Answered step by step

Verified Expert Solution

Question

1 Approved Answer

true or false A SALES-TYPE LEASE with a selling profit requires recording sales revenue and cost of goods sold by the lessor at the beginning

true or false

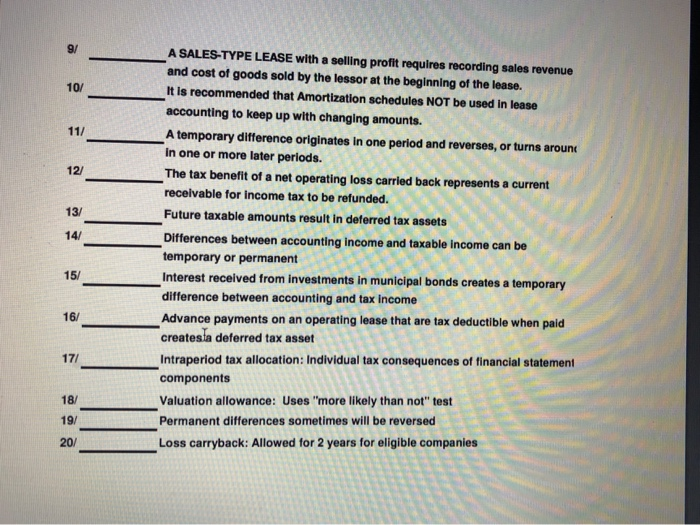

A SALES-TYPE LEASE with a selling profit requires recording sales revenue and cost of goods sold by the lessor at the beginning of the lease. It is recommended that Amortization schedules NOT be used in lease accounting to keep up with changing amounts. A temporary difference originates in one period and reverses, or turns around In one or more later periods. The tax benefit of a net operating loss carried back represents a current receivable for Income tax to be refunded. Future taxable amounts result in deferred tax assets Differences between accounting income and taxable income can be temporary or permanent Interest received from investments in municipal bonds creates a temporary difference between accounting and tax income Advance payments on an operating lease that are tax deductible when paid createsta deferred tax asset Intraperiod tax allocation: Individual tax consequences of financial statement components Valuation allowance: Uses "more likely than not" test Permanent differences sometimes will be reversed Loss carryback: Allowed for 2 years for eligible companies Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started