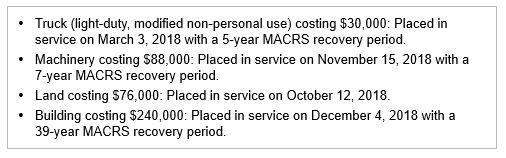

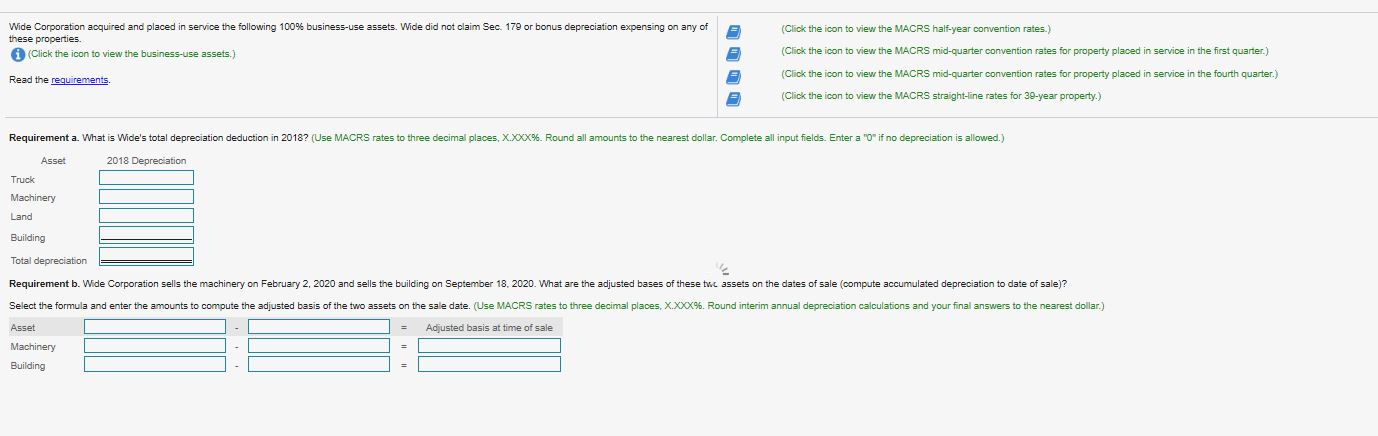

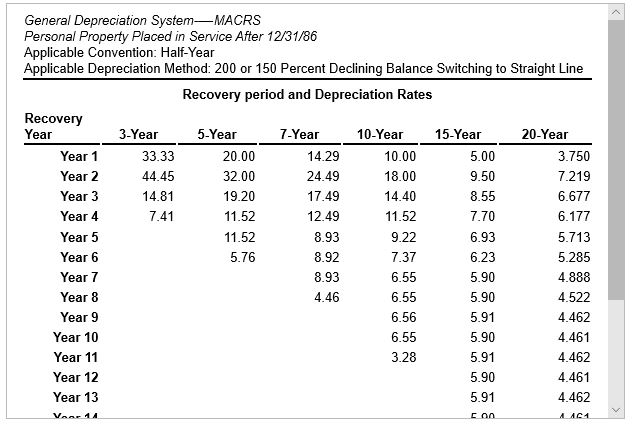

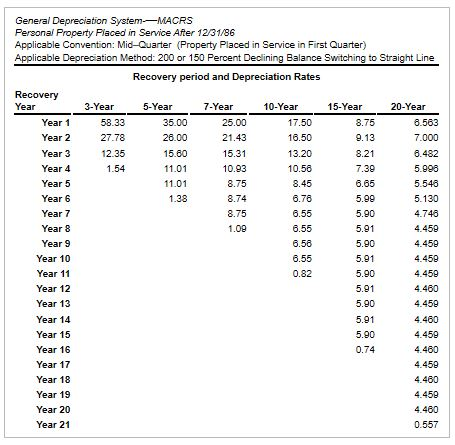

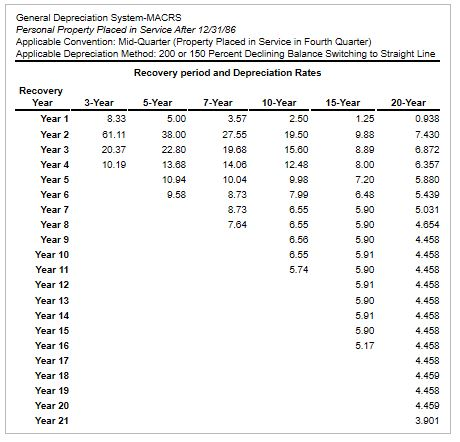

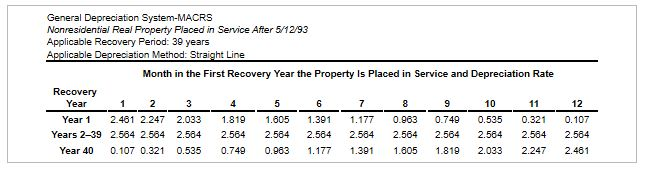

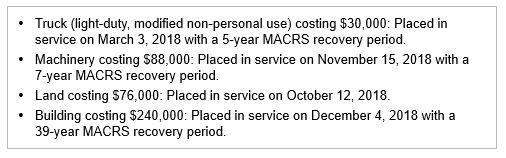

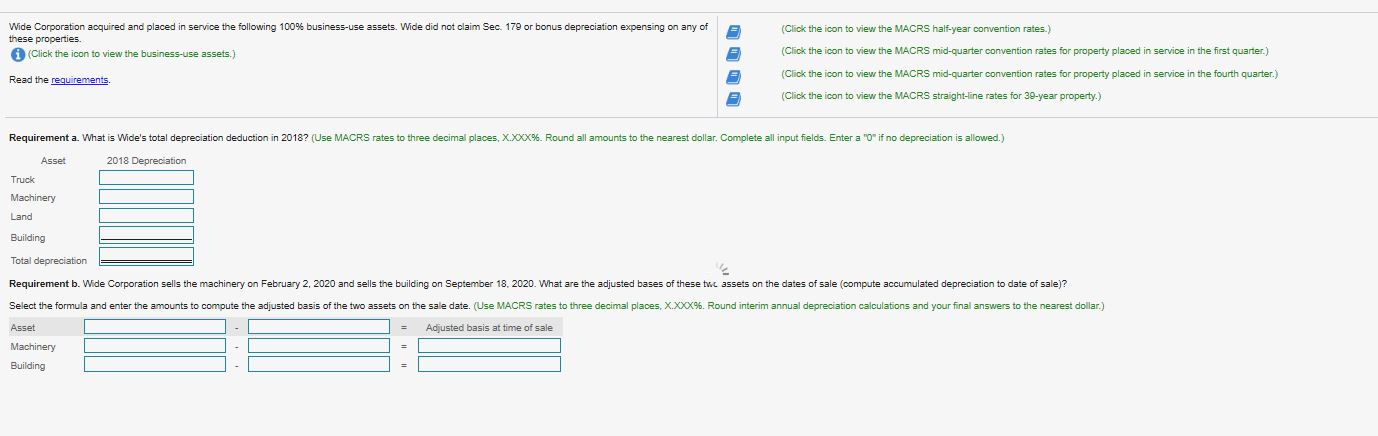

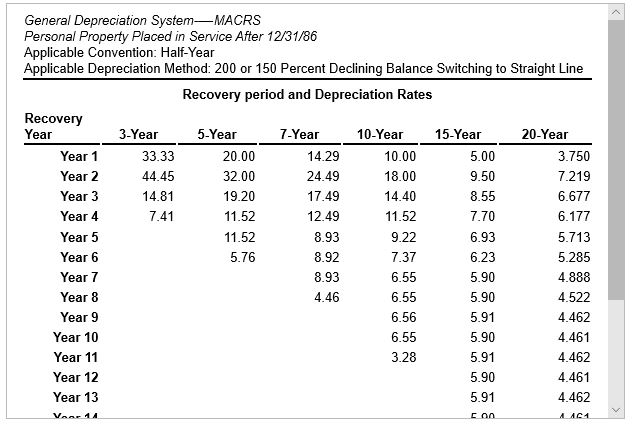

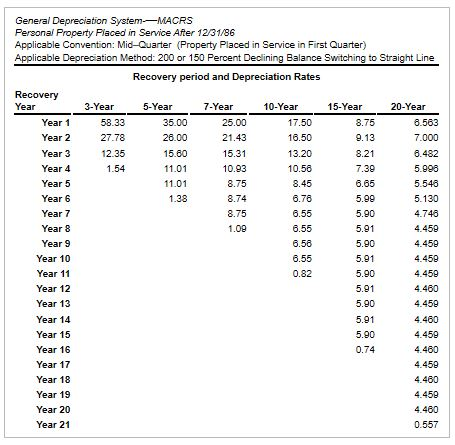

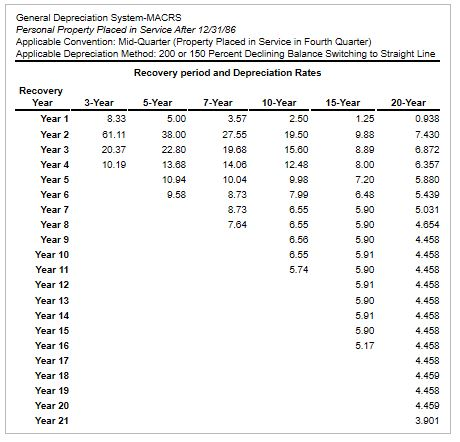

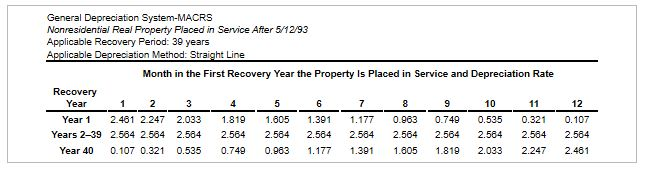

Truck (light-duty, modified non-personal use) costing $30,000: Placed in service on March 3, 2018 with a 5-year MACRS recovery period. Machinery costing $88,000: Placed in service on November 15, 2018 with a 7-year MACRS recovery period. Land costing $76,000: Placed in service on October 12, 2018. Building costing $240,000: Placed in service on December 4, 2018 with a 39-year MACRS recovery period. . (Click the icon to view the MACRS half-year convention rates. Wide Corporation acquired and placed in service the following 100% business-use assets. Wide did not claim Sec 179 or bonus depreciation expensing on any of these properties i (Click the icon to view the business-use assets.) Read the requirements. (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the first quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) (Click the icon to view the MACRS straight-line rates for 39-year property.) three decimal