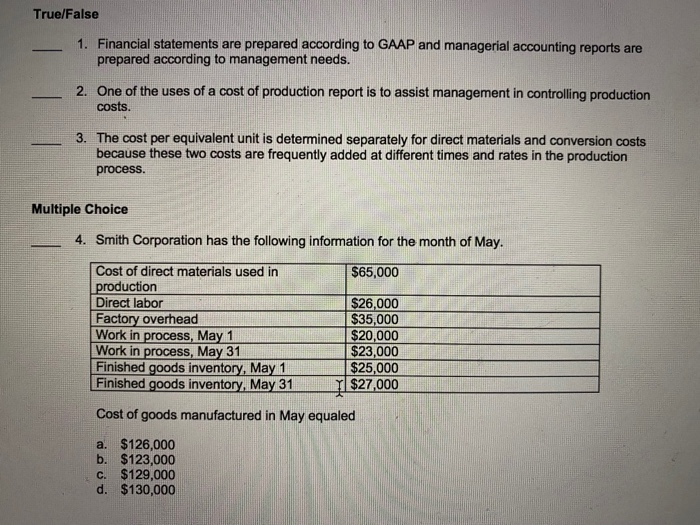

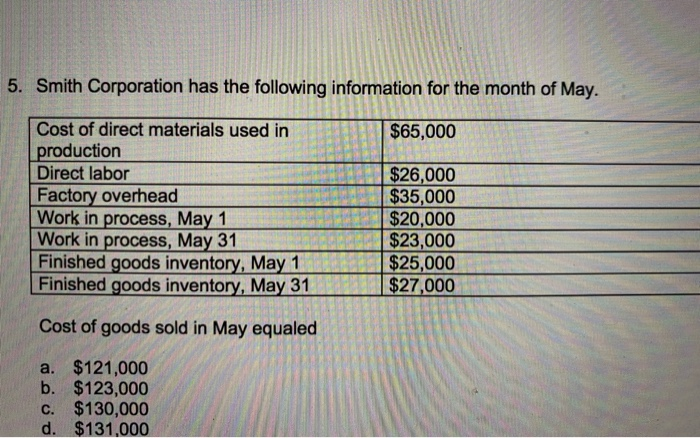

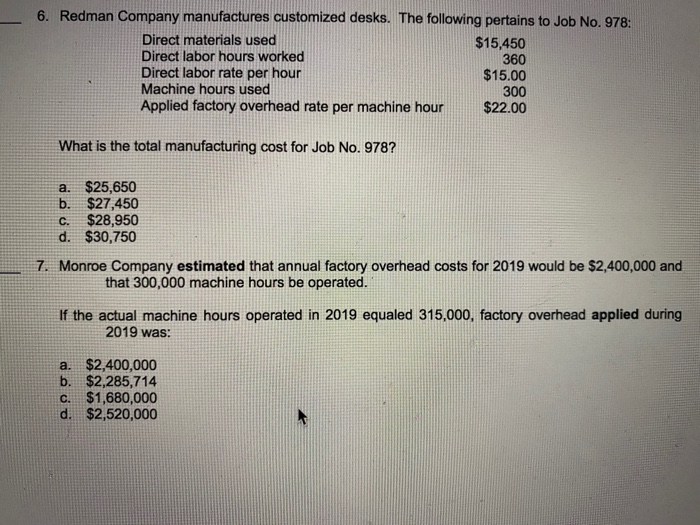

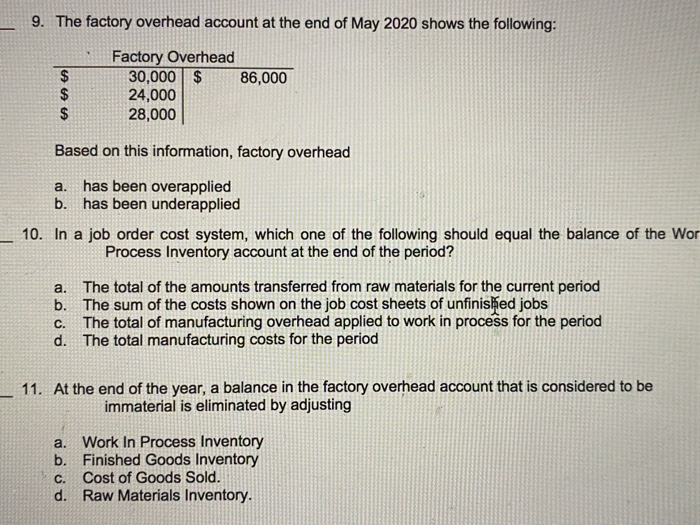

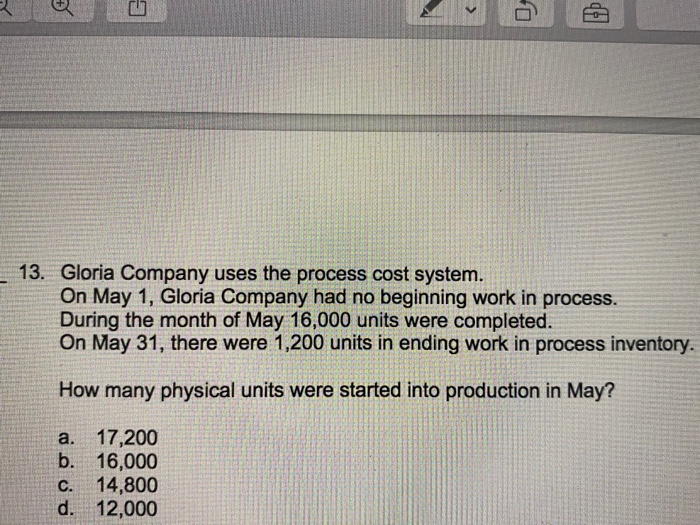

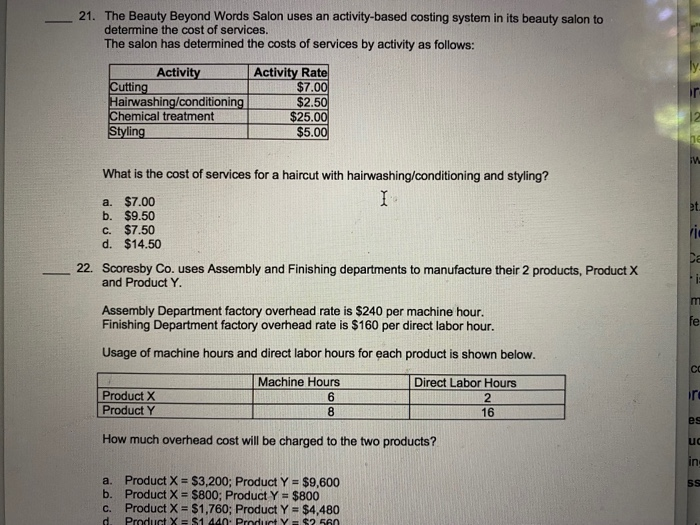

True/False 1. Financial statements are prepared according to GAAP and managerial accounting reports are prepared according to management needs. 2. One of the uses of a cost of production report is to assist management in controlling production costs. 3. The cost per equivalent unit is determined separately for direct materials and conversion costs because these two costs are frequently added at different times and rates in the production process. Multiple Choice 4. Smith Corporation has the following information for the month of May. $65,000 Cost of direct materials used in production Direct labor Factory overhead Work in process, May 1 Work in process, May 31 Finished goods inventory, May 1 Finished goods inventory, May 31 $26,000 $35,000 $20,000 $23,000 $25,000 Il $27,000 Cost of goods manufactured in May equaled a. $126,000 b. $123,000 C. $129,000 d. $130,000 5. Smith Corporation has the following information for the month of May. $65,000 Cost of direct materials used in production Direct labor Factory overhead Work in process, May 1 Work in process, May 31 Finished goods inventory, May 1 Finished goods inventory, May 31 $26,000 $35,000 $20,000 $23,000 $25,000 $27,000 Cost of goods sold in May equaled a. $121,000 b. $123,000 c. $130,000 d. $131,000 6. Redman Company manufactures customized desks. The following pertains to Job No. 978: Direct materials used $15,450 Direct labor hours worked 360 Direct labor rate per hour $15.00 Machine hours used 300 Applied factory overhead rate per machine hour $22.00 What is the total manufacturing cost for Job No. 978? a. $25,650 b. $27,450 C. $28,950 d. $30,750 7. Monroe Company estimated that annual factory overhead costs for 2019 would be $2,400,000 and that 300,000 machine hours be operated. If the actual machine hours operated in 2019 equaled 315,000, factory overhead applied during 2019 was: a. $2,400,000 b. $2,285,714 C. $1,680,000 d. $2,520,000 9. The factory overhead account at the end of May 2020 shows