Question

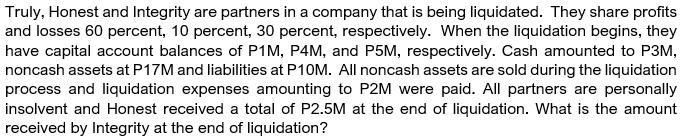

Truly, Honest and Integrity are partners in a company that is being liquidated. They share profits and losses 60 percent, 10 percent, 30 percent,

Truly, Honest and Integrity are partners in a company that is being liquidated. They share profits and losses 60 percent, 10 percent, 30 percent, respectively. When the liquidation begins, they have capital account balances of P1M, P4M, and P5M, respectively. Cash amounted to P3M, noncash assets at P17M and liabilities at P10M. All noncash assets are sold during the liquidation process and liquidation expenses amounting to P2M were paid. All partners are personally insolvent and Honest received a total of P2.5M at the end of liquidation. What is the amount received by Integrity at the end of liquidation?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount received by Integrity at the end of the liquidation we need to follow the li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App