Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during Its first four months of operations.

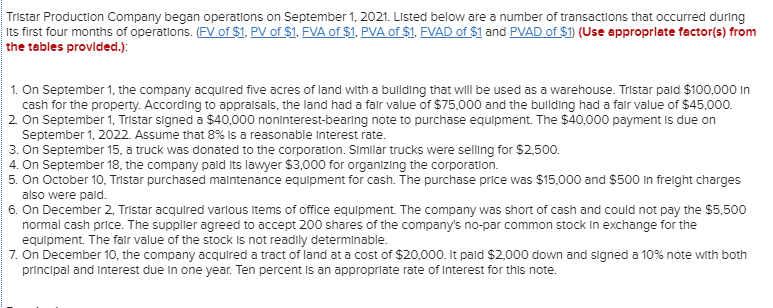

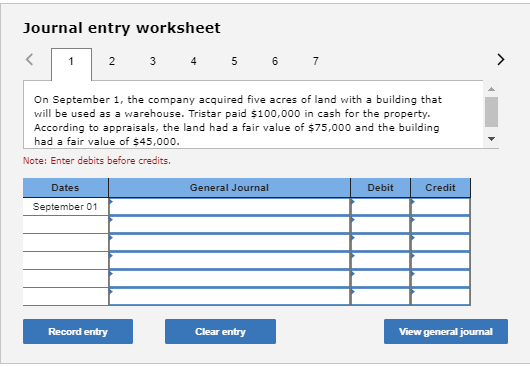

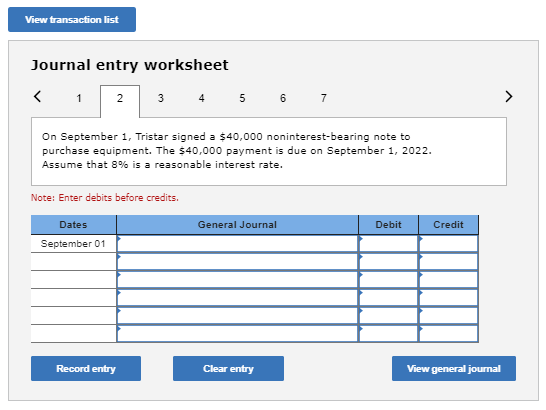

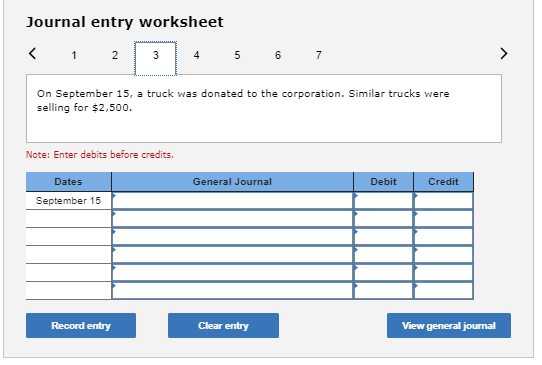

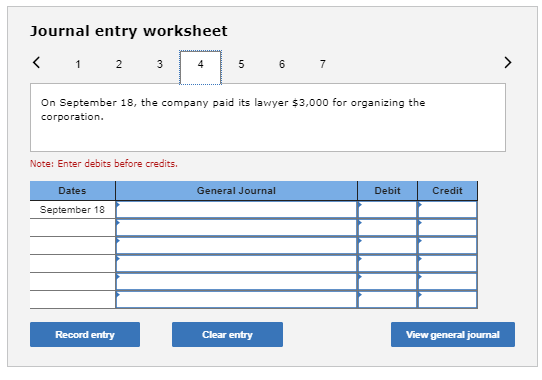

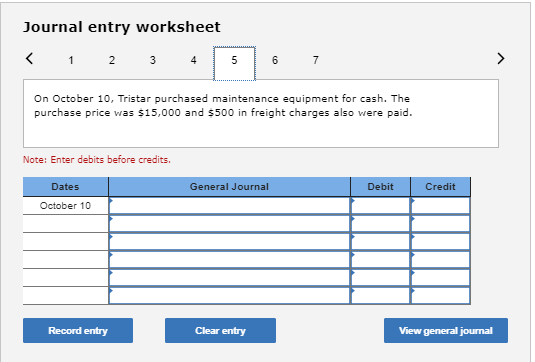

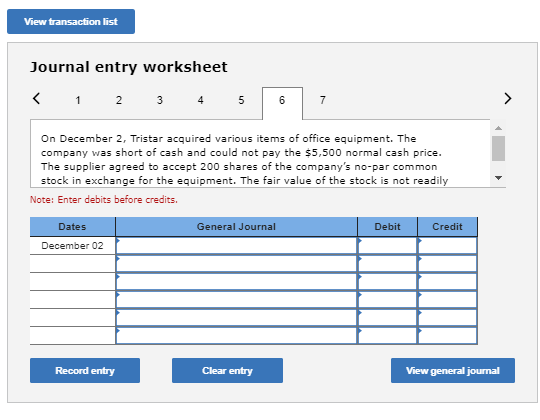

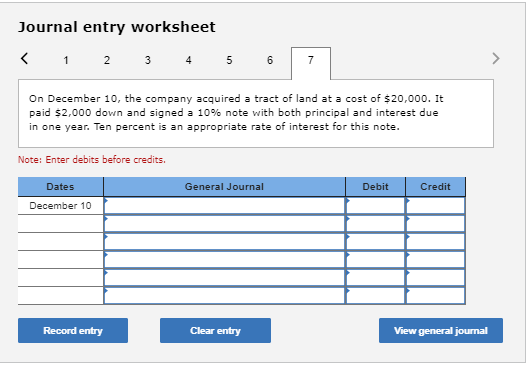

Tristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during Its first four months of operations. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): 1 1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar pald $100,000 In cash for the property. According to appraisals, the land had a fair value of $75,000 and the building had a fair value of $45,000. 12. On September 1, Tristar signed a $40,000 noninterest-bearing note to purchase equipment. The $40,000 payment is due on September 1, 2022. Assume that 8% is a reasonable Interest rate. 3. On September 15, a truck was donated to the corporation. Similar trucks were selling for $2,500. 4. On September 18, the company pald Its lawyer $3,000 for organizing the corporation. 5. On October 10, Tristar purchased maintenance equipment for cash. The purchase price was $15,000 and $500 In freight charges also were pald. 6. On December 2, Tristar acquired various items of office equipment. The company was short of cash and could not pay the $5,500 normal cash price. The supplier agreed to accept 200 shares of the company's no-par common stock in exchange for the equipment. The fair value of the stock is not readily determinable. 7. On December 10, the company acquired a tract of land at a cost of $20,000. It paid $2,000 down and signed a 10% note with both principal and Interest due in one year. Ten percent is an appropriate rate of Interest for this note. T Journal entry worksheet 2 3 4 5 6 7 On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $100,000 in cash for the property. According to appraisals, the land had a fair value of $75,000 and the building had a fair value of $45,000. Note: Enter debits before credits. General Journal Debit Credit Dates September 01 Record entry Clear entry View general journal View transaction list Journal entry worksheet 3 4 5 6 7 On September 1, Tristar signed a $40,000 noninterest-bearing note to purchase equipment. The $40,000 payment is due on September 1, 2022. Assume that 8% is a reasonable interest rate. Note: Enter debits before credits. Dates General Journal Debit Credit September 01 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started