places, X.XXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "O"if no depreciation is allowed.) Asset Requirement a. What is Wide's total depreciation deduction in 2018? (Use MACRS rates 2018 Depreciation Truck Machinery Land Building Total depreciation Requirement b. Wide Corporation sells the machinery on February 2, 2020 and sells the building on September 18, 2020. What are the adjusted bases of these twc assets on the dates of sale (compute accumulated depreciation to date of sale)? Select the formula and enter the amounts to compute the adjusted basis of the two assets on the sale date. (Use MACRS rates to three decimal places, X.XX%. Round interim annual depreciation calculations and your final answers to the nearest dollar.) Adjusted basis at time of sale Asset Machinery Building General Depreciation SystemMACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 7.41 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 6.93 5.713 Year 6 5.76 8.92 7.37 6.23 5.285 Year 7 8.93 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 4.522 Year 9 6.56 5.91 4.462 Year 10 6.55 5.90 4.461 Year 11 3.28 5.91 4.462 Year 12 5.90 4.461 Year 13 5.91 4.462 Voor 14 con 1 AC 1 General Depreciation System--MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in First Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 58.33 35.00 25.00 17.50 8.75 6.563 Year 2 27.78 26.00 21.43 16.50 9.13 7.000 Year 3 12.35 15.80 15.31 13.20 8.21 8.482 Year 