the following: $ $ $ Factory Overhead 30,000 $ 86,000 24,000 28,000 Based on this information, factory overhead a. has been overapplied b. has been underapplied 10. In a job order cost system, which one of the following should equal the balance of the Wor Process Inventory account at the end of the period? a. The total of the amounts transferred from raw materials for the current period b. The sum of the costs shown on the job cost sheets of unfinished jobs The total of manufacturing overhead applied to work in process for the period d. The total manufacturing costs for the period C. 11. At the end of the year, a balance in the factory overhead account that is considered to be immaterial is eliminated by adjusting a. Work In Process Inventory b. Finished Goods Inventory C. Cost of Goods Sold. d. Raw Materials Inventory. 13. Gloria Company uses the process cost system. On May 1, Gloria Company had no beginning work in process. During the month of May 16,000 units were completed. On May 31, there were 1,200 units in ending work in process inventory. How many physical units were started into production in May? a. 17,200 b. 16,000 C. 14,800 d. 12,000 21. The Beauty Beyond Words Salon uses an activity-based costing system in its beauty salon to determine the cost of services. The salon has determined the costs of services by activity as follows: Activity Activity Rate Cutting $7.00 Hairwashing/conditioning $2.50 Chemical treatment $25.000 Styling $5.00 M et. What is the cost of services for a haircut with hairwashing/conditioning and styling? a. $7.00 b. $9.50 $7.50 d. $14.50 22. Scoresby Co. uses Assembly and Finishing departments to manufacture their 2 products, Product X and Product Y. C. Assembly Department factory overhead rate is $240 per machine hour. Finishing Department factory overhead rate is $160 per direct labor hour. fe Usage of machine hours and direct labor hours for each product is shown below. Machine Hours 6 8 Product X Product Y Direct Labor Hours 2 16 ir es How much overhead cost will be charged to the two products? ud 5S a. b. C. d Product X = $3,200; Product Y = $9,600 Product X = $800; Product Y = $800 Product X = $1,760; Product Y = $4,480 Product X = $1 440 ProductY = $2.500