Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Troy Ltd purchased a new machine on 1 September 2019 at a cost of $196,900 (excluding GST). The entity estimated that the machine has

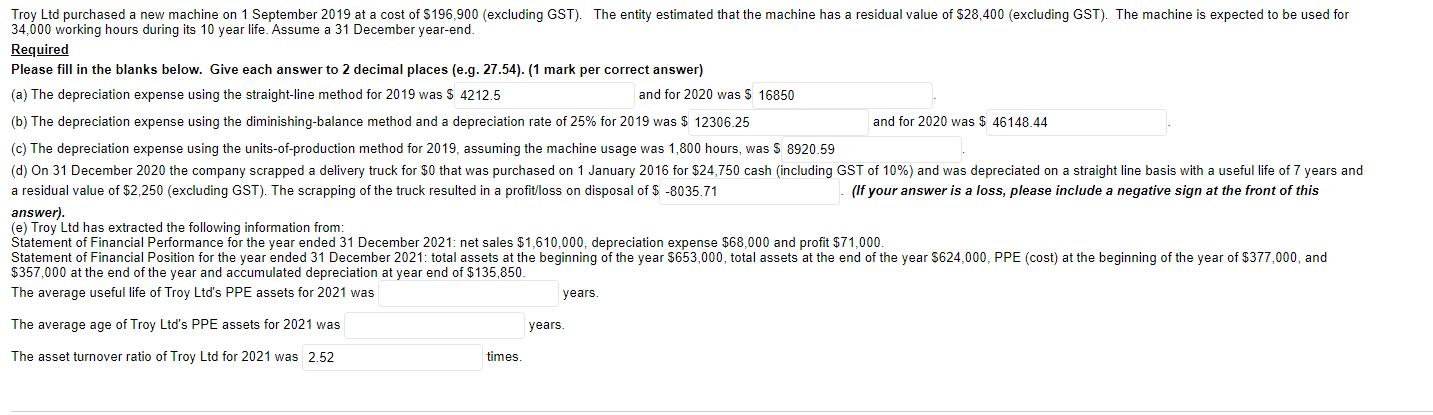

Troy Ltd purchased a new machine on 1 September 2019 at a cost of $196,900 (excluding GST). The entity estimated that the machine has a residual value of $28,400 (excluding GST). The machine is expected to be used for 34,000 working hours during its 10 year life. Assume a 31 December year-end. Required Please fill in the blanks below. Give each answer to 2 decimal places (e.g. 27.54). (1 mark per correct answer) (a) The depreciation expense using the straight-line method for 2019 was $ 4212.5 (b) The depreciation expense using the diminishing-balance method and a depreciation rate of 25% for 2019 was $ 12306.25 (c) The depreciation expense using the units-of-production method for 2019, assuming the machine usage was 1,800 hours, was $ 8920.59 (d) On 31 December 2020 the company scrapped a delivery truck for $0 that was purchased on 1 January 2016 for $24,750 cash (including GST of 10%) and was depreciated on a straight line basis with a useful life of 7 years and a residual value of $2,250 (excluding GST). The scrapping of the truck resulted in a profit/loss on disposal of $ -8035.71 (If your answer is a loss, please include a negative sign at the front of this times. answer). (e) Troy Ltd has extracted the following information from: Statement of Financial Performance for the year ended 31 December 2021: net sales $1,610,000, depreciation expense $68,000 and profit $71,000. Statement of Financial Position for the year ended 31 December 2021: total assets at the beginning of the year $653,000, total assets at the end of the year $624,000, PPE (cost) at the beginning of the year of $377,000, and $357,000 at the end of the year and accumulated depreciation at year end of $135,850. The average useful life of Troy Ltd's PPE assets for 2021 was The average age of Troy Ltd's PPE assets for 2021 was The asset turnover ratio of Troy Ltd for 2021 was 2.52 years. and for 2020 was $ 16850 years. and for 2020 was $46148.44

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a The depreciation expense using Straight line method for 2019 was 561667 and for 2020 was 16850 Explanation Given Machine purchased on 1 September 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started