Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True / False 1. The current market cap of LYFT is over $4 billion. 2. In the IPO of Lyft 32,500,000 shares of class A

True / False

1. The current market cap of LYFT is over $4 billion.

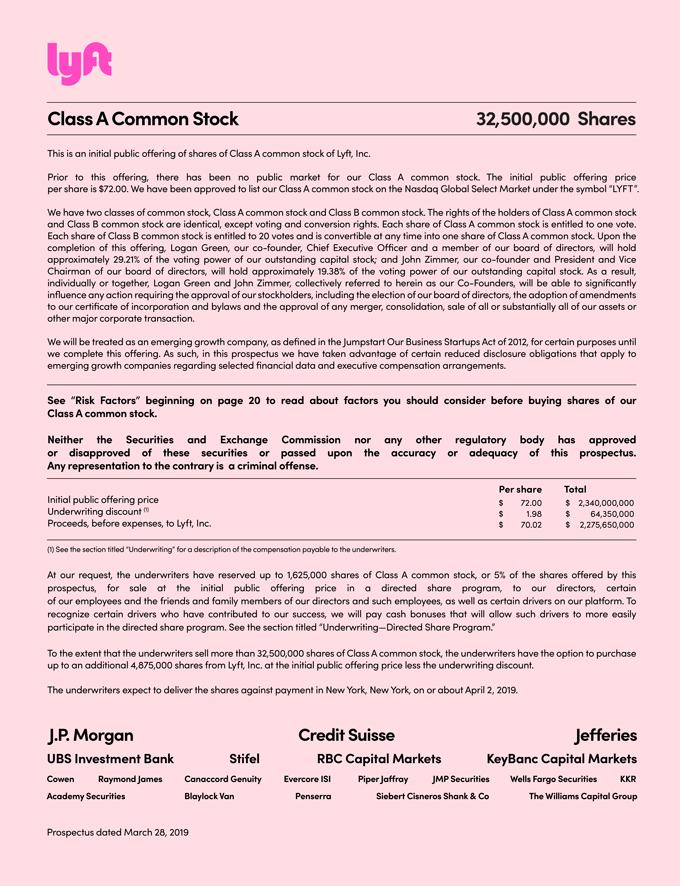

2. In the IPO of Lyft 32,500,000 shares of class A common shares were offered to the public for $72 per share.

3. JP Morgan underwrote the entire IPO of LYFT.

4. The number of outstanding shares of LYFT common shares has not increased since its IPO.

This is an initial public offering of shares of Class A common stock of Lyft, Inc. Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price per share is $72.00. We have been approved to list our Class A common stock on the Nasdoq Global Select Market under the symbol "LYFT". We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 20 votes and is convertible at any time into one share of Class A common stock. Upon the completion of this offering, Logan Green, our co-founder, Chief Executive Officer and a member of our board of directors, will hold opproximately 29.21% of the voting power of our outstanding capital stock; and John Zimmer, our co-founder and President and Vice Chairman of our board of directors, will hold approximately 19.38% of the voting power of our outstanding capital stock. As a result, individually or together, Logan Green and John Zimmer, collectively referred to herein as our Co-Founders, will be able to significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger, consolidation, sale of all or substantially all of our assets or other mojor corporate transaction. We will be treated as an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, for certain purposes until we complete this offering. As such, in this prospectus we have taken advantage of certain reduced disclosure obligations that apply to emerging growth companies regarding selected financial data and executive compensation arrangements. See "Risk Factors" beginning on page 20 to read about factors you should consider before buying shares of our Class A common stock. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. (7) See the section titlod "Underwriting" for a description of the componsotion payable to the underwriters. At our request, the underwriters have reserved up to 1,625,000 shares of Class A common stock, or 5% of the shares offered by this prospectus, for sale at the initial public offering price in a directed share program, to our directors, certain of our employees and the friends and family members of our directors and such employees, as well as certain drivers on our platform. To recognize certain drivers who have contributed to our success, we will pay cash bonuses that will allow such drivers to more easily participate in the directed share program. See the section titled "Underwriting-Directed Share Program." To the extent that the underwriters sell more than 32,500,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 4,875,000 shares from Lyft, Inc, at the initial public offering price less the underwriting discount. The underwriters expect to deliver the shares against payment in New York, New York, on or about April 2, 2019. This is an initial public offering of shares of Class A common stock of Lyft, Inc. Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price per share is $72.00. We have been approved to list our Class A common stock on the Nasdoq Global Select Market under the symbol "LYFT". We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 20 votes and is convertible at any time into one share of Class A common stock. Upon the completion of this offering, Logan Green, our co-founder, Chief Executive Officer and a member of our board of directors, will hold opproximately 29.21% of the voting power of our outstanding capital stock; and John Zimmer, our co-founder and President and Vice Chairman of our board of directors, will hold approximately 19.38% of the voting power of our outstanding capital stock. As a result, individually or together, Logan Green and John Zimmer, collectively referred to herein as our Co-Founders, will be able to significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger, consolidation, sale of all or substantially all of our assets or other mojor corporate transaction. We will be treated as an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, for certain purposes until we complete this offering. As such, in this prospectus we have taken advantage of certain reduced disclosure obligations that apply to emerging growth companies regarding selected financial data and executive compensation arrangements. See "Risk Factors" beginning on page 20 to read about factors you should consider before buying shares of our Class A common stock. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. (7) See the section titlod "Underwriting" for a description of the componsotion payable to the underwriters. At our request, the underwriters have reserved up to 1,625,000 shares of Class A common stock, or 5% of the shares offered by this prospectus, for sale at the initial public offering price in a directed share program, to our directors, certain of our employees and the friends and family members of our directors and such employees, as well as certain drivers on our platform. To recognize certain drivers who have contributed to our success, we will pay cash bonuses that will allow such drivers to more easily participate in the directed share program. See the section titled "Underwriting-Directed Share Program." To the extent that the underwriters sell more than 32,500,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 4,875,000 shares from Lyft, Inc, at the initial public offering price less the underwriting discount. The underwriters expect to deliver the shares against payment in New York, New York, on or about April 2, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started