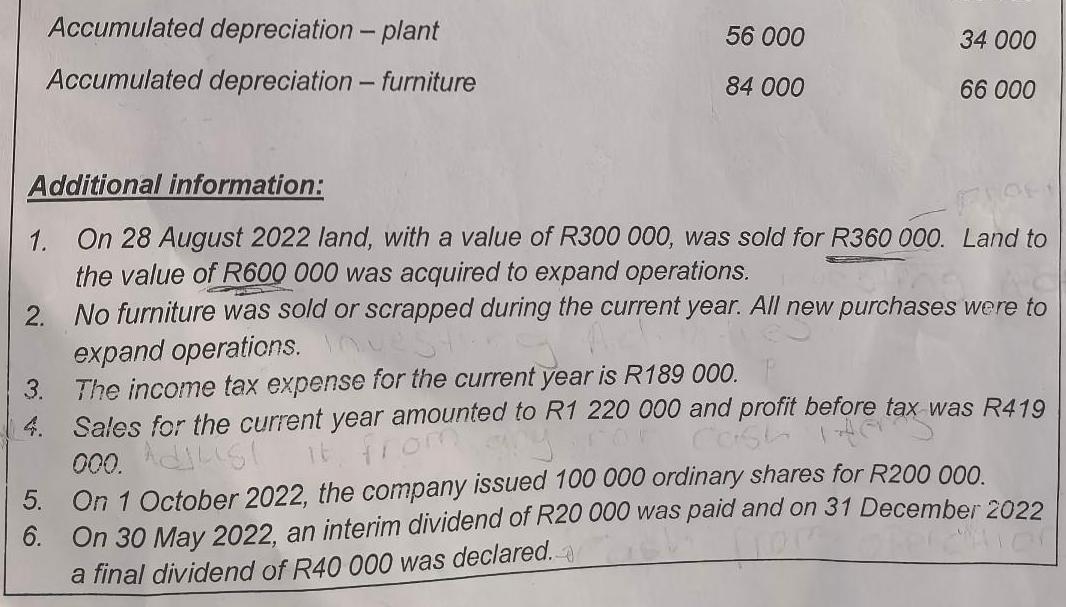

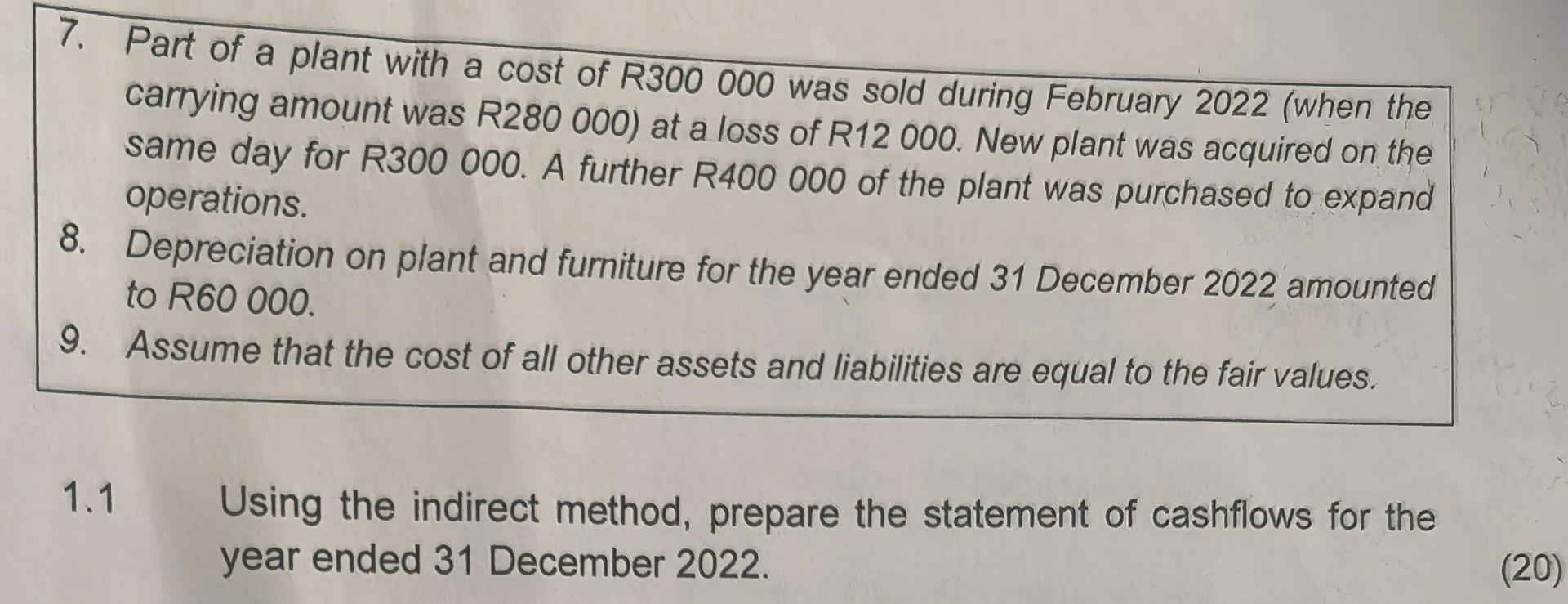

TRIG You are the senior accountant at Rocky Limited (Rocky). Rocky is a JSE listed company and the financial year end is 31 December 2022. You are in the process of assisting in the completion of the financial statements for the financial year. As part of this process you have been tasked with the preparation of the cash flow statement. Below is the relevant information: Asset OL-Sledil Debit Balances: Land at valuation Plant at cost Furniture at cost Inventories Trades and other receivables Assets Bank 2022 R 1 300 000 1 200 000 680 000 86 000 145 000 2021 R 1 000 000 800 000 450 000 44 000 188 000 Trades and other receivables Bank -OL Credit Balances: Share capital Retained earnings Long-term borrowings Trade and other payables Bank overdraft Taxation payable Dividends payable Revaluation surplus Accumulated depreciation - plant 145 000 1 000 000 730 000 750 000 93 000 218 000 230 000 100 000 200 000 56 000 SURA 188 000 46 000 800 000 560 000 464 000 70 000 144 000 240 000 150 000 34 000 Accumulated depreciation Accumulated depreciation - plant - furniture 56 000 84 000 34 000 66 000 Additional information: 1. On 28 August 2022 land, with a value of R300 000, was sold for R360 000. Land to the value of R600 000 was acquired to expand operations. 2. No furniture was sold or scrapped during the current year. All new purchases were to expand operations. 3. The income tax expense for the current year is R189 000. 4. Sales for the current year amounted to R1 220 000 and profit before tax was R419 000. Adjlis it from 5. On 1 October 2022, the company issued 100 000 ordinary shares for R200 000. On 30 May 2022, an interim dividend of R20 000 was paid and on 31 December 2022 a final dividend of R40 000 was declared. 100 7. Part of a plant with a cost of R300 000 was sold during February 2022 (when the carrying amount was R280 000) at a loss of R12 000. New plant was acquired on the same day for R300 000. A further R400 000 of the plant was purchased to expand operations. 8. Depreciation on plant and furniture for the year ended 31 December 2022 amounted to R60 000. 9. Assume that the cost of all other assets and liabilities are equal to the fair values. 1.1 Using the indirect method, prepare the statement of cashflows for the year ended 31 December 2022. (20)

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started