Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Trudy's Tax Services is a business that prepares tax returns for clients. The following balances appeared in the records of Trudy's Tax Services at

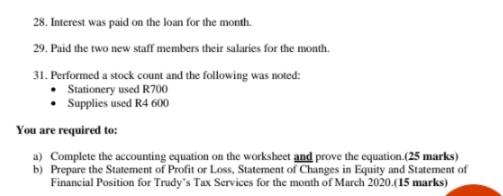

Trudy's Tax Services is a business that prepares tax returns for clients. The following balances appeared in the records of Trudy's Tax Services at the beginning of March 2020: Description Bank Equipment Stationery Asset Accounts Receivable Supplies Asset Accounts Payable Capital R 19 080 95 000 320 28 400 7200 20 000 The following transactions took place during March 2020: 1. A loan was taken out with ABC Bank amounting to R80 000. Interest will be charged at 12% per annum. 2. The owner purchased a computer from his personal savings on behalf of the business costing R22 000. 3. Purchased a vehicle costing R120 000, 20% was paid immediately and the remainder on credit. 4. Two new staff members were employed. Each one is entitled to a salary of R8 600 each. 5. Purchased stationery on credit amounting to R590. 9. Paid rent for the month, R3 000. 10. Rendered services on credit to a new client AJ Traders, R4 500. 15. The rates account was received, R1 500 for the business and R800 for the owner's home. Both amounts were paid from the business bank account. 17. Rendered services for cash, R22 000. 24. Received the full amount owing from AJ Traders. 25. Received the telephone account R820, and paid it immediately. 26. Paid the electricity account, R800 for the month. 28. Interest was paid on the loan for the month. 29. Paid the two new staff members their salaries for the month. 31. Performed a stock count and the following was noted: Stationery used R700 Supplies used R4 600 You are required to: a) Complete the accounting equation on the worksheet and prove the equation (25 marks) b) Prepare the Statement of Profit or Loss, Statement of Changes in Equity and Statement of Financial Position for Trudy's Tax Services for the month of March 2020.(15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started