Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True/False 1.Net present value is the present value of the cash flows subtracted from the initial investment. 2.Projects with an NPV of zero decrease shareholders'

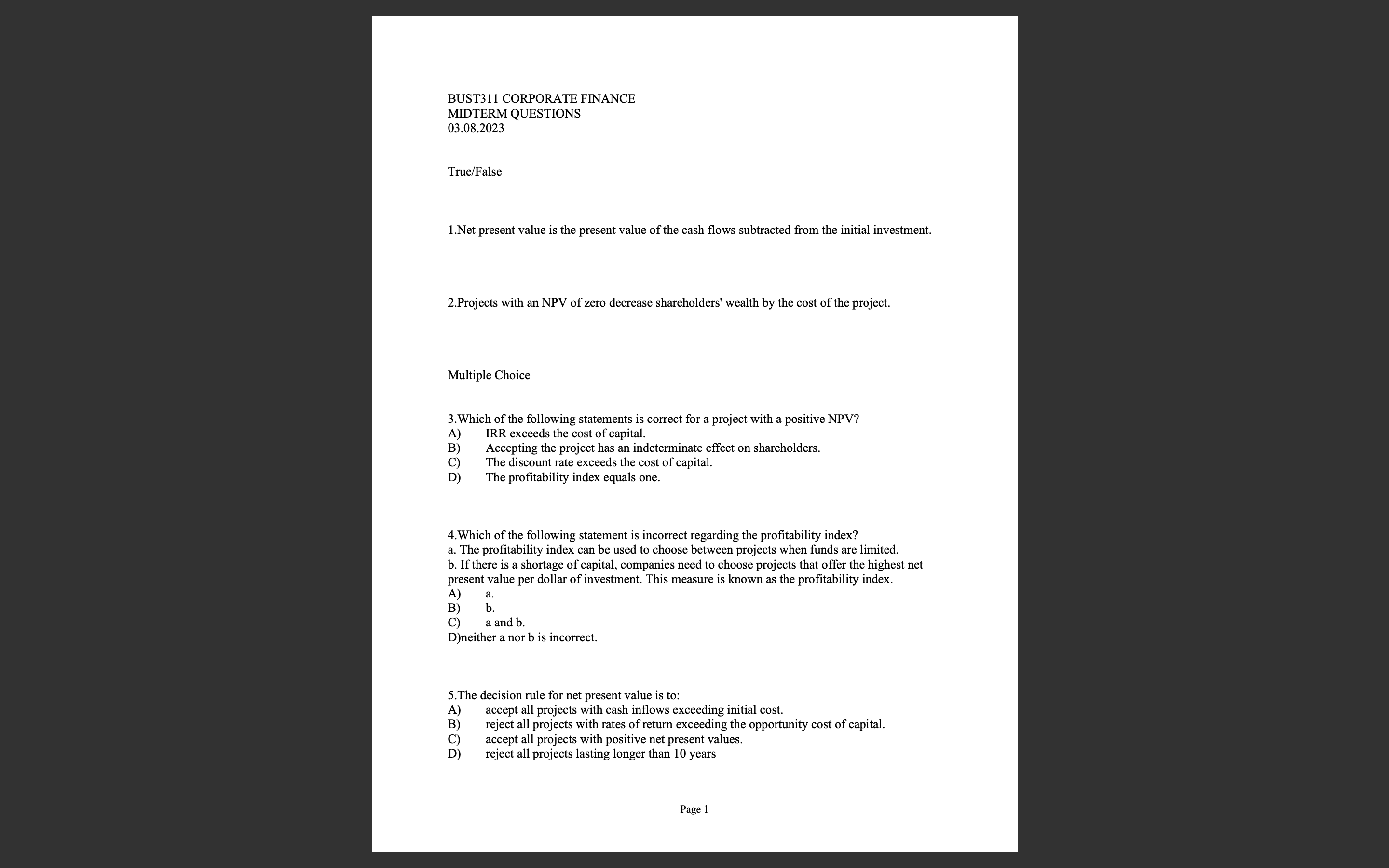

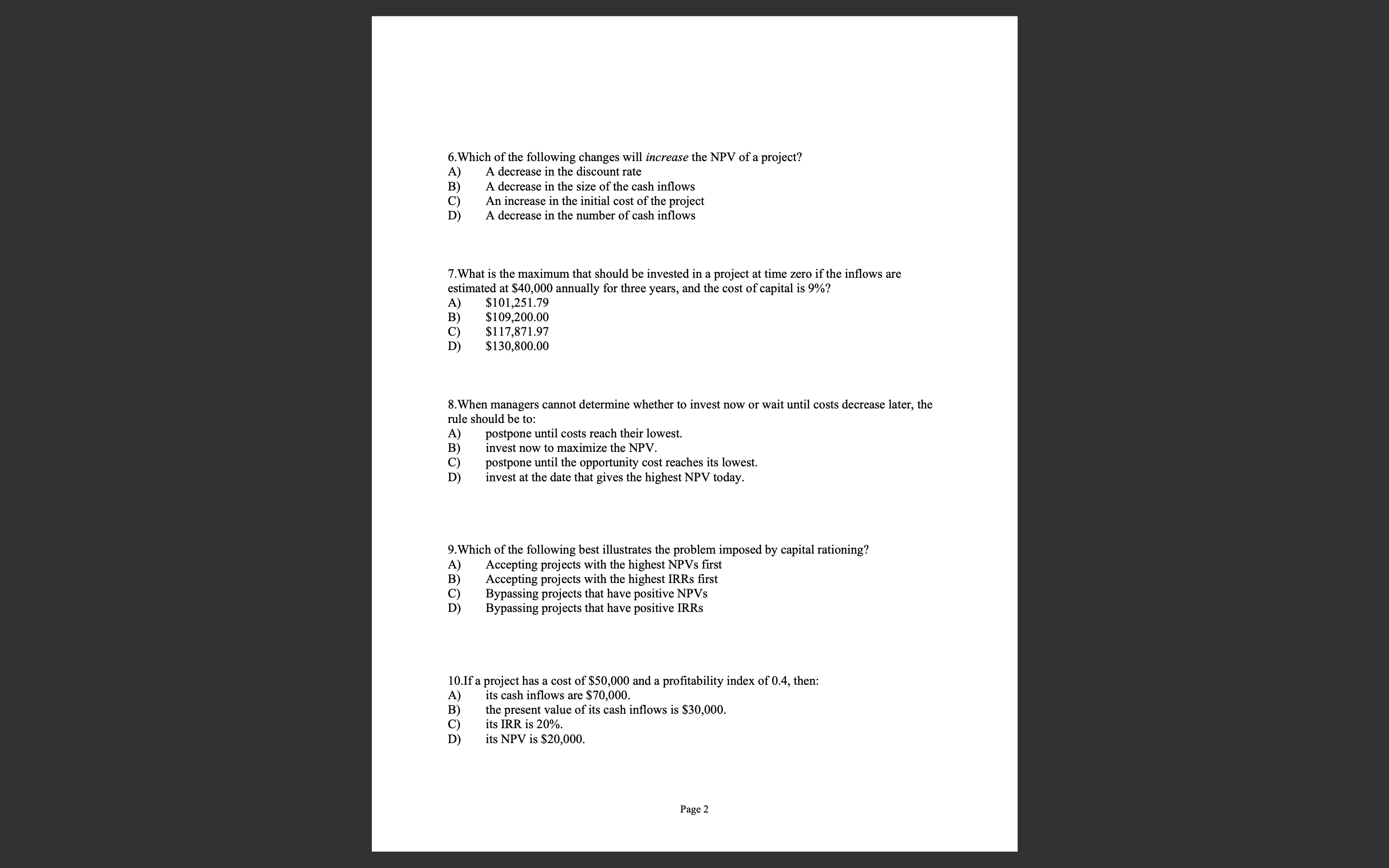

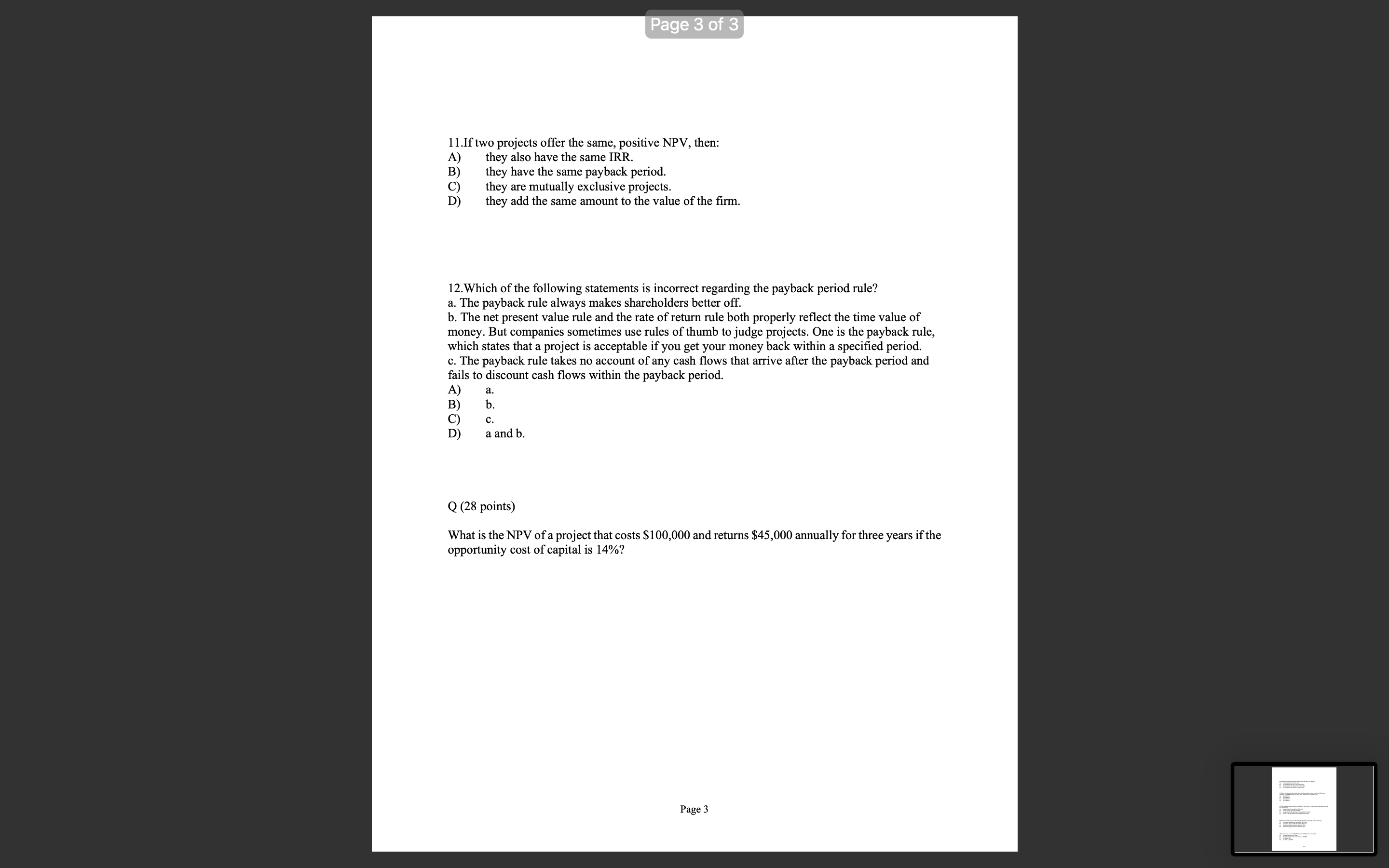

True/False 1.Net present value is the present value of the cash flows subtracted from the initial investment. 2.Projects with an NPV of zero decrease shareholders' wealth by the cost of the project. Multiple Choice 3.Which of the following statements is correct for a project with a positive NPV? A) IRR exceeds the cost of capital. B) Accepting the project has an indeterminate effect on shareholders. C) The discount rate exceeds the cost of capital. D) The profitability index equals one. 4.Which of the following statement is incorrect regarding the profitability index? a. The profitability index can be used to choose between projects when funds are limited. b. If there is a shortage of capital, companies need to choose projects that offer the highest net present value per dollar of investment. This measure is known as the profitability index. A) a. B) b. and b. D)neither a nor b is incorrect. 