Answered step by step

Verified Expert Solution

Question

1 Approved Answer

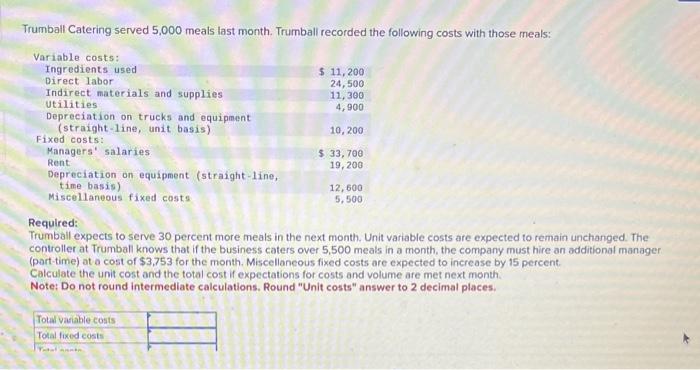

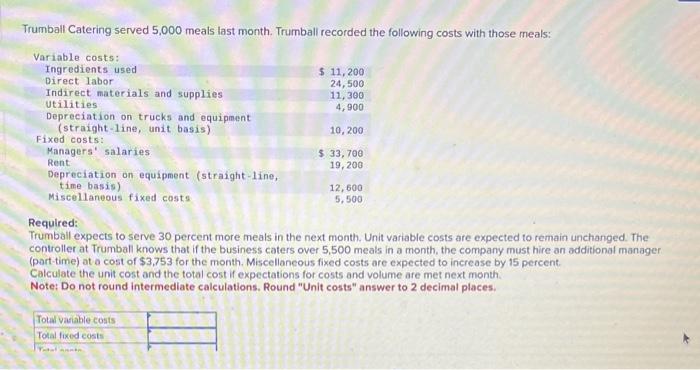

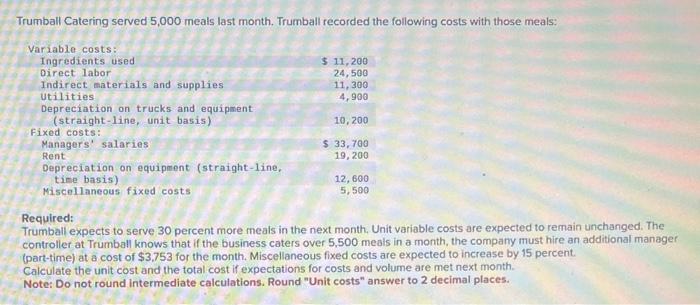

Trumball Catering served 5,000 meals last monthTrumball recorded the following costs with those meals 11,200 24,590 11,300 4,900 Variable costs: Ingredients used Direct labor Indirect

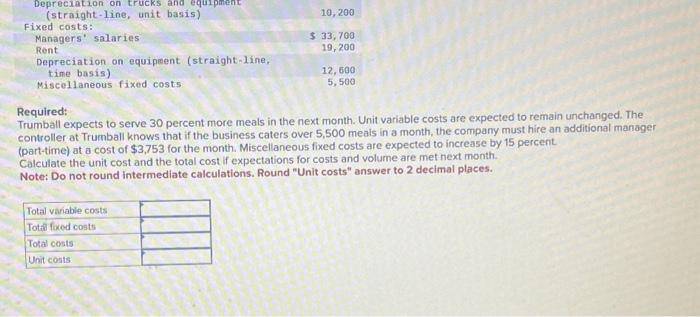

Trumball Catering served 5,000 meals last monthTrumball recorded the following costs with those meals 11,200 24,590 11,300 4,900 Variable costs: Ingredients used Direct labor Indirect materials and supplies Utilities Depreciation on trucks and equipment straightline, unit basis) Fixed costs: Kanagerssalaries Rent Depreciation on equipment (straight -line basis Miscellaneous fixed costs 10,200 33,700 19,200 Required: Trumball expects to serve 30 percent more meals in the next monthUnit variable costs are expected to remain unchanged. The controller at Trumball knows that if the business caters over 5,500 meals in a month, the company must hire an additional manager (part-time) at a cost of $3,753 for the monthMiscellaneous fixed costs are expected to increase by 15 percent Calculate the unit cost and the total cost if expectations for costs and volume are met next month Note: Do not round intermediate calculationsRound "Unit costs answer to 2 decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started