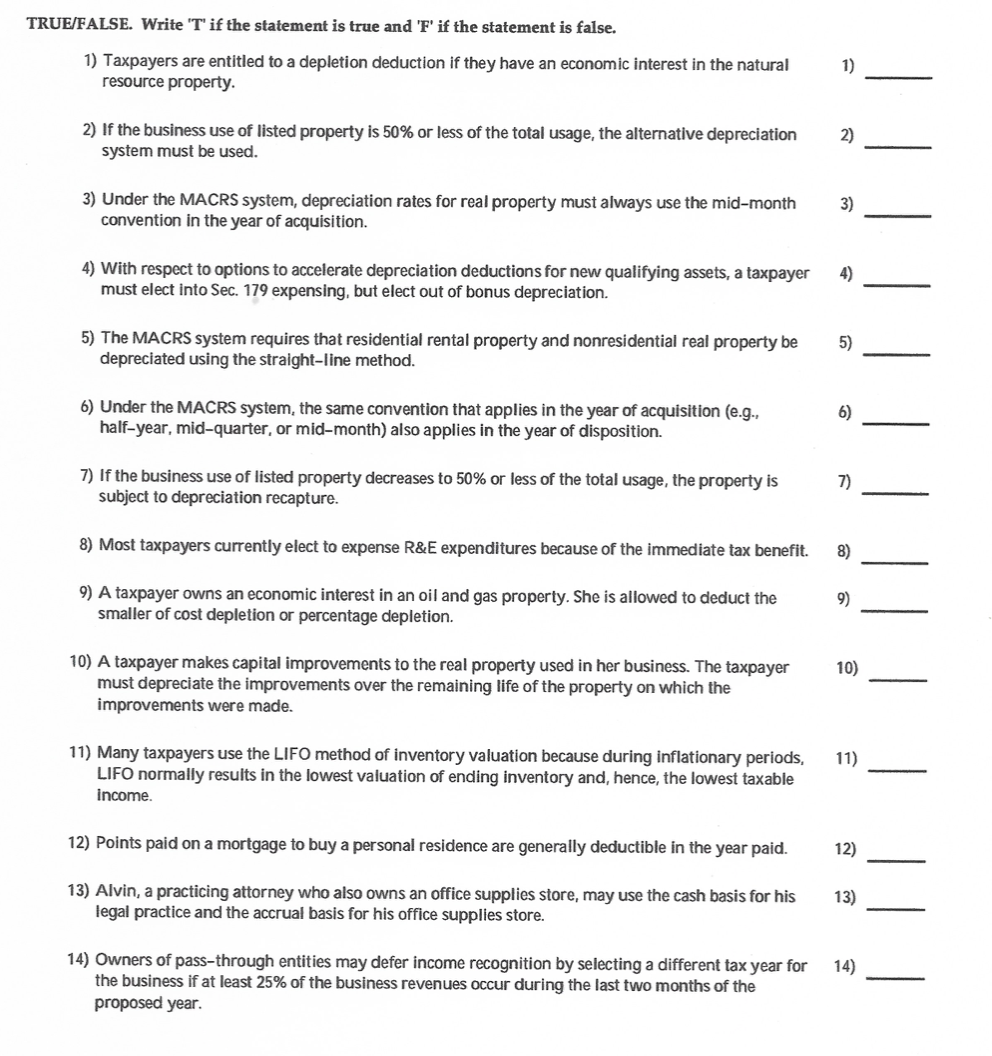

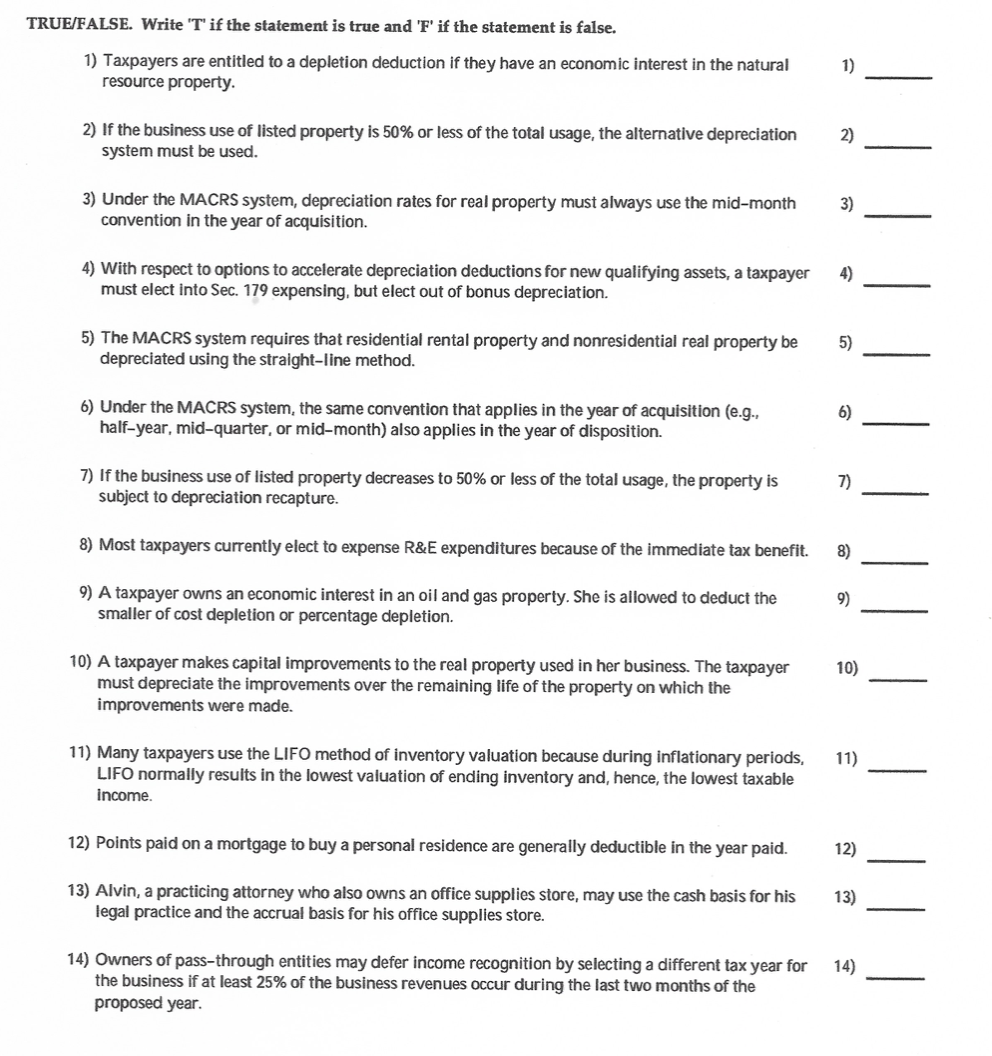

TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) Taxpayers are entitled to a depletion deduction if they have an economic interest in the natural resource property. 1) 2) If the business use of listed property is 50% or less of the total usage, the alternative depreciation system must be used. 2) 3) Under the MACRS system, depreciation rates for real property must always use the mid-month convention in the year of acquisition. 3) 4) With respect to options to accelerate depreciation deductions for new qualifying assets, a taxpayer must elect into Sec. 179 expensing, but elect out of bonus depreciation. 4) 5) The MACRS system requires that residential rental property and nonresidential real property be depreciated using the straight-line method. 5) 6) Under the MACRS system, the same convention that applies in the year of acquisition (e.g., half-year, mid-quarter, or mid-month) also applies in the year of disposition. 6) 7) If the business use of listed property decreases to 50% or less of the total usage, the property is subject to depreciation recapture. 7) 8) Most taxpayers currently elect to expense R&E expenditures because of the immediate tax benefit. 8) 9) A taxpayer owns an economic interest in an oil and gas property. She is allowed to deduct the smaller of cost depletion or percentage depletion. 9) 10) 10) A taxpayer makes capital improvements to the real property used in her business. The taxpayer must depreciate the improvements over the remaining life of the property on which the improvements were made. 11) 11) Many taxpayers use the LIFO method of inventory valuation because during inflationary periods, LIFO normally results in the lowest valuation of ending inventory and, hence, the lowest taxable income. 12) Points paid on a mortgage to buy a personal residence are generally deductible in the year paid. 12) 13) Alvin, a practicing attorney who also owns an office supplies store, may use the cash basis for his legal practice and the accrual basis for his office supplies store. 13) 14) 14) Owners of pass-through entities may defer income recognition by selecting a different tax year for the business if at least 25% of the business revenues occur during the last two months of the proposed year