Answered step by step

Verified Expert Solution

Question

1 Approved Answer

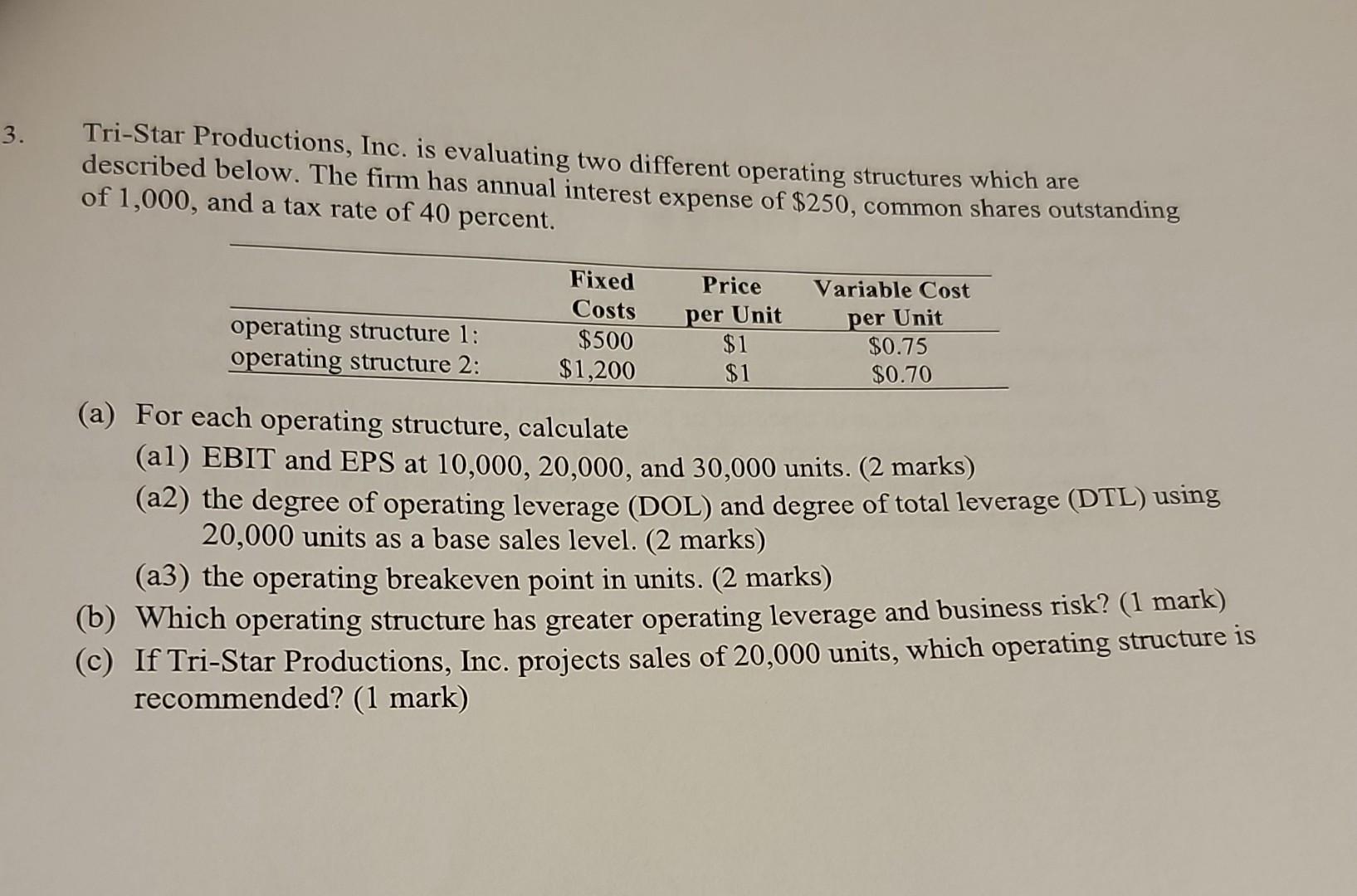

Tri-Star Productions, Inc. is evaluating two different operating structures which are described below. The firm has annual interest expense of $250, common shares outstanding of

Tri-Star Productions, Inc. is evaluating two different operating structures which are described below. The firm has annual interest expense of $250, common shares outstanding of 1,000 , and a tax rate of 40 percent. (a) For each operating structure, calculate (a1) EBIT and EPS at 10,000, 20,000, and 30,000 units. (2 marks) (a2) the degree of operating leverage (DOL) and degree of total leverage (DTL) using 20,000 units as a base sales level. ( 2 marks) (a3) the operating breakeven point in units. (2 marks) (b) Which operating structure has greater operating leverage and business risk? (1 mark) (c) If Tri-Star Productions, Inc. projects sales of 20,000 units, which operating structure is recommended? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started