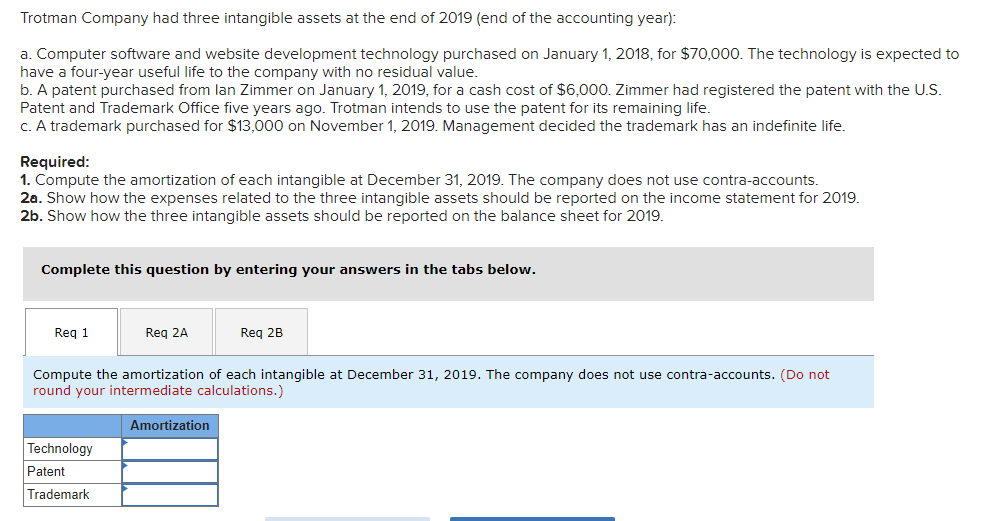

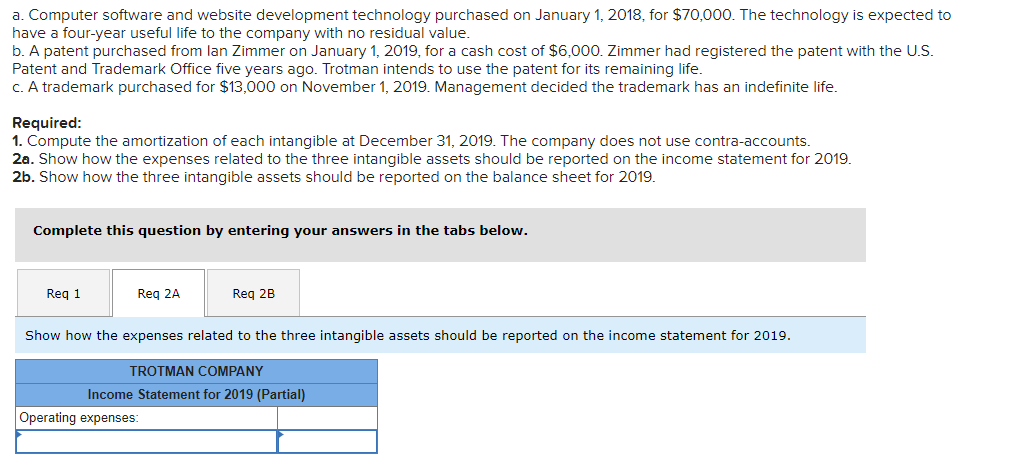

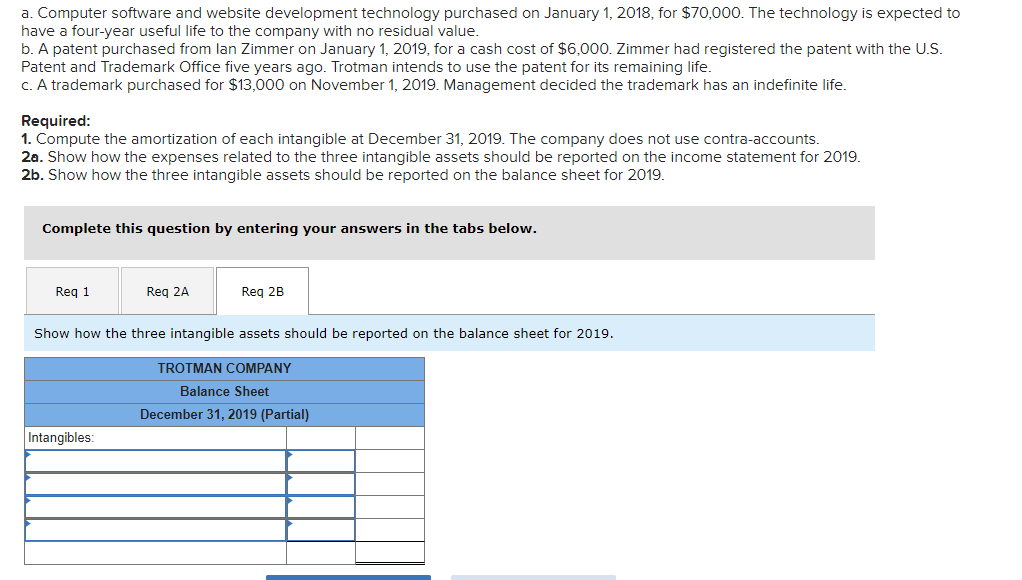

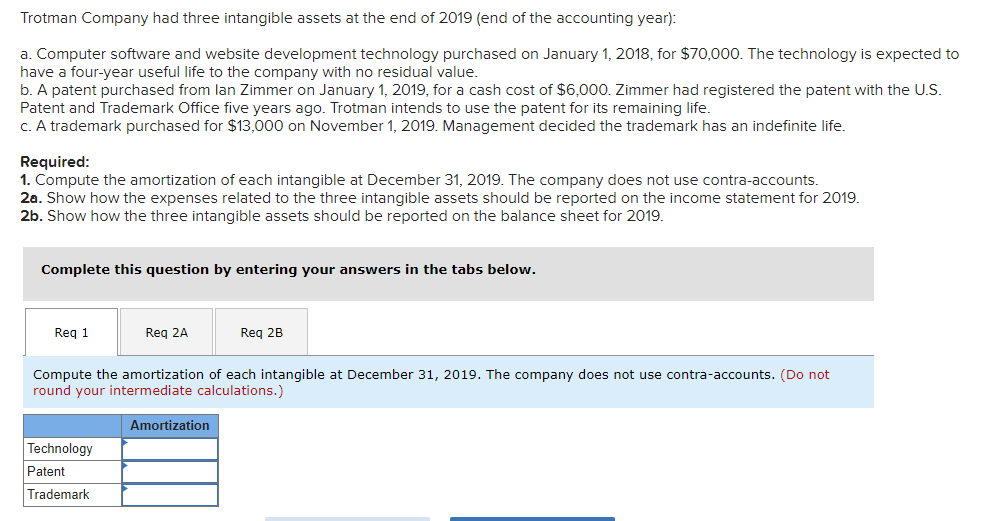

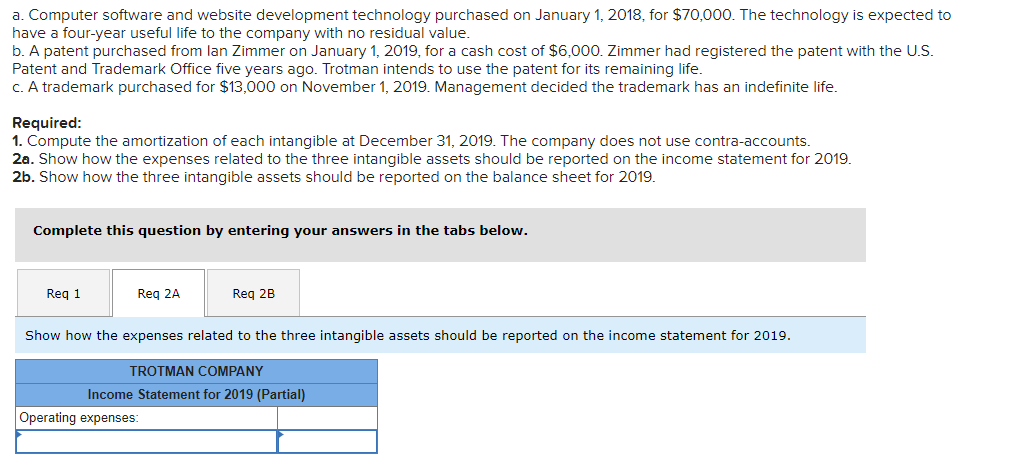

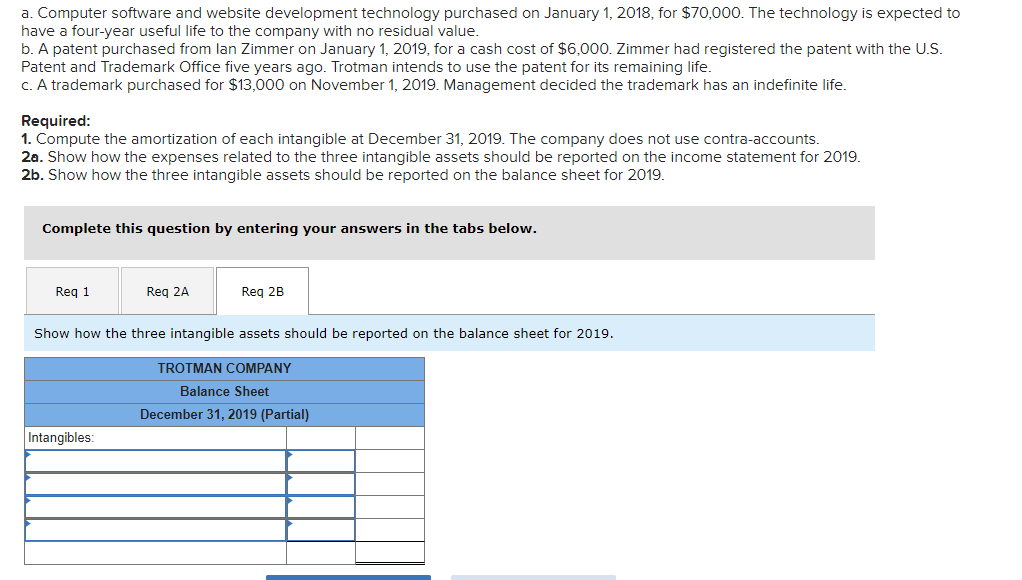

Trotman Company had three intangible assets at the end of 2019 (end of the accounting year): a. Computer software and website development technology purchased on January 1, 2018, for $70,000. The technology is expected to have a four-year useful life to the company with no residual value. b. A patent purchased from lan Zimmer on January 1, 2019, for a cash cost of $6,000. Zimmer had registered the patent with the U.S. Patent and Trademark Office five years ago. Trotman intends to use the patent for its remaining life. c. A trademark purchased for $13,000 on November 1, 2019. Management decided the trademark has an indefinite life. Required: 1. Compute the amortization of each intangible at December 31, 2019. The company does not use contra-accounts. 2a. Show how the expenses related to the three intangible assets should be reported on the income statement for 2019. 2b. Show how the three intangible assets should be reported on the balance sheet for 2019. