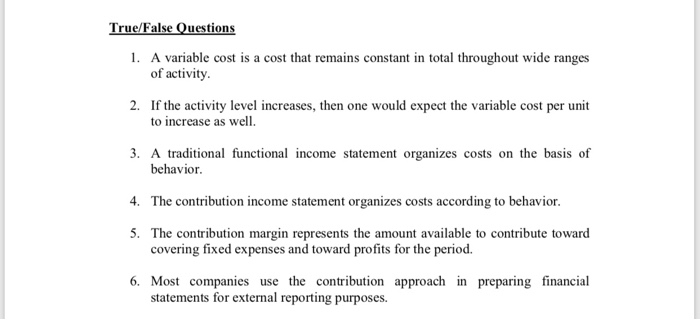

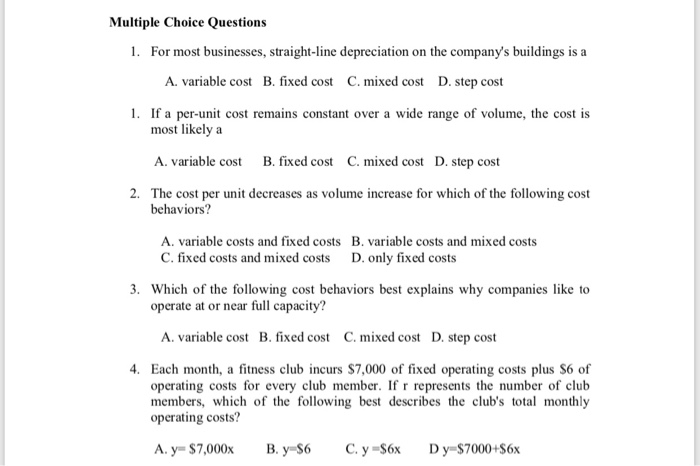

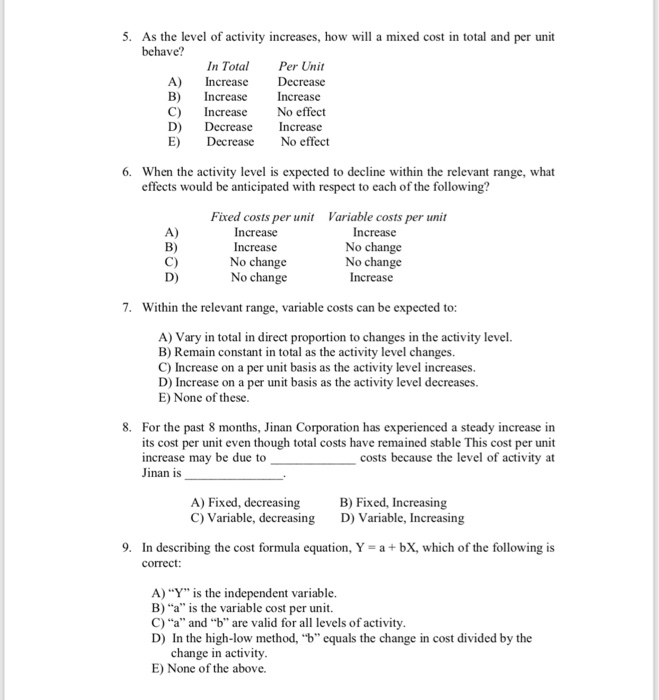

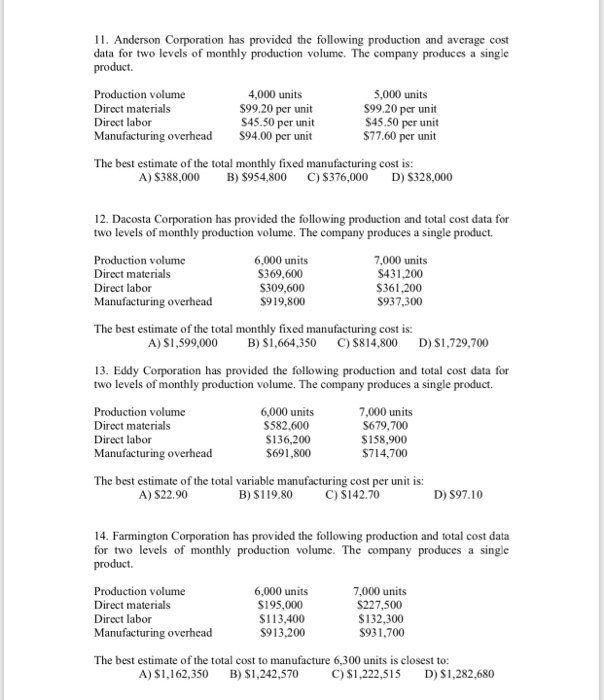

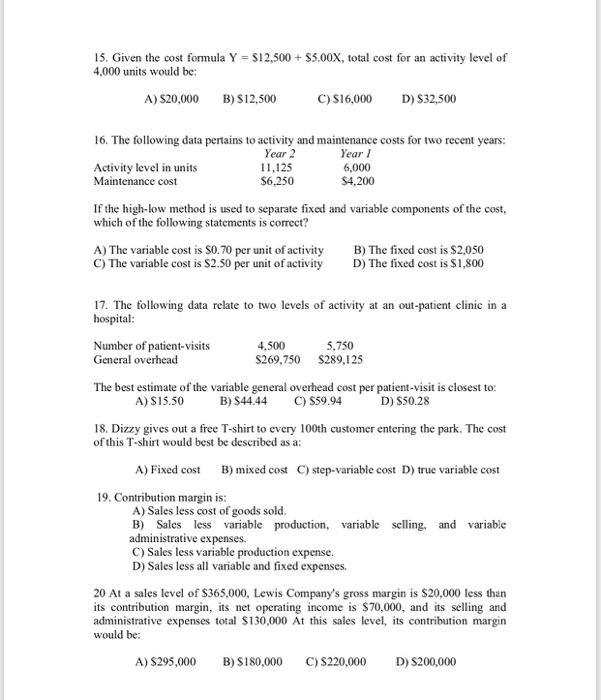

True/False Questions 1. A variable cost is a cost that remains constant in total throughout wide ranges of activity. 2. If the activity level increases, then one would expect the variable cost per unit to increase as well. 3. A traditional functional income statement organizes costs on the basis of behavior. 4. The contribution income statement organizes costs according to behavior. 5. The contribution margin represents the amount available to contribute toward covering fixed expenses and toward profits for the period. 6. Most companies use the contribution approach in preparing financial statements for external reporting purposes. Multiple Choice Questions 1. For most businesses, straight-line depreciation on the company's buildings is a A. variable cost B. fixed cost C. mixed cost D. step cost 1. If a per-unit cost remains constant over a wide range of volume, the cost is most likely a A. variable cost B. fixed cost C. mixed cost D. step cost 2. The cost per unit decreases as volume increase for which of the following cost behaviors? A. variable costs and fixed costs B. variable costs and mixed costs C. fixed costs and mixed costs D. only fixed costs 3. Which of the following cost behaviors best explains why companies like to operate at or near full capacity? A. variable cost B. fixed cost C. mixed cost D. step cost 4. Each month, a fitness club incurs $7,000 of fixed operating costs plus $6 of operating costs for every club member. If r represents the number of club members, which of the following best describes the club's total monthly operating costs? A. y=$7,000x B. y=$6 C. y =$6x Dy=$7000+$6x 5. As the level of activity increases, how will a mixed cost in total and per unit behave? In Total Per Unit A) Increase Decrease B) Increase Increase Increase No effect Decrease Increase E) Decrease No effect C) D) 6. When the activity level is expected to decline within the relevant range, what effects would be anticipated with respect to each of the following? A) Fixed costs per unit Variable costs per unit Increase Increase Increase No change No change No change No change Increase 7. Within the relevant range, variable costs can be expected to: A) Vary in total in direct proportion to changes in the activity level. B) Remain constant in total as the activity level changes. C) Increase on a per unit basis as the activity level increases. D) Increase on a per unit basis as the activity level decreases. E) None of these. 8. For the past 8 months, Jinan Corporation has experienced a steady increase in its cost per unit even though total costs have remained stable This cost per unit increase may be due to costs because the level of activity at Jinan is A) Fixed, decreasing C) Variable, decreasing B) Fixed, Increasing D) Variable, Increasing 9. In describing the cost formula equation, Y = a +bX, which of the following is correct: A) "Y" is the independent variable B) "a" is the variable cost per unit. C) "a" and "b" are valid for all levels of activity. D) In the high-low method, "b" equals the change in cost divided by the change in activity. E) None of the above. 