5.The decision rule for net present value is to: A) accept all projects with cash inflows exceeding initial cost. B) reject all projects with rates of return exceeding the opportunity cost of capital. C) accept all projects with positive net present values. D) reject all projects lasting longer than 10 years Page 1 6. Which of the following changes will increase the NPV of a project? A) A decrease in the discount rate B) A decrease in the size of the cash inflows C) An increase in the initial cost of the project D) A decrease in the number of cash inflows 7.What is the maximum that should be invested in a project at time zero if the inflows are estimated at $40,000 annually for three years, and the cost of capital is 9% ? A) $101,251.79 B) $109,200.00 C) $117,871.97 D) $130,800.00 8. When managers cannot determine whether to invest now or wait until costs decrease later, the rule should be to: A) postpone until costs reach their lowest. B) invest now to maximize the NPV. C) postpone until the opportunity cost reaches its lowest. D) invest at the date that gives the highest NPV today. 9.Which of the following best illustrates the problem imposed by capital rationing? A) Accepting projects with the highest NPVs first B) Accepting projects with the highest IRRs first C) Bypassing projects that have positive NPVs D) Bypassing projects that have positive IRRs 10.If a project has a cost of $50,000 and a profitability index of 0.4 , then: A) its cash inflows are $70,000. B) the present value of its cash inflows is $30,000. C) its IRR is 20%. D) its NPV is $20,000. Page 2

