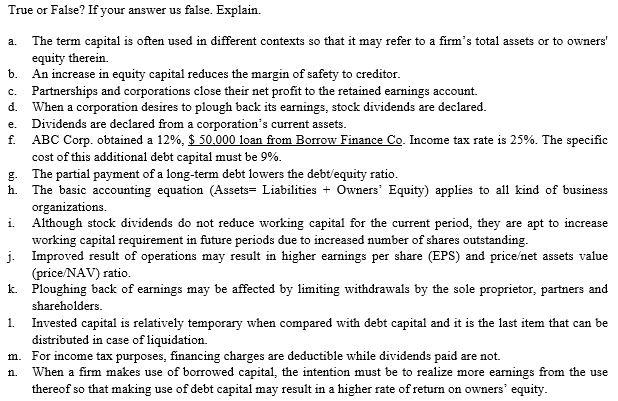

True or False? If your answer us false. Explain. a. h. The term capital is often used in different contexts so that it may refer to a firm's total assets or to owners' equity therein. b. An increase in equity capital reduces the margin of safety to creditor. c. Partnerships and corporations close their net profit to the retained earnings account. d. When a corporation desires to plough back its earnings, stock dividends are declared. e. Dividends are declared from a corporation's current assets. f. ABC Corp. obtained a 12%, $ 50.000 loan from Borrow Finance Co. Income tax rate is 25%. The specific cost of this additional debt capital must be 9%. 8. The partial payment of a long-term debt lowers the debt/equity ratio. The basic accounting equation (Assets= Liabilities + Owners' Equity) applies to all kind of business organizations. i. Although stock dividends do not reduce working capital for the current period, they are apt to increase working capital requirement in future periods due to increased number of shares outstanding. j. Improved result of operations may result in higher earnings per share (EPS) and price net assets value (price/NAV) ratio. k Ploughing back of earnings may be affected by limiting withdrawals by the sole proprietor, partners and shareholders. 1. Invested capital is relatively temporary when compared with debt capital and it is the last item that can be distributed in case of liquidation. m. For income tax purposes, financing charges are deductible while dividends paid are not. n. When a firm makes use of borrowed capital, the intention must be to realize more earnings from the use thereof so that making use of debt capital may result in a higher rate of return on owners' equity. True or False? If your answer us false. Explain. a. h. The term capital is often used in different contexts so that it may refer to a firm's total assets or to owners' equity therein. b. An increase in equity capital reduces the margin of safety to creditor. c. Partnerships and corporations close their net profit to the retained earnings account. d. When a corporation desires to plough back its earnings, stock dividends are declared. e. Dividends are declared from a corporation's current assets. f. ABC Corp. obtained a 12%, $ 50.000 loan from Borrow Finance Co. Income tax rate is 25%. The specific cost of this additional debt capital must be 9%. 8. The partial payment of a long-term debt lowers the debt/equity ratio. The basic accounting equation (Assets= Liabilities + Owners' Equity) applies to all kind of business organizations. i. Although stock dividends do not reduce working capital for the current period, they are apt to increase working capital requirement in future periods due to increased number of shares outstanding. j. Improved result of operations may result in higher earnings per share (EPS) and price net assets value (price/NAV) ratio. k Ploughing back of earnings may be affected by limiting withdrawals by the sole proprietor, partners and shareholders. 1. Invested capital is relatively temporary when compared with debt capital and it is the last item that can be distributed in case of liquidation. m. For income tax purposes, financing charges are deductible while dividends paid are not. n. When a firm makes use of borrowed capital, the intention must be to realize more earnings from the use thereof so that making use of debt capital may result in a higher rate of return on owners' equity