Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Trumpet Co. consigned eight heavy machineries to Cold Breeze Co. Each machine costs P 1,000,000 and has suggested retail price of P 2,100,000. Trumpet

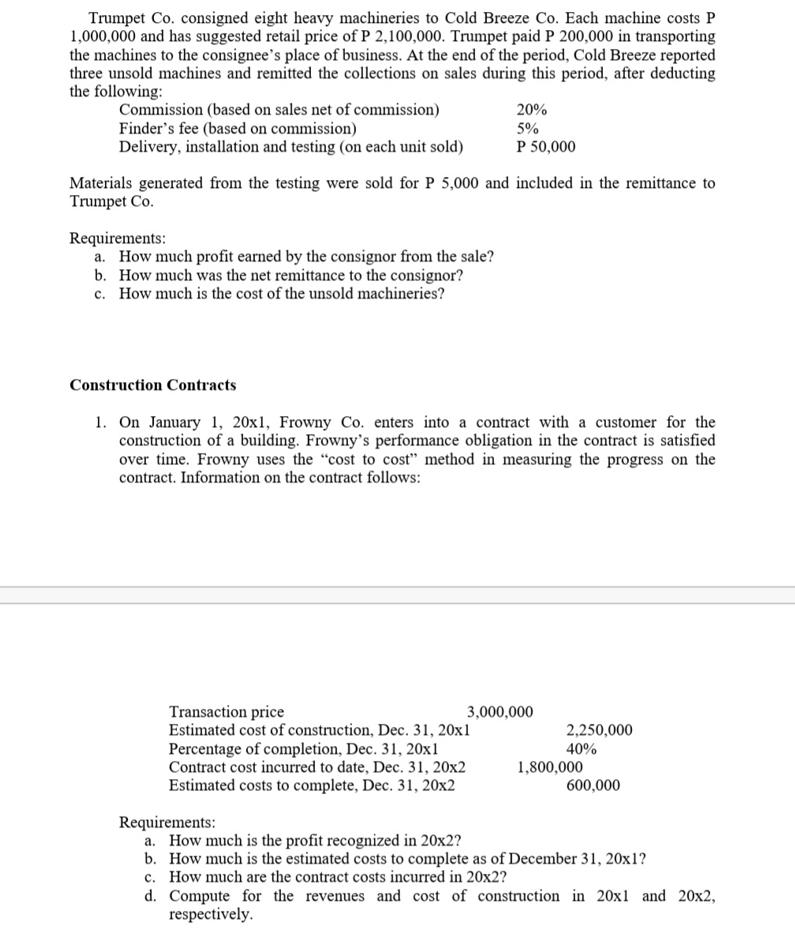

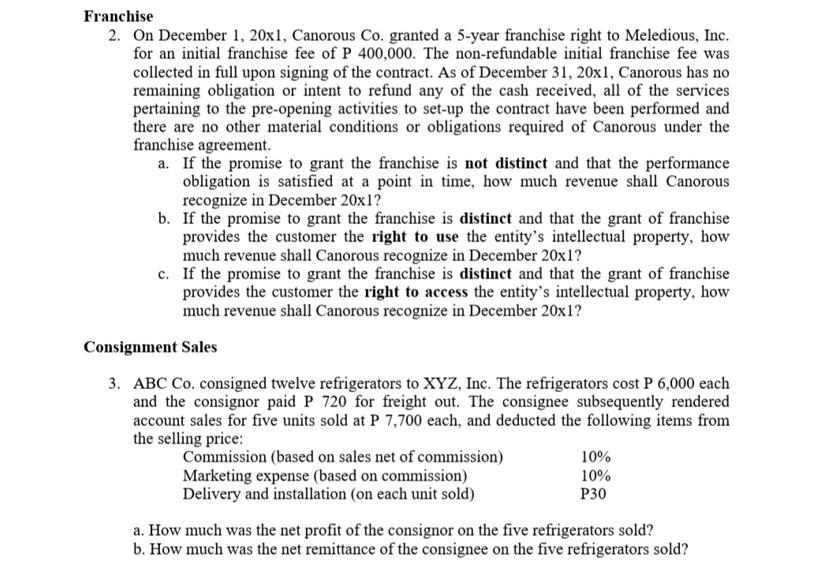

Trumpet Co. consigned eight heavy machineries to Cold Breeze Co. Each machine costs P 1,000,000 and has suggested retail price of P 2,100,000. Trumpet paid P 200,000 in transporting the machines to the consignee's place of business. At the end of the period, Cold Breeze reported three unsold machines and remitted the collections on sales during this period, after deducting the following: Commission (based on sales net of commission) Finder's fee (based on commission) Delivery, installation and testing (on each unit sold) Materials generated from the testing were sold for P 5,000 and included in the remittance to Trumpet Co. Requirements: a. How much profit earned by the consignor from the sale? b. How much was the net remittance to the consignor? c. How much is the cost of the unsold machineries? Construction Contracts 20% 5% P 50,000 1. On January 1, 20x1, Frowny Co. enters into a contract with a customer for the construction of a building. Frowny's performance obligation in the contract is satisfied over time. Frowny uses the "cost to cost" method in measuring the progress on the contract. Information on the contract follows: Transaction price Estimated cost of construction, Dec. 31, 20x1 Percentage of completion, Dec. 31, 20x1 Contract cost incurred to date, Dec. 31, 20x2 Estimated costs to complete, Dec. 31, 20x2 3,000,000 2,250,000 40% 1,800,000 600,000 Requirements: a. How much is the profit recognized in 20x2? b. How much is the estimated costs to complete as of December 31, 20x1? c. How much are the contract costs incurred in 20x2? d. Compute for the revenues and cost of construction in 20x1 and 20x2, respectively. Franchise 2. On December 1, 20x1, Canorous Co. granted a 5-year franchise right to Meledious, Inc. for an initial franchise fee of P 400,000. The non-refundable initial franchise fee was collected in full upon signing of the contract. As of December 31, 20x1, Canorous has no remaining obligation or intent to refund any of the cash received, all of the services pertaining to the pre-opening activities to set-up the contract have been performed and there are no other material conditions or obligations required of Canorous under the franchise agreement. a. If the promise to grant the franchise is not distinct and that the performance obligation is satisfied at a point in time, how much revenue shall Canorous recognize in December 20x1? b. If the promise to grant the franchise is distinct and that the grant of franchise provides the customer the right to use the entity's intellectual property, how much revenue shall Canorous recognize in December 20x1? c. If the promise to grant the franchise is distinct and that the grant of franchise provides the customer the right to access the entity's intellectual property, how much revenue shall Canorous recognize in December 20x1? Consignment Sales 3. ABC Co. consigned twelve refrigerators to XYZ, Inc. The refrigerators cost P 6,000 each and the consignor paid P 720 for freight out. The consignee subsequently rendered account sales for five units sold at P 7,700 each, and deducted the following items from the selling price: Commission (based on sales net of commission) Marketing expense (based on commission) Delivery and installation (on each unit sold) 10% 10% P30 a. How much was the net profit of the consignor on the five refrigerators sold? b. How much was the net remittance of the consignee on the five refrigerators sold?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the text provided in the image Im going to answer the first question about Trumpet Cos consignment sale to Cold Breeze Co Requirements for Tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started