Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRTS Ltd. is a multi-modal public transportation operator that operates a city subway train network, a bus network and a taxi network. The company

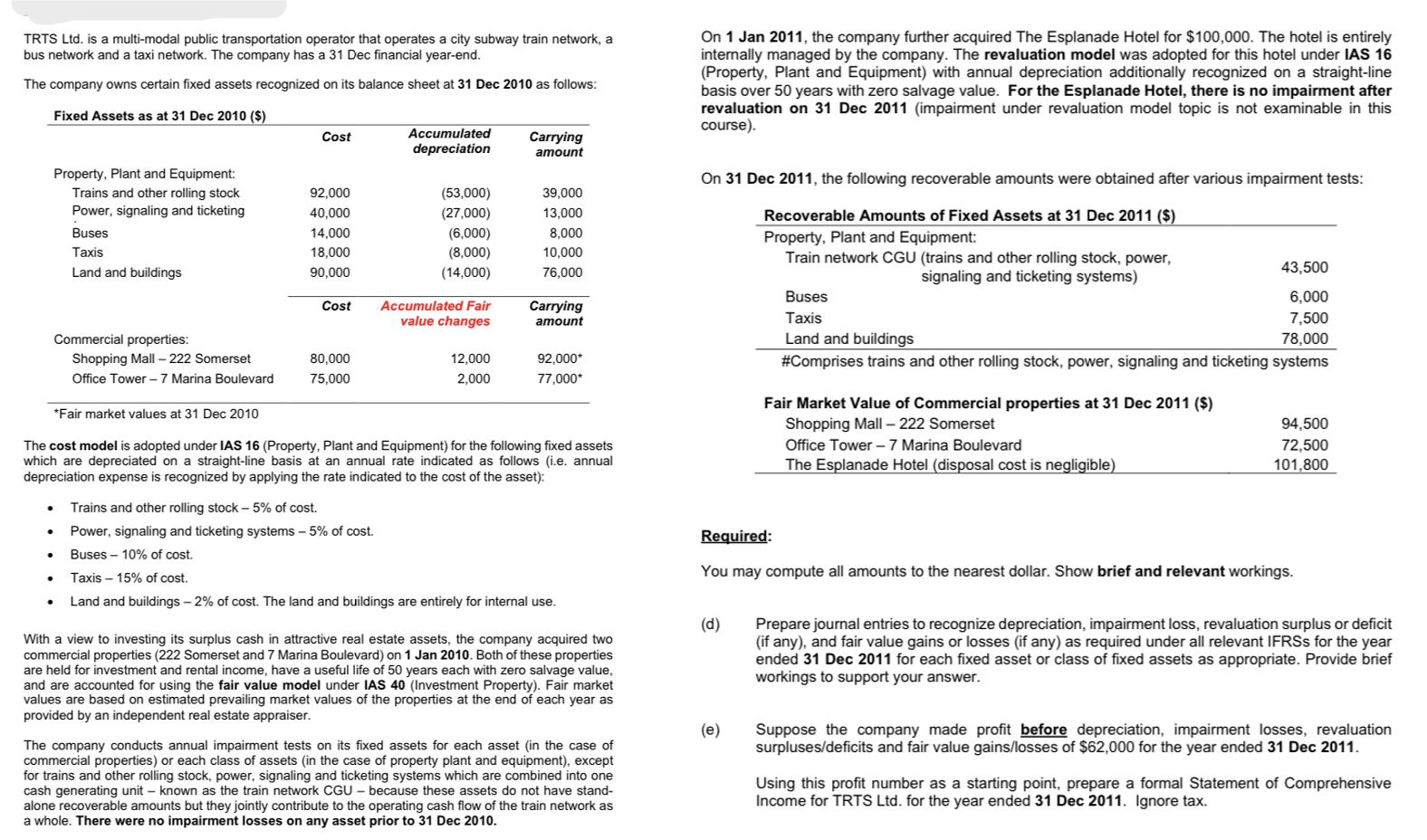

TRTS Ltd. is a multi-modal public transportation operator that operates a city subway train network, a bus network and a taxi network. The company has a 31 Dec financial year-end. The company owns certain fixed assets recognized on its balance sheet at 31 Dec 2010 as follows: Fixed Assets as at 31 Dec 2010 ($) Cost Accumulated depreciation Carrying amount On 1 Jan 2011, the company further acquired The Esplanade Hotel for $100,000. The hotel is entirely internally managed by the company. The revaluation model was adopted for this hotel under IAS 16 (Property, Plant and Equipment) with annual depreciation additionally recognized on a straight-line basis over 50 years with zero salvage value. For the Esplanade Hotel, there is no impairment after revaluation on 31 Dec 2011 (impairment under revaluation model topic is not examinable in this course). Property, Plant and Equipment: On 31 Dec 2011, the following recoverable amounts were obtained after various impairment tests: Trains and other rolling stock 92,000 (53,000) 39,000 Power, signaling and ticketing 40,000 (27,000) 13,000 Recoverable Amounts of Fixed Assets at 31 Dec 2011 ($) Buses 14,000 (6,000) 8,000 Taxis 18,000 (8,000) 10,000 Land and buildings 90,000 (14,000) 76,000 Property, Plant and Equipment: Train network CGU (trains and other rolling stock, power, signaling and ticketing systems) 43,500 Buses 6,000 Cost Accumulated Fair value changes Carrying amount Taxis 7,500 Commercial properties: Land and buildings 78,000 Shopping Mall - 222 Somerset 80,000 Office Tower - 7 Marina Boulevard 75,000 *Fair market values at 31 Dec 2010 12,000 2,000 92,000* 77,000* #Comprises trains and other rolling stock, power, signaling and ticketing systems Fair Market Value of Commercial properties at 31 Dec 2011 ($) Shopping Mall - 222 Somerset 94,500 The cost model is adopted under IAS 16 (Property, Plant and Equipment) for the following fixed assets which are depreciated on a straight-line basis at an annual rate indicated as follows (i.e. annual depreciation expense is recognized by applying