4 1.54 11.01 10.93 10.58 7.39 5.998 Year 5 11.01 8.75 8.45 6.65 5.548 Year 6 1.38 8.74 6.76 5.99 5.130 Year 7 8.75 6.55 5.90 4.748 Year 8 1.09 6.55 5.91 4.450 Year 9 6.58 5.90 4.450 Year 10 6.55 5.91 4.459 Year 11 0.82 5.90 4.459 Year 12 5.91 4.480 Year 13 5.90 4.450 Year 14 5.91 4.460 Year 15 5.90 4.459 Year 16 0.74 4.480 Year 17 4.450 Year 18 4.460 Year 19 4.450 Year 20 4.460 Year 21 0.557 General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 8.33 5.00 3.57 2.50 1.25 0.938 Year 2 81.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 8.872 Year 4 10.10 13.88 14.06 12.48 8.00 8.357 Year 5 10.94 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 8.56 5.90 4.458 Year 10 8.55 5.91 4.458 Year 11 5.74 5.90 4.458 Year 12 5.91 4.458 Year 13 5.90 4.458 Year 14 5.91 4.458 Year 15 5.90 4.458 Year 16 5.17 4.458 Year 17 4.458 Year 18 4.450 Year 19 4.458 Year 20 4.459 Year 21 3.901 General Depreciation System-MACRS Nonresidential Real Property Placed in Service After 5/12/93 Applicable Recovery Period: 39 years Applicable Depreciation Method: Straight Line Month in the First Recovery Year the Property Is Placed in Service and Depreciation Rate Recovery Year 1 2 3 4 5 6 7 8 9 10 11 Year 1 2.481 2.247 2.033 1.819 1.605 1.391 1.177 0.963 0.749 0.535 0.321 Years 2-39 2.584 2.584 2.564 2.564 2.584 2.584 2.584 2.564 2.564 2.584 2.584 Year 40 0.107 0.321 0.535 0.749 0.983 1.177 1.391 1.805 1.819 2.033 2.247 12 0.107 2.584 2.461