Question

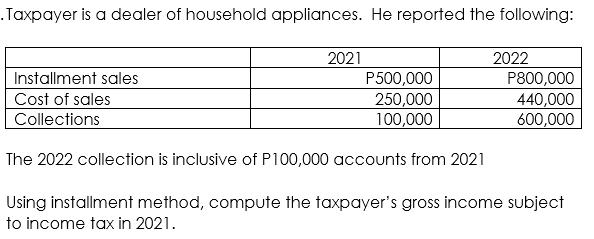

A. 250,000 B. 150,000 C. 100,000 D. 50,000 .Taxpayer is a dealer of household appliances. He reported the following: 2021 2022 P500,000 250,000 100,000 Installment

A. 250,000

B. 150,000

C. 100,000

D. 50,000

.Taxpayer is a dealer of household appliances. He reported the following: 2021 2022 P500,000 250,000 100,000 Installment sales Cost of sales Collections The 2022 collection is inclusive of P100,000 accounts from 2021 Using installment method, compute the taxpayer's gross income subject to income tax in 2021. P800,000 440,000 600,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Under the installment method gross profit is deferred till the collection of the cash related to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting with IFRS Fold Out Primer

Authors: John Wild

5th edition

978-0077408770, 77408772, 978-0077413804

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App