the rate indicated to the cost of the asset): Office Tower-7 Marina Boulevard The Esplanade Hotel (disposal cost is negligible) 72,500 101,800 Trains and other rolling stock - 5% of cost. Power, signaling and ticketing systems -5% of cost. Buses 10% of cost. Required: Taxis -15% of cost. Land and buildings-2% of cost. The land and buildings are entirely for internal use. With a view to investing its surplus cash in attractive real estate assets, the company acquired two commercial properties (222 Somerset and 7 Marina Boulevard) on 1 Jan 2010. Both of these properties are held for investment and rental income, have a useful life of 50 years each with zero salvage value, and are accounted for using the fair value model under IAS 40 (Investment Property). Fair market values are based on estimated prevailing market values of the properties at the end of each year as provided by an independent real estate appraiser. The company conducts annual impairment tests on its fixed assets for each asset (in the case of commercial properties) or each class of assets (in the case of property plant and equipment), except for trains and other rolling stock, power, signaling and ticketing systems which are combined into one cash generating unit - known as the train network CGU - because these assets do not have stand- alone recoverable amounts but they jointly contribute to the operating cash flow of the train network as a whole. There were no impairment losses on any asset prior to 31 Dec 2010. You may compute all amounts to the nearest dollar. Show brief and relevant workings. (d) Prepare journal entries to recognize depreciation, impairment loss, revaluation surplus or deficit (if any), and fair value gains or losses (if any) as required under all relevant IFRSS for the year ended 31 Dec 2011 for each fixed asset or class of fixed assets as appropriate. Provide brief workings to support your answer. (e) Suppose the company made profit before depreciation, impairment losses, revaluation surpluses/deficits and fair value gains/losses of $62,000 for the year ended 31 Dec 2011. Using this profit number as a starting point, prepare a formal Statement of Comprehensive Income for TRTS Ltd. for the year ended 31 Dec 2011. Ignore tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started