Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True or False (Ampongan Chapter 19) CHAPTER 19 - TAX REMEDIES 653 EXERCISE 19-1. TRUE OR FALSE QUESTIONS 1. Distraint is an extrajudicial remedy in

True or False (Ampongan Chapter 19)

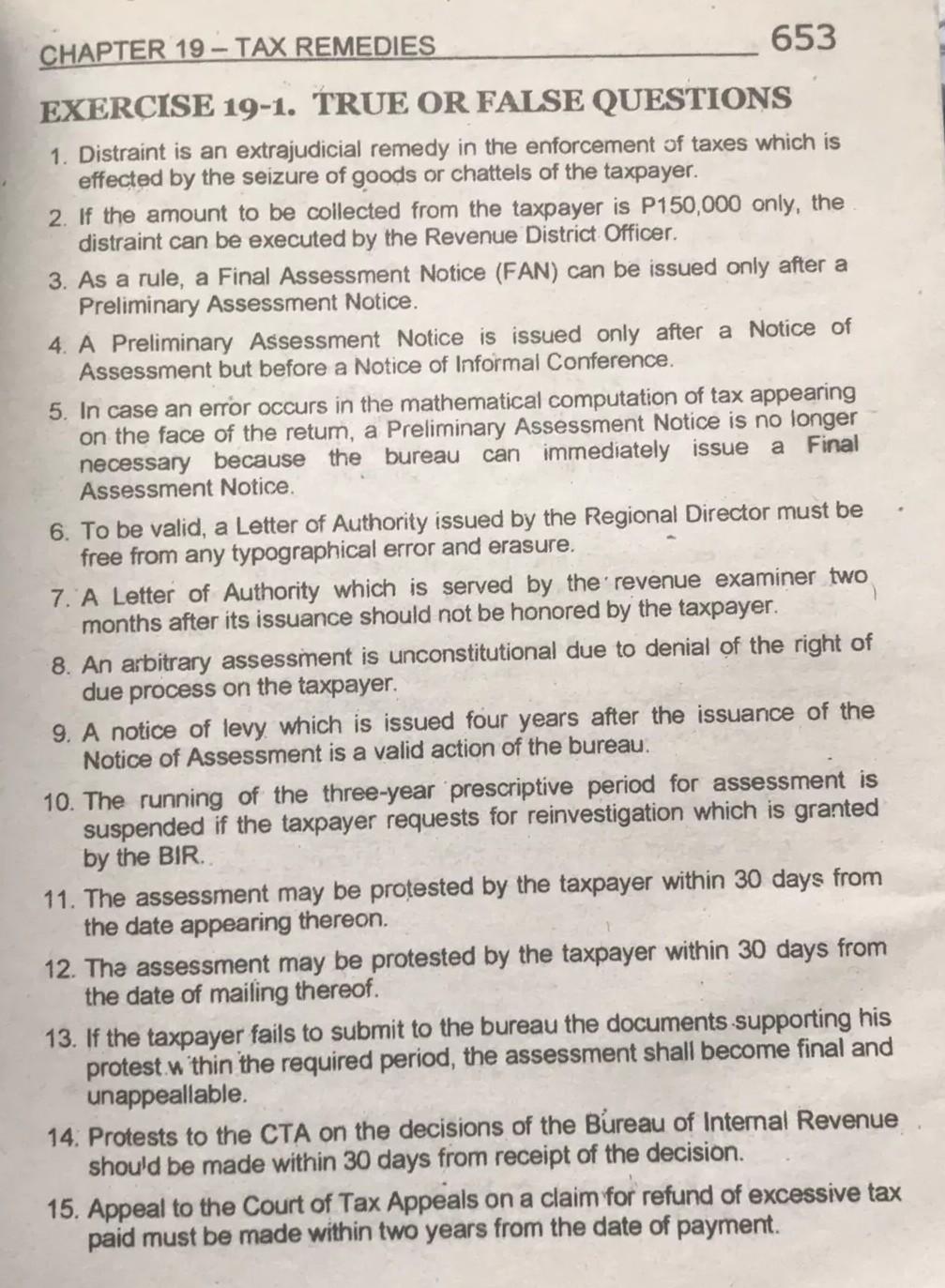

CHAPTER 19 - TAX REMEDIES 653 EXERCISE 19-1. TRUE OR FALSE QUESTIONS 1. Distraint is an extrajudicial remedy in the enforcement of taxes which is effected by the seizure of goods or chattels of the taxpayer. 2. If the amount to be collected from the taxpayer is P150,000 only, the distraint can be executed by the Revenue District Officer 3. As a rule, a Final Assessment Notice (FAN) can be issued only after a Preliminary Assessment Notice. 4. A Preliminary Assessment Notice is issued only after a Notice of Assessment but before a Notice of Informal Conference. 5. In case an error occurs in the mathematical computation of tax appearing on the face of the retum, a Preliminary Assessment Notice is no longer necessary because the bureau can immediately issue a Final Assessment Notice. 6. To be valid, a Letter of Authority issued by the Regional Director must be free from any typographical error and erasure. 7. A Letter of Authority which is served by the revenue examiner two months after its issuance should not be honored by the taxpayer. 8. An arbitrary assessment is unconstitutional due to denial of the right of due process on the taxpayer. 9. A notice of levy which is issued four years after the issuance of the Notice of Assessment is a valid action of the bureau. 10. The running of the three-year prescriptive period for assessment is suspended if the taxpayer requests for reinvestigation which is granted by the BIR. 11. The assessment may be protested by the taxpayer within 30 days from the date appearing thereon. 12. The assessment may be protested by the taxpayer within 30 days from the date of mailing thereof. 13. If the taxpayer fails to submit to the bureau the documents supporting his protest .w 'thin the required period, the assessment shall become final and unappeallable. 14. Protests to the CTA on the decisions of the Bureau of Internal Revenue should be made within 30 days from receipt of the decision. 15. Appeal to the Court of Tax Appeals on a claim for refund of excessive tax paid must be made within two years from the date of payment. CHAPTER 19 - TAX REMEDIES 653 EXERCISE 19-1. TRUE OR FALSE QUESTIONS 1. Distraint is an extrajudicial remedy in the enforcement of taxes which is effected by the seizure of goods or chattels of the taxpayer. 2. If the amount to be collected from the taxpayer is P150,000 only, the distraint can be executed by the Revenue District Officer 3. As a rule, a Final Assessment Notice (FAN) can be issued only after a Preliminary Assessment Notice. 4. A Preliminary Assessment Notice is issued only after a Notice of Assessment but before a Notice of Informal Conference. 5. In case an error occurs in the mathematical computation of tax appearing on the face of the retum, a Preliminary Assessment Notice is no longer necessary because the bureau can immediately issue a Final Assessment Notice. 6. To be valid, a Letter of Authority issued by the Regional Director must be free from any typographical error and erasure. 7. A Letter of Authority which is served by the revenue examiner two months after its issuance should not be honored by the taxpayer. 8. An arbitrary assessment is unconstitutional due to denial of the right of due process on the taxpayer. 9. A notice of levy which is issued four years after the issuance of the Notice of Assessment is a valid action of the bureau. 10. The running of the three-year prescriptive period for assessment is suspended if the taxpayer requests for reinvestigation which is granted by the BIR. 11. The assessment may be protested by the taxpayer within 30 days from the date appearing thereon. 12. The assessment may be protested by the taxpayer within 30 days from the date of mailing thereof. 13. If the taxpayer fails to submit to the bureau the documents supporting his protest .w 'thin the required period, the assessment shall become final and unappeallable. 14. Protests to the CTA on the decisions of the Bureau of Internal Revenue should be made within 30 days from receipt of the decision. 15. Appeal to the Court of Tax Appeals on a claim for refund of excessive tax paid must be made within two years from the date of paymentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started