True/False 1.Net present value is the present value of the cash flows subtracted from the initial investment. 2.Projects with an NPV of zero decrease shareholders' wealth by the cost of the project. Multiple Choice 3.Which of the following statements is correct for a project with a positive NPV? A) IRR exceeds the cost of capital. B) Accepting the project has an indeterminate effect on shareholders. C) The discount rate exceeds the cost of capital. D) The profitability index equals one. 4.Which of the following statement is incorrect regarding the profitability index? a. The profitability index can be used to choose between projects when funds are limited. b. If there is a shortage of capital, companies need to choose projects that offer the highest net present value per dollar of investment. This measure is known as the profitability index. A) a. B) b. and b. D)neither a nor b is incorrect. 5.The decision rule for net present value is to: A) accept all projects with cash inflows exceeding initial cost. B) reject all projects with rates of return exceeding the opportunity cost of capital. C) accept all projects with positive net present values. D) reject all projects lasting longer than 10 years Page 1 6. Which of the following changes will increase the NPV of a project? A) A decrease in the discount rate B) A decrease in the size of the cash inflows C) An increase in the initial cost of the project D) A decrease in the number of cash inflows 7.What is the maximum that should be invested in a project at time zero if the inflows are estimated at $40,000 annually for three years, and the cost of capital is 9% ? A) $101,251.79 B) $109,200.00 C) $117,871.97 D) $130,800.00 8. When managers cannot determine whether to invest now or wait until costs decrease later, the rule should be to: A) postpone until costs reach their lowest. B) invest now to maximize the NPV. C) postpone until the opportunity cost reaches its lowest. D) invest at the date that gives the highest NPV today. 9.Which of the following best illustrates the problem imposed by capital rationing? A) Accepting projects with the highest NPVs first B) Accepting projects with the highest IRRs first C) Bypassing projects that have positive NPVs D) Bypassing projects that have positive IRRs 10.If a project has a cost of $50,000 and a profitability index of 0.4 , then: A) its cash inflows are $70,000. B) the present value of its cash inflows is $30,000. C) its IRR is 20%. D) its NPV is $20,000. Page 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started