Question: Trimester T1, 2022 Unit Code HC1010 Unit Title Accounting for Business Assessment Type Group Assignment Assessment Title Accounting for Business Decisions Purpose of the assessment

![class and perform independent research of the key topics. Mapping] Learning Outcomes:](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673b64c95b953_673673b64c93e12b.jpg)

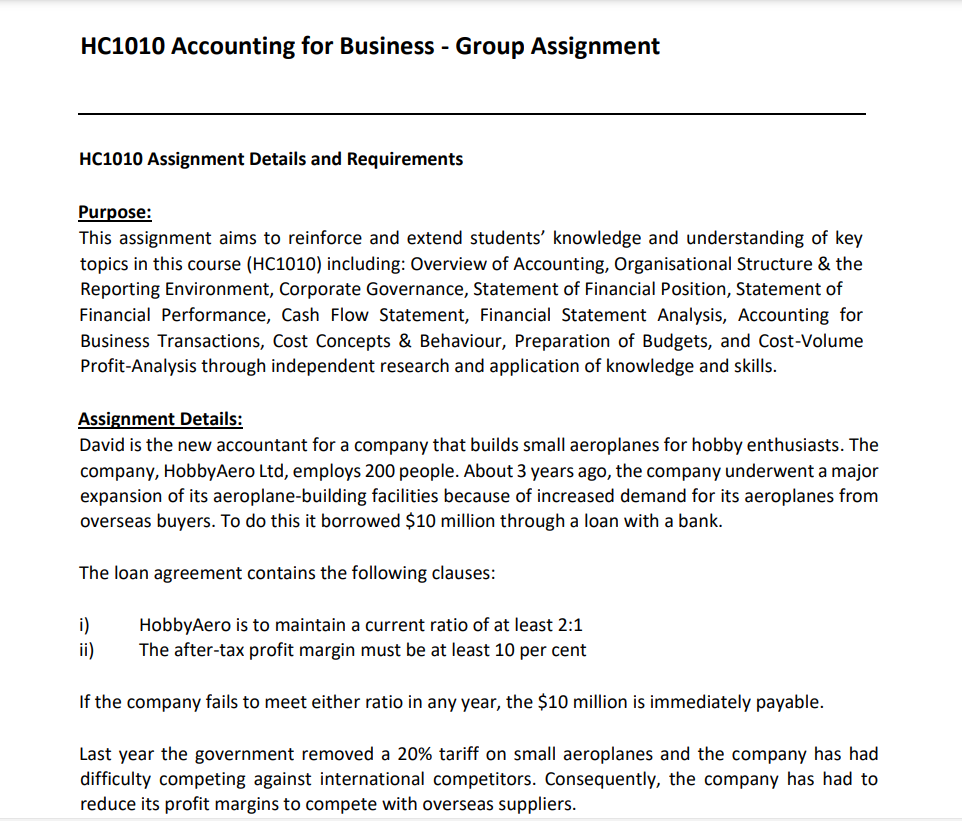

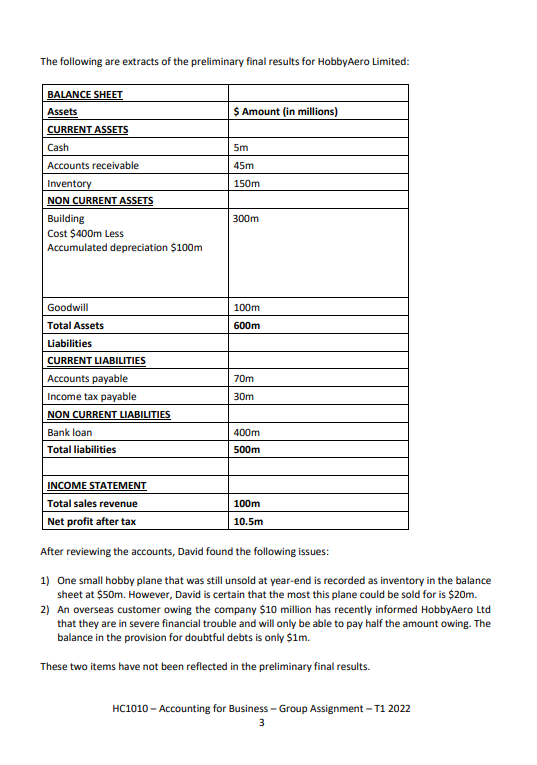

Trimester T1, 2022 Unit Code HC1010 Unit Title Accounting for Business Assessment Type Group Assignment Assessment Title Accounting for Business Decisions Purpose of the assessment (with ULCi Students are required to apply knowledge learned in class and perform independent research of the key topics. Mapping] Learning Outcomes: - Obtain and contextualise business information for business accounting to explain and apply different concepts of costs to business decisions; ' Apply, analyse, synthesise and evaluate information from multiple sources to make decisions about the nancial performance of entities including assets, liabilities, owner's equity, revenue and expenses; - Prepare, analyse, and interpret transaction data and nancial statements for data driven decision-making; ' Evaluate the complex concepts of accounting such as roles and purposes of accounting and preparation of worksheets; and - Communicate accounting information in writing professionally. Weight 30% of the total assessments Total Marks 20 marks Word limit 2,500 words Due Date Week 10 - Friday, 27'\" May, 2022 - 11:59pm [Australian Eastern Standard Time). HC1010 Accounting for Business - Group Assignment HC1010 Assignment Details and Requirements PUEEDSE: This assignment aims to reinforce and extend students' knowledge and understanding of key topics in this course (HClOlD) including: Overview of Accounting, Organisational Structure 8: the Reporting Environment, Corporate Governance, Statement of Financial Position, Statement of Financial Performance, lCash Flow Statement, Financial Statement Analysis, Accounting for Business Transactions, Cost Concepts 8: Behaviour, Preparation of Budgets, and Cost-Volume Profit-Analysis through independent research and application of knowledge and skills. Assignment Details: David is the new accountant for a company that builds small aeroplanes for hobby enthusiasts. The company, HobbyAero Ltd, employs 200 people. About 3 years ago, the company underwent a major expansion of its aeroplane-building facilities because of increased demand for its aeroplanes from overseas buyers. To do this it borrowed $10 million through a loan with a bank. The loan agreement contains the following clauses: i] HobbyAero is to maintain a current ratio of at least 2:1 ii] The after-tax profit margin must be at least 10 per cent Ifthe company fails to meet either ratio in any year, the $10 million is immediately payable. Last year the government removed a 20% tariff on small aeroplanes and the company has had difculty competing against international competitors. Consequently, the company has had to reduce its profit margins to compete with overseas suppliers. The following are extracts of the preliminary final results for HobbyAero Limited: BALANCE SHEET Assets $ Amount (in millions) CURRENT ASSETS Cash 5m Accounts receivable 45m Inventory 150m NON CURRENT ASSETS Building 300m Cost $400m Less Accumulated depreciation $100m Goodwill 100m Total Assets 600m Liabilities CURRENT LIABILITIES Accounts payable 70m Income tax payable 30m NON CURRENT LIABILITIES Bank loar 400m Total liabilities 500m INCOME STATEMENT Total sales revenue 100m Net profit after tax 10.5m After reviewing the accounts, David found the following issues: 1) One small hobby plane that was still unsold at year-end is recorded as inventory in the balance sheet at $50m. However, David is certain that the most this plane could be sold for is $20m. 2) An overseas customer owing the company $10 million has recently informed HobbyAero Ltd that they are in severe financial trouble and will only be able to pay half the amount owing. The balance in the provision for doubtful debts is only $1m. These two items have not been reflected in