TRUE or FALSE: If the statement is FALSE, EXPLAIN why it is so. 29 - 30

Can u answer this too? Solve.

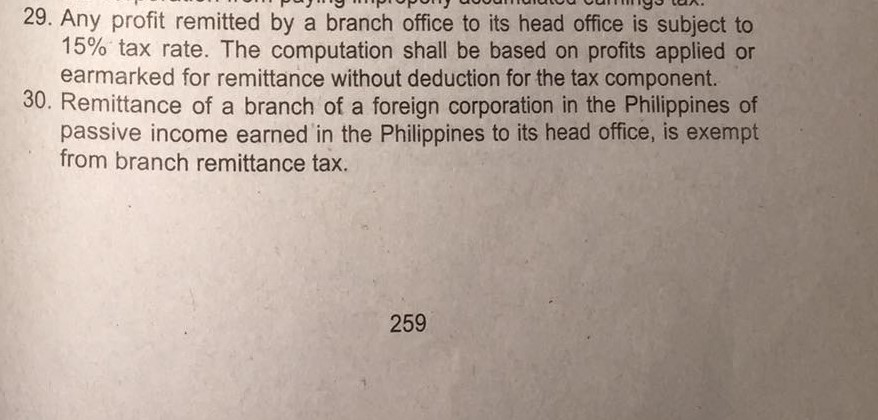

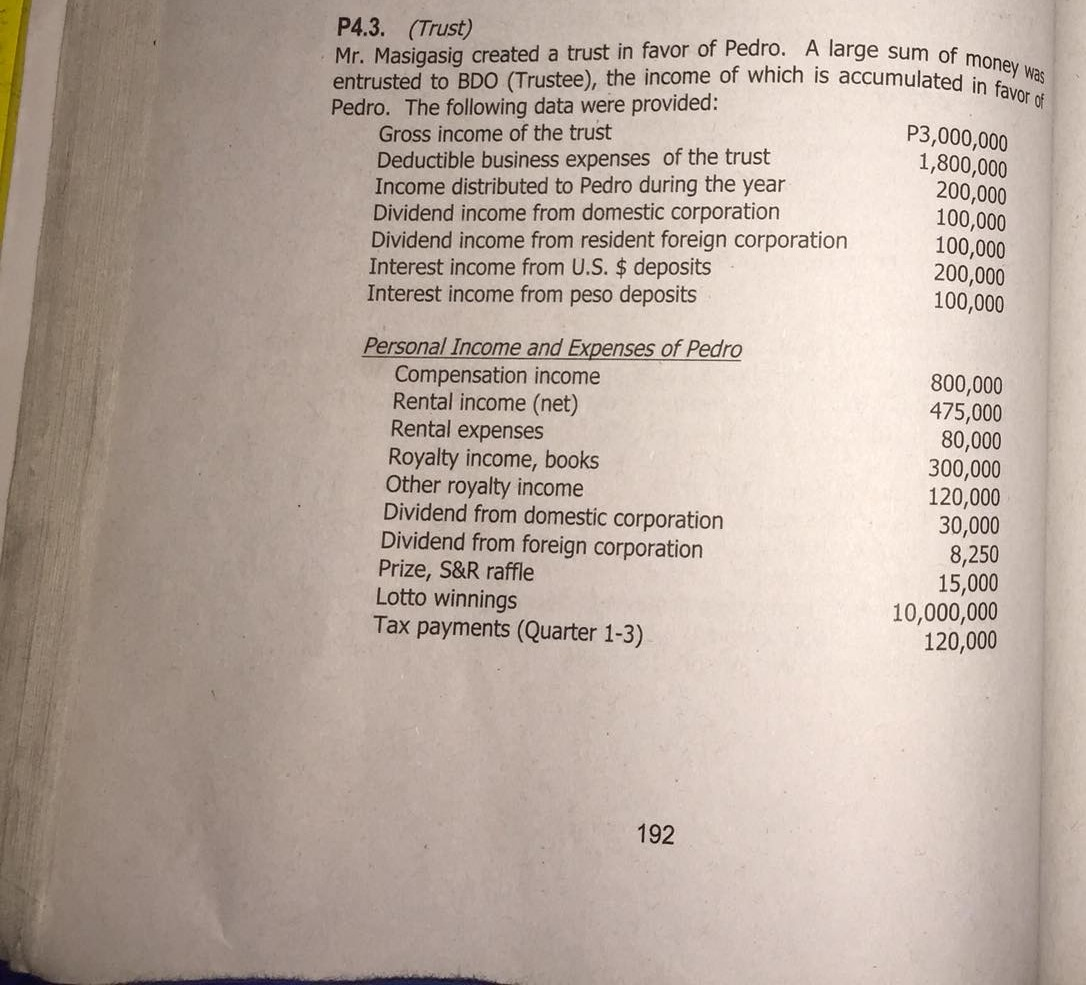

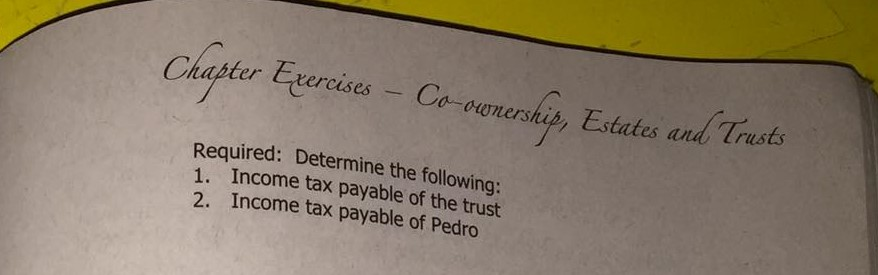

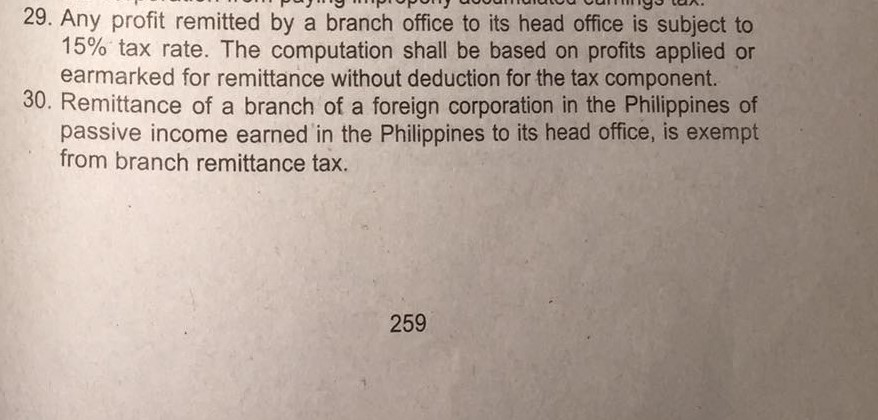

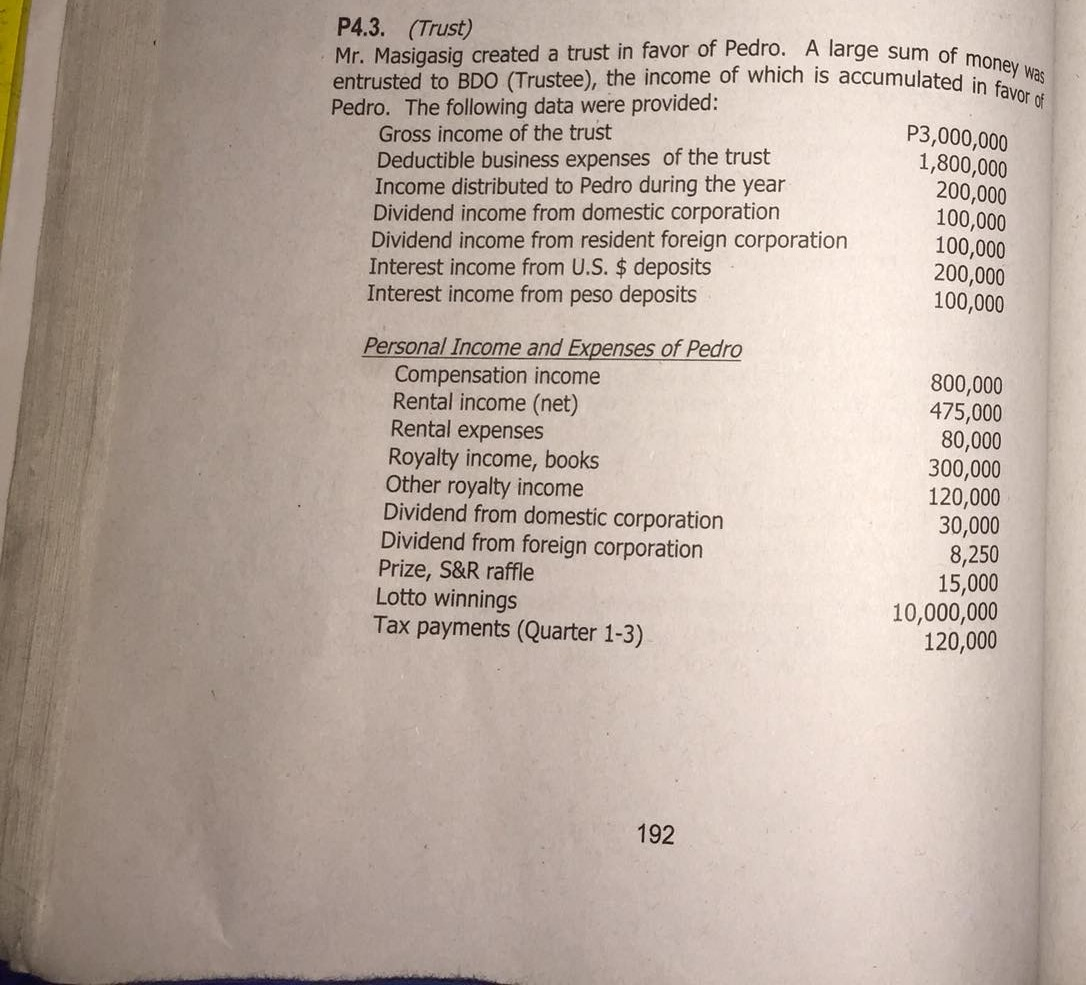

O PO POPOLUUUUUUUTILA. 29. Any profit remitted by a branch office to its head office is subject to 15% tax rate. The computation shall be based on profits applied or earmarked for remittance without deduction for the tax component. 30. Remittance of a branch of a foreign corporation in the Philippines of passive income earned in the Philippines to its head office, is exempt from branch remittance tax. 259 large sum of money was P4.3. (Trust) Mr. Masigasig created a trust in favor of Pedro. A large sum entrusted to BDO (Trustee), the income of which is accumulated Pedro. The following data were provided: Gross income of the trust Deductible business expenses of the trust Income distributed to Pedro during the year Dividend income from domestic corporation Dividend income from resident foreign corporation 100,000 Interest income from U.S. $ deposits 200,000 Interest income from peso deposits 100,000 P3,000,000 1,800,000 200,000 100,000 Personal Income and Expenses of Pedro Compensation income Rental income (net) Rental expenses Royalty income, books Other royalty income Dividend from domestic corporation Dividend from foreign corporation Prize, S&R raffle Lotto winnings Tax payments (Quarter 1-3) 800,000 475,000 80,000 300,000 120,000 30,000 8,250 15,000 10,000,000 120,000 192 Chapter Exercises - Co-ownership, Estates and Trusts Required: Determine the following: 1. Income tax payable of the trust 2. Income tax payable of Pedro O PO POPOLUUUUUUUTILA. 29. Any profit remitted by a branch office to its head office is subject to 15% tax rate. The computation shall be based on profits applied or earmarked for remittance without deduction for the tax component. 30. Remittance of a branch of a foreign corporation in the Philippines of passive income earned in the Philippines to its head office, is exempt from branch remittance tax. 259 large sum of money was P4.3. (Trust) Mr. Masigasig created a trust in favor of Pedro. A large sum entrusted to BDO (Trustee), the income of which is accumulated Pedro. The following data were provided: Gross income of the trust Deductible business expenses of the trust Income distributed to Pedro during the year Dividend income from domestic corporation Dividend income from resident foreign corporation 100,000 Interest income from U.S. $ deposits 200,000 Interest income from peso deposits 100,000 P3,000,000 1,800,000 200,000 100,000 Personal Income and Expenses of Pedro Compensation income Rental income (net) Rental expenses Royalty income, books Other royalty income Dividend from domestic corporation Dividend from foreign corporation Prize, S&R raffle Lotto winnings Tax payments (Quarter 1-3) 800,000 475,000 80,000 300,000 120,000 30,000 8,250 15,000 10,000,000 120,000 192 Chapter Exercises - Co-ownership, Estates and Trusts Required: Determine the following: 1. Income tax payable of the trust 2. Income tax payable of Pedro