Question

Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-

Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95- 1234321 and her Social Security number is 123-45-6789. Trish keeps her books on the cash basis. The income and expenses for the year are:

|

The truck is not considered a passenger automobile for purposes of the luxury automobile limitations.

Trish also has a qualified home office of 250 sq. ft. Her home is 2,000 sq. ft. Her 2017 purchase price and basis in the home, not including land, is $100,000 (the home’s market value is $150,000). She incurred the following costs in 2022 related to the entire home:

|

Required:

For tax purposes, Trish elected out of bonus depreciation in all years except 2022. She did not elect immediate expensing in any year. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule above. Complete Trish’s Schedule C, Form 8829, and Form 4562.

- Make realistic assumptions about any missing data.

- Enter all amounts as positive numbers.

- If an amount box does not require an entry or the answer is zero, enter "0".

- If required round any dollar amount to the nearest dollar.

Trish’s bookkeeper has provided the following book-basis fixed asset rollforward:

| Himple Retail Fixed Asset Rollforward 12/31/2022 (book basis) | ||||||||||||

| DEPR | COST | 2020 | 2021 | 2022 | ACCUM | NET BOOK | ||||||

| ASSET | IN SERVICE | METHOD | LIFE | BASIS | DEPR | DEPR | DEPR | DEPR | VALUE | |||

| CASH REGISTER | 8/15/2020 | SL | 5 | 10,000.00 | 833.33 | 2,000.00 | 2,000.00 | 4,833.33 | 5,166.67 | |||

| 2020 TOTAL ADDITIONS | 10,000.00 | 833.33 | 2,000.00 | 2,000.00 | 4,833.33 | 5,166.67 | ||||||

RETAIL FIXTURES | 6/21/2021 | SL | 7 | 5,500.00 | 458.33 | 785.71 | 1,244.04 | 4,255.96 | ||||

| FURNITURE | 6/12/2021 | SL | 7 | 4,100.00 | 341.67 | 585.71 | 927.38 | 3,172.62 | ||||

| 2021 TOTAL ADDITIONS | 9,600.00 | - | 800.00 | 1,371.42 | 2,171.42 | 7,428.58 | ||||||

| TOTAL | 19,600.00 | 833.33 | 2,800.00 | 3,371.42 | 7,004.75 | 12,595.25 | ||||||

DELIVERY TRUCK | 10/1/2022 | SL | 5 | 38,000.00 | 1,900.00 | 1,900.00 | 36,100.00 | |||||

| DESK AND CABINETRY | 6/1/2022 | SL | 7 | 12,000.00 | 1,000.00 | 1,000.00 | 11,000.00 | |||||

| COMPUTER | 6/1/2022 | SL | 5 | 3,000.00 | 350.00 | 350.00 | 2,650.00 | |||||

| 2022 TOTAL ADDITIONS | 53,000.00 | - | - | 3,250.00 | 3,250.00 | 49,750.00 | ||||||

| TOTAL | 72,600.00 | 833.33 | 2,800.00 | 6,621.42 | 10,254.75 | 62,345.25 | ||||||

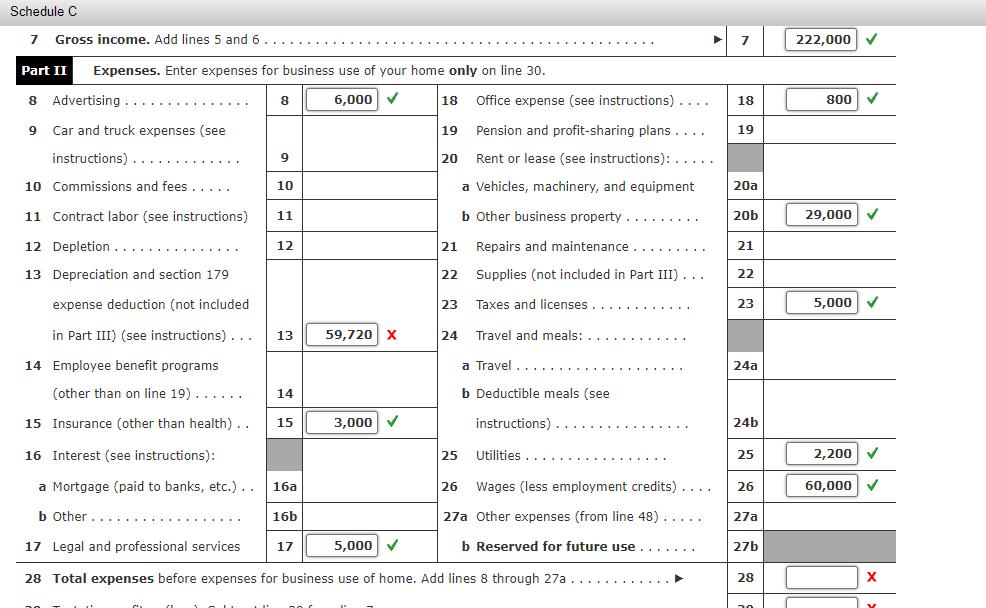

Please help me determine what goes on Line 13 of Schedule C.

Schedule C 7 Gross income. Add lines 5 and 6 .... Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising.... 7 222,000 8 6,000 18 Office expense (see instructions).. 18 800 9 Car and truck expenses (see 19 Pension and profit-sharing plans.... 19 instructions) ... 9 20 Rent or lease (see instructions): ..... 10 Commissions and fees ..... 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) 12 Depletion..... 11 b Other business property... 20b 29,000 12 21 Repairs and maintenance. . . 21 13 Depreciation and section 179 expense deduction (not included 22 Supplies (not included in Part III) ... 22 23 Taxes and licenses. 23 5,000 in Part III) (see instructions) ... 13 59,720 X 24 Travel and meals:.. 14 Employee benefit programs a Travel.... 24a (other than on line 19). . . . . . 15 Insurance (other than health) .. 16 Interest (see instructions): 14 b Deductible meals (see 15 3,000 instructions). 24b 25 Utilities... 25 2,200 a Mortgage (paid to banks, etc.).. b Other... 16a 26 Wages (less employment credits) .... 26 60,000 16b 27a Other expenses (from line 48). 27a 17 Legal and professional services 17 5,000 b Reserved for future use....... 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a ..... 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started