the preliminary final results. HC1010 - Accounting for Business - Group Assignment - T1 2022As you are an accounting student, you have been asked to advise on the following: a. Explain to David how the accounts receivable and inventory should be valued on the financial statement. After applying the correct measurement basis, determine the effect of the adjustment of the accounts receivable and inventory on: (1) profit and (2) assets. Explain to David the effect of the adjustment to accounts receivable and inventory on the Current ratio and the after-tax profit margin. Will the change in these ratios have an effect on the loan agreement with the bank? C. Explain to David the difference between financial and management accounting. Give an example of how management accounting reports would be incorporated into financial accounting reports. d. Explain to David what liquidity and financial structure ratios from the balance sheet could indicate the company is in financial difficulty. Calculate these liquidity and financial structure ratios for HobbyAero Limited. e. Explain to David what the ethical challenges he is facing in this scenario for both the business and for the accountant working for the business. Explain and discuss your responses to the above issues and provide your advice and recommendations to David in a report form. Resources and Useful Links: 1. www.business.gov.au 2. www.business.now.gov.au 3. www.business.vic.gov.au 4. www.business.qld.gov.au Recommended Textbook: Hancock, P., Robinson, P., and Bazley, M. 2019. Contemporary accounting: a strategic approach for users. Cengage Learning Group Formation and Group Assignment: Students are required to work on the assignment in groups of 3-4, produce and submit a group report. Group membership need to use a cover page where they need to write their details, with parts of the assignment that they have completed. This is to ensure that all students participate equitably in the group assignment and that students are responsible for the academic integrity of all components of the assignment. Each group needs to complete the group assignment completion HC1010 - Accounting for Business - Group Assignment - T1 2022table provided on Blackboard which identifies which student/students are responsible for the various sections of the assignment. The assessment item must be submitted on Blackboard. The assignment must be in a report format and submitted through the SafeAssign final submission link. Assessment Design - Adapted Harvard Referencing Holmes will be implementing as a pilot program a revised Harvard approach to referencing. The following guidelines apply: 1. Reference sources in assignments are limited to sources which provide full text access to the source's content for lecturers and markers. 2. The Reference list should be located on a separate page at the end of the essay and titled: References. 3. It should include the details of all the in-text citations, arranged alphabetically A-Z by author surname. In addition, it MUST include a hyperlink to the full text of the cited reference source. For example; Hawking, P., Mccarthy, B. and Stein, A. 2004. Second Wave ERP Education, Journal of Information Systems Education, Fall, http://jise.org/Volume153/JISEv15n3p327.pdf 4. All assignments will require additional in-text reference details which will consist of the surname of the author/authors or name of the authoring body, year of publication, page number of content, paragraph where the content can be found. For example; "The company decided to implement an enterprise wide data warehouse business intelligence strategies (Hawking et al, 2004, p3(4])." author year page (Hawking et al, 2004, p3(4)) paragraph Non-Adherence to Referencing Guidelines Where students do not follow the above guidelines: 1. Students who submit assignments which do not comply with the guidelines may be asked to resubmit their assignments. 2. Late penalties will apply, as per the Student Handbook each day, after the student/s have been notified of the resubmission requirements. HC1010 - Accounting for Business - Group Assignment - T1 2022 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts