Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True False and multiple choice questions. I need only the answers, but answer all to give u . Thnx 11. Which of the following is

True False and multiple choice questions.

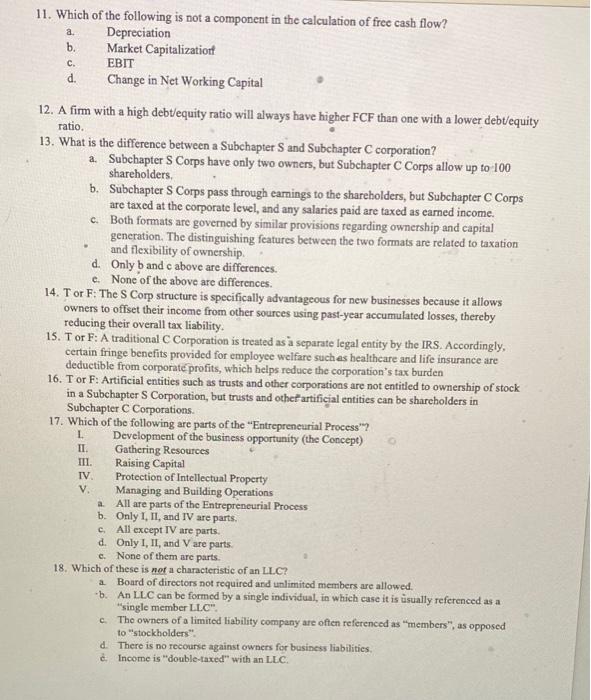

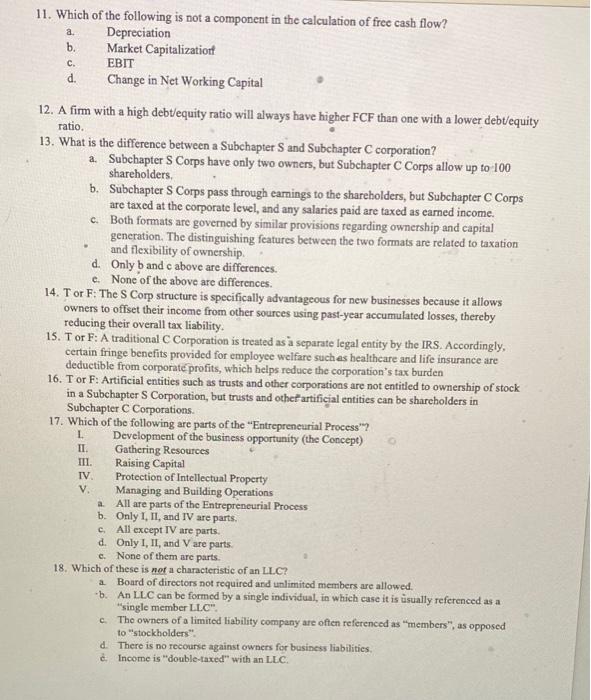

11. Which of the following is not a component in the calculation of free cash flow? a. Depreciation b. Market Capitalizationt c. EBIT d. Change in Net Working Capital 12. A firm with a high debt/equity ratio will always have higher FCF than one with a lower debt/equity ratio. 13. What is the difference between a Subchapter S and Subchapter C corporation? a. Subchapter S Corps have only two owners, but Subchapter C Corps allow up to 100 shareholders. b. Subchapter S Corps pass through eamings to the shareholders, but Subchapter C Corps are taxed at the corporate level, and any salaries paid are taxed as earned income. c. Both formats are governed by similar provisions regarding ownership and capital generation. The distinguishing features between the two formats are related to taxation and flexibility of ownership. d. Only b and c above are differences. e. None of the above are differences. 14. T or F: The S Corp structure is specifically advantageoes for new businesses because it allows owners to offset their income from other sources using past-year accumulated losses, thereby reducing their overall tax liability. 15. T or F: A traditional C Corporation is treated as a separate legal entity by the IRS. Accordingly, certain fringe benefits provided for employee welfare such es healtheare and life insurance are deductible from corporate profits, which helps reduce the corporation's tax burden 16. T or F: Artificial entities such as trusts and other corporations are not entitied to ownership of stock in a Subchapter S Corporation, but trusts and othet artificial entities can be shareholders in Subchapter C Corporations. 17. Which of the following are parts of the "Entrepreneurial Process"? 1. Development of the business opportunity (the Concept) II. Gathering Resources III. Raising Capital IV. Protection of Intellectual Property V. Managing and Building Operations a. All are parts of the Entrepreneurial Process b. Only I, II, and IV are parts. c. All except IV are parts. d. Only I, II, and V are parts. c. None of them are parts. 18. Which of these is not a characteristic of an LLC? a. Bourd of directors not required and unlimited members are allowed. b. An LLC can be formed by a single individual, in which case it is uisually referenced as a "single member LLC". c. The owners of a limited liability company are offen referenced as "members", as opposed to "stockholders". d. There is no recourse against owners for besiness liabilitics. c. Income is "double-taxed" with an LLC I need only the answers, but answer all to give u . Thnx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started