Answered step by step

Verified Expert Solution

Question

1 Approved Answer

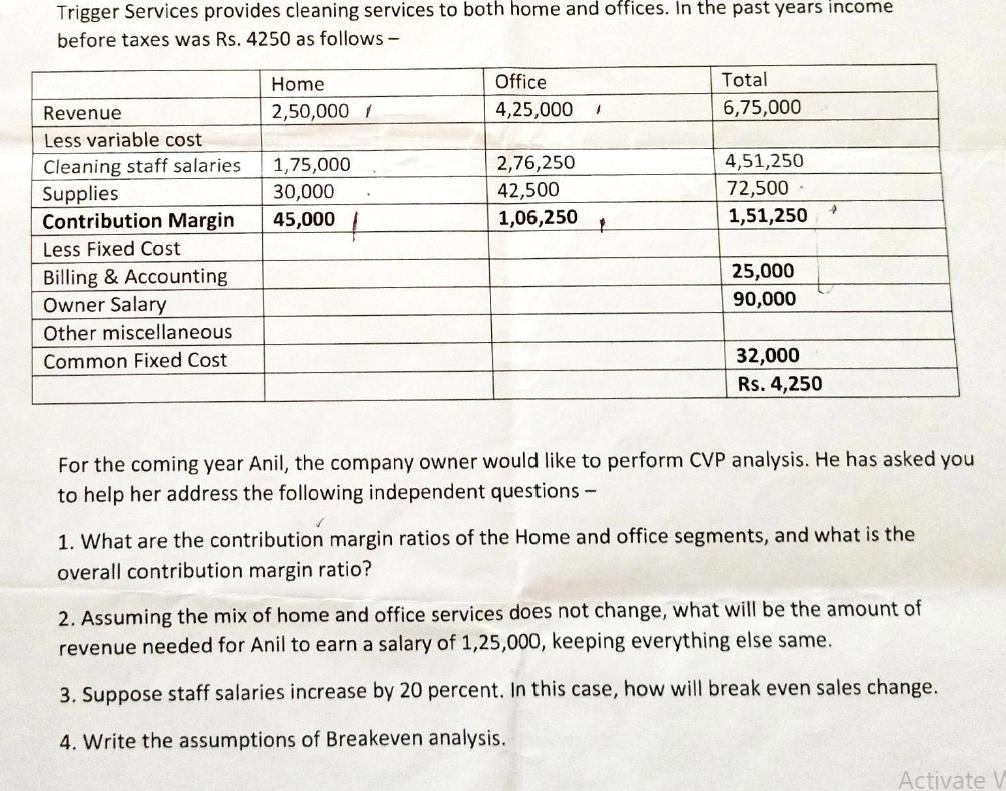

Trigger Services provides cleaning services to both home and offices. In the past years income before taxes was Rs. 4250 as follows - Home

Trigger Services provides cleaning services to both home and offices. In the past years income before taxes was Rs. 4250 as follows - Home Revenue 2,50,000 / Office 4,25,000 ' Total 6,75,000 Less variable cost Cleaning staff salaries 1,75,000 2,76,250 Supplies 30,000 Contribution Margin 45,000 42,500 1,06,250 4,51,250 72,500 1,51,250 Less Fixed Cost Billing & Accounting 25,000 Owner Salary 90,000 Other miscellaneous Common Fixed Cost 32,000 Rs. 4,250 For the coming year Anil, the company owner would like to perform CVP analysis. He has asked you to help her address the following independent questions - 1. What are the contribution margin ratios of the Home and office segments, and what is the overall contribution margin ratio? 2. Assuming the mix of home and office services does not change, what will be the amount of revenue needed for Anil to earn a salary of 1,25,000, keeping everything else same. 3. Suppose staff salaries increase by 20 percent. In this case, how will break even sales change. 4. Write the assumptions of Breakeven analysis. Activate V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started