Answered step by step

Verified Expert Solution

Question

1 Approved Answer

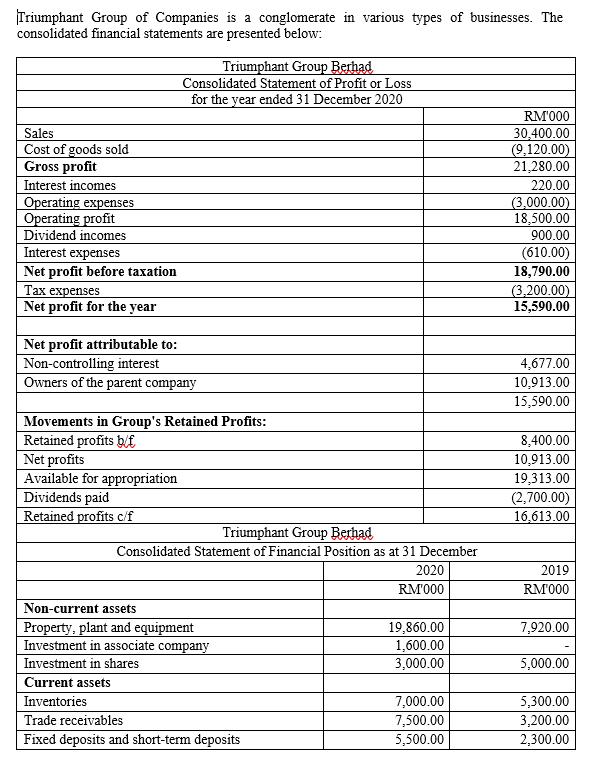

Triumphant Group of Companies is a conglomerate in various types of businesses. The consolidated financial statements are presented below: Triumphant Group Berhad Consolidated Statement

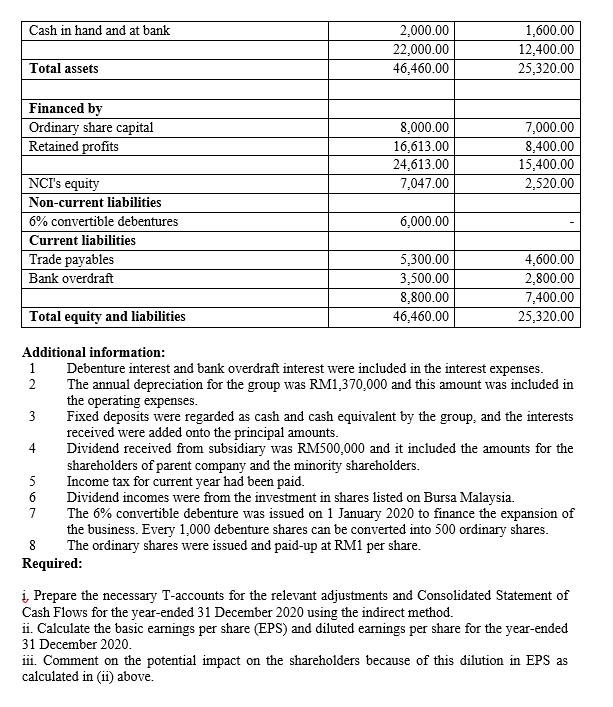

Triumphant Group of Companies is a conglomerate in various types of businesses. The consolidated financial statements are presented below: Triumphant Group Berhad Consolidated Statement of Proft or Loss for the year ended 31 December 2020 RM'000 Sales 30,400.00 (9,120.00) 21,280.00 Cost of goods sold Gross profit Interest incomes Operating expenses Operating profit 220.00 (3,000.00) 18,500.00 900.00 Dividend incomes Interest expenses Net profit before taxation expenses Net profit for the year (610.00) 18,790.00 (3,200.00) 15,590.00 Net profit attributable to: Non-controlling interest Owners of the parent company 4,677.00 10,913.00 15,590.00 Movements in Group's Retained Profits: Retained profits blE Net profits Available for appropriation Dividends paid Retained profits c/f 8,400.00 10,913.00 19,313.00 (2,700.00) 16,613.00 Triumphant Group Berhad Consolidated Statement of Financial Position as at 31 December 2020 2019 RM'000 RM'000 Non-current assets Property, plant and equipment Investment in associate company 19,860.00 7,920.00 1,600.00 3,000.00 Investment in shares 5,000.00 Current assets Inventories 7,000.00 5,300.00 Trade receivables 7,500.00 3,200.00 Fixed deposits and short-term deposits 5,500.00 2,300.00 Cash in hand and at bank 2,000.00 1,600.00 22,000.00 46,460.00 12,400.00 Total assets 25,320.00 Financed by Ordinary share capital Retained profits 8,000.00 16,613.00 24,613.00 7,047.00 7,000.00 8,400.00 15,400.00 NCI's equity 2,520.00 Non-current liabilities 6% convertible debentures 6,000.00 Current liabilities Trade payables 5,300.00 3,500.00 8,800.00 46,460.00 4,600.00 Bank overdraft 2,800.00 7,400.00 Total equity and liabilities 25,320.00 Additional information: Debenture interest and bank overdraft interest were included in the interest expenses. The annual depreciation for the group was RM1,370,000 and this amount was included in the operating expenses. Fixed deposits were regarded as cash and cash equivalent by the group, and the interests received were added onto the principal amounts. Dividend received from subsidiary was RM500,000 and it included the amounts for the shareholders of parent company and the minority shareholders. Income tax for current year had been paid. 2 3 5 6. Dividend incomes were from the investment in shares listed on Bursa Malaysia. The 6% convertible debenture was issued on 1 January 2020 to finance the expansion of the business. Every 1,000 debenture shares can be converted into 500 ordinary shares. The ordinary shares were issued and paid-up at RM1 per share. Required: Prepare the necessary T-accounts for the relevant adjustments and Consolidated Statement of Cash Flows for the year-ended 31 December 2020 using the indirect method. ii. Calculate the basic earnings per share (EPS) and diluted earnings per share for the year-ended 31 December 2020. iii. Comment on the potential impact on the shareholders because of this dilution in EPS as calculated in (ii) above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Answer 2 Answer 3 Eps and di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started