11. Anderson Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 4,000 units $99.20 per unit S45.50 per unit $94.00 per unit 5,000 units $99.20 per unit $45.50 per unit $77.60 per unit The best estimate of the total monthly fixed manufacturing cost is: A) $388,000 B) $954,800 C) $376,000 D) $328,000 12. Dacosta Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 6,000 units $369,600 $309,600 $919,800 7,000 units S431,200 S361,200 $937,300 The best estimate of the total monthly fixed manufacturing cost is: A) S1,599,000 B) S1,664,350 C) $814,800 D) $1,729,700 13. Eddy Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 6,000 units $582,600 $136,200 $691,800 7,000 units S679,700 $ 158,900 $714,700 The best estimate of the total variable manufacturing cost per unit is: A) $22.90 B) $119.80 C) S142.70 D) $97.10 14. Farmington Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 6,000 units $195,000 $113,400 $913,200 7,000 units $227,500 $132,300 $931,700 The best estimate of the total cost to manufacture 6,300 units is closest to: A) $1,162,350 B) $1,242,570 C) $1,222,515 D) $1,282,680 15. Given the cost formula Y = $12,500 + $5.00X, total cost for an activity level of 4,000 units would be: A) S20,000 B) $12,500 C) $16,000 D) $32,500 16. The following data pertains to activity and maintenance costs for two recent years: Year 2 Year 1 Activity level in units 11.125 6,000 Maintenance cost $6,250 $4,200 If the high-low method is used to separate fixed and variable components of the cost, which of the following statements is correct? A) The variable cost is $0.70 per unit of activity C) The variable cost is $2.50 per unit of activity B) The fixed cost is $2,050 D) The fixed cost is $1,800 17. The following data relate to two levels of activity at an out-patient clinic in a hospital: Number of patient-visits General overhead 4,500 $269,750 5.750 $289,125 The best estimate of the variable general overhead cost per patient-visit is closest to A) $15.50 B) S44.44 C) $59.94 D ) $50.28 18. Dizzy gives out a free T-shirt to every 100th customer entering the park. The cost of this T-shirt would best be described as a: A) Fixed cost B) mixed cost C) step-variable cost D) true variable cost 19. Contribution margin is: A) Sales less cost of goods sold. B) Sales less variable production, variable administrative expenses. C) Sales less variable production expense. D) Sales less all variable and fixed expenses. selling, and variable 20 At a sales level of $365,000, Lewis Company's gross margin is $20,000 less than its contribution margin, its net operating income is $70,000, and its selling and administrative expenses total $130,000 At this sales level, its contribution margin would be: A) S295,000 B) S180,000 C) $220,000 D) $200,000