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 2B Compute the amortization of each intangible at December 31, 2019. The company does not use contra-accounts. (Do not round your intermediate calculations.) Amortization Technology Patent Trademark a. Computer software and website development technology purchased on January 1, 2018, for $70,000. The technology is expected to have a four-year useful life to the company with no residual value. b. A patent purchased from lan Zimmer on January 1, 2019, for a cash cost of $6,000. Zimmer had registered the patent with the U.S. Patent and Trademark Office five years ago. Trotman intends to use the patent for its remaining life. c. A trademark purchased for $13,000 on November 1, 2019. Management decided the trademark has an indefinite life. Required: 1. Compute the amortization of each intangible at December 31, 2019. The company does not use contra-accounts. 2a. Show how the expenses related to the three intangible assets should be reported on the income statement for 2019. 2b. Show how the three intangible assets should be reported on the balance sheet for 2019. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 2B Show how the expenses related to the three intangible assets should be reported on the income statement for 2019. TROTMAN COMPANY Income Statement for 2019 (Partial) Operating expenses: a. Computer software and website development technology purchased on January 1, 2018, for $70,000. The technology is expected to have a four-year useful life to the company with no residual value. b. A patent purchased from lan Zimmer on January 1, 2019, for a cash cost of $6,000. Zimmer had registered the patent with the U.S. Patent and Trademark Office five years ago. Trotman intends to use the patent for its remaining life. c. A trademark purchased for $13,000 on November 1, 2019. Management decided the trademark has an indefinite life. Required: 1. Compute the amortization of each intangible at December 31, 2019. The company does not use contra-accounts. 2a. Show how the expenses related to the three intangible assets should be reported on the income statement for 2019. 2b. Show how the three intangible assets should be reported on the balance sheet for 2019. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Show how the three intangible assets should be reported on the balance sheet for 2019. TROTMAN COMPANY Balance Sheet December 31, 2019 (